Idaho Agreement to Compromise Debt by Returning Secured Property

Description

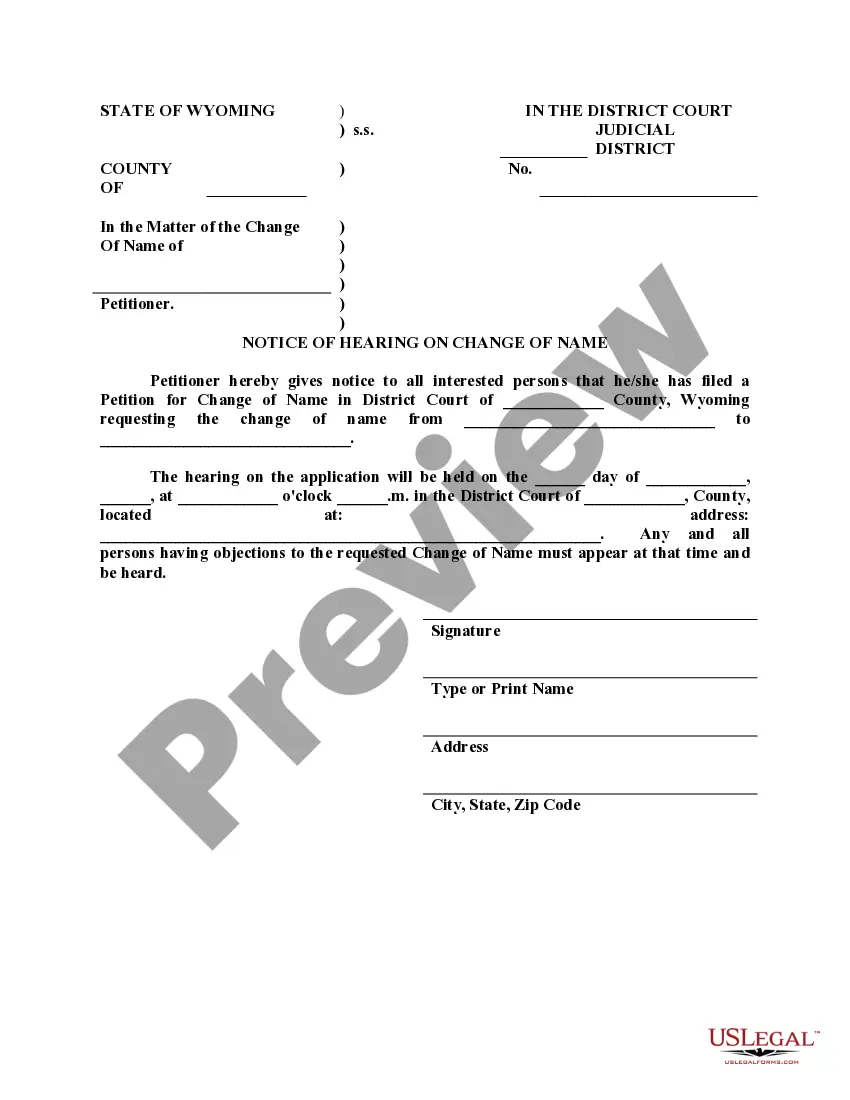

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Locating the appropriate authentic document template can be a challenge. Certainly, there are numerous templates accessible online, but how can you find the valid form you require? Utilize the US Legal Forms website. The service provides an extensive collection of templates, including the Idaho Agreement to Settle Debt by Returning Secured Property, suitable for both business and personal needs.

If you are already registered, Log In to your account and click the Download button to obtain the Idaho Agreement to Settle Debt by Returning Secured Property. Use your account to access the legal forms you have previously purchased. Visit the My documents section of your account and download another version of the document you need.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have chosen the correct form for your city/region. You can browse the form using the Preview button and review the form description to confirm this is indeed the right one for you.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- If the form does not fulfill your requirements, use the Search field to find the correct form.

- Once you are confident that the form meets your needs, select the Purchase Now button to acquire the form.

- Choose the pricing plan that suits you and enter the necessary details.

- Create your account and complete your order using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

- Fill out, edit, print, and sign the obtained Idaho Agreement to Settle Debt by Returning Secured Property.

Form popularity

FAQ

Writing a debt settlement agreement requires you to specify the debt owed, settlement amount, and payment schedule. Ensure all terms are documented in plain language to avoid misunderstandings. The Idaho Agreement to Compromise Debt by Returning Secured Property can be a valuable framework for drafting this agreement, offering solid protection for both parties involved.

To write a settlement agreement, start by defining the parties involved and the nature of the dispute. Clearly detail the resolution terms, including any payments or actions required from each party. Utilizing the Idaho Agreement to Compromise Debt by Returning Secured Property ensures you effectively structure this agreement for optimal clarity and compliance.

The 11-word phrase to stop debt collectors is: 'I do not want to be contacted by your company.' This statement legally protects you by communicating your preference to cease all communications. Incorporating this into your debt resolution strategy, alongside tools like the Idaho Agreement to Compromise Debt by Returning Secured Property, can promote peaceful negotiations.

Writing a debt agreement involves clearly stating the terms of repayment between the debtor and creditor. Start by outlining the total debt amount, payment schedule, and any interest applicable. The Idaho Agreement to Compromise Debt by Returning Secured Property serves as an excellent template for creating these agreements, ensuring both parties understand their obligations and rights.

The 777 rule is a guiding principle that explains the rights of consumers against debt collectors. It emphasizes that collectors may not contact you after receiving a written notice to cease communication. By following the Idaho Agreement to Compromise Debt by Returning Secured Property, consumers can effectively address debt issues and potentially resolve them without lengthy disputes.

The Fair Debt Collection Practices Act allows consumers in Idaho to dispute debts and request validation from debt collectors. It provides protection against harassment and illegal collection tactics. Knowing your rights under this act empowers you to consider options, such as the Idaho Agreement to Compromise Debt by Returning Secured Property, as a means to resolve your financial issues amicably.

One of the most common violations of the FDCPA involves debt collectors contacting individuals during inconvenient times, often early in the morning or late at night. Other common violations include failing to identify themselves or misrepresenting the amount owed. If you find yourself in such a situation, exploring the Idaho Agreement to Compromise Debt by Returning Secured Property can be an effective way to regain control of your financial situation.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that regulates how debt collectors can operate in Idaho and across the United States. It sets guidelines to prevent abusive, deceptive, and unfair collection practices. Understanding this act can help you navigate options like the Idaho Agreement to Compromise Debt by Returning Secured Property, allowing you to make informed decisions about your debts.

In Idaho, a debt collector typically has five years to collect a debt. This timeframe starts from the date of the last payment or interaction regarding the debt. It's crucial to note this timeframe when considering an Idaho Agreement to Compromise Debt by Returning Secured Property, as it can impact your options for negotiation.

When property is described as subject to a security interest, it indicates that the creditor has a legal claim to that property in case of default. This concept is key in understanding asset protection and creditor rights. It is particularly relevant in an Idaho Agreement to Compromise Debt by Returning Secured Property, as it defines the boundaries of what creditors can reclaim. Clarity on this term ensures all parties are aware of their rights and obligations.