Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

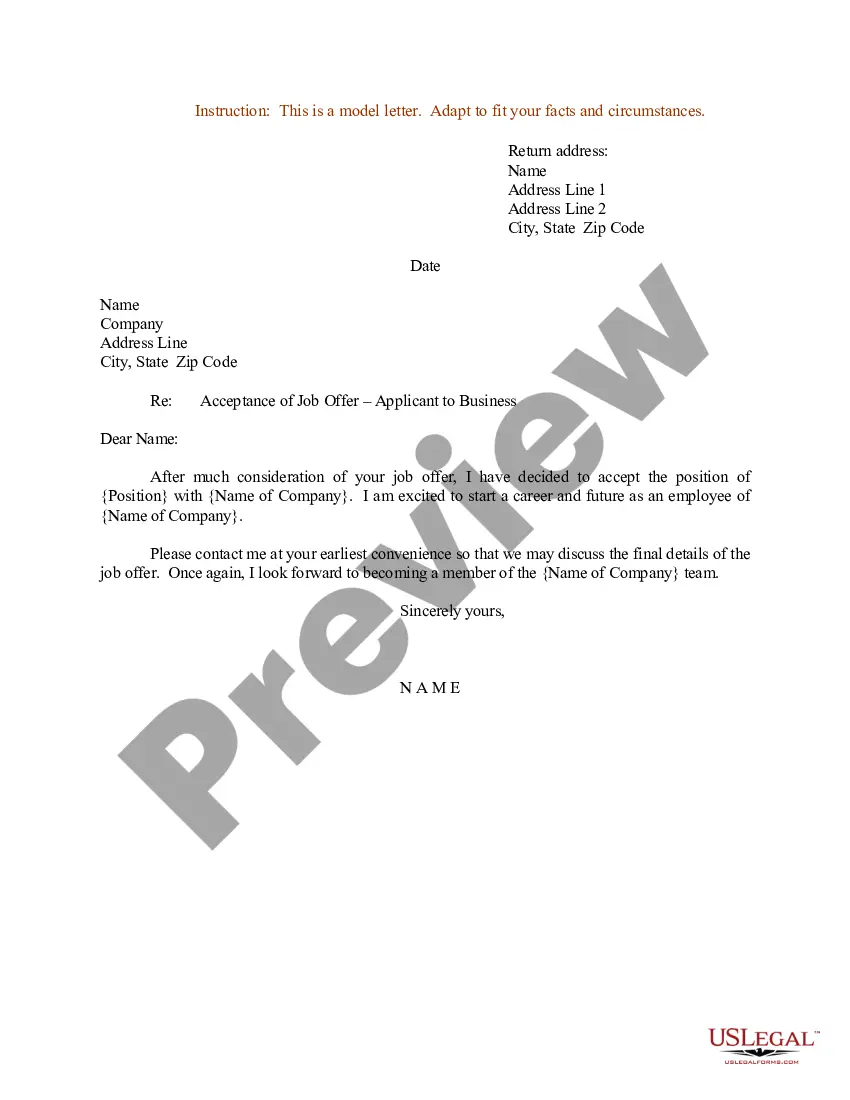

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

You have the ability to dedicate time online searching for the valid document template that fulfills the federal and state criteria you require.

US Legal Forms offers a wide array of valid forms that can be reviewed by professionals.

You can easily download or print the Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to from your account.

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

- Each legal document template you purchase is yours to keep for years.

- To acquire another copy of a purchased form, navigate to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your preference.

- Review the form description to ensure you have selected the right one.

Form popularity

FAQ

The Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to is often considered one of the best options for married couples. This trust allows for shared control over assets, flexibility in management, and the ability to adjust terms as circumstances change. Additionally, it can help safeguard your collective estate, providing peace of mind for both parties. Evaluating your unique needs with a legal expert can help you finalize the best trust setup.

In a marital trust, income typically includes earnings generated from investments, interest, and dividends. When utilizing an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to, this income is generally intended for the benefit of both spouses during their lifetimes. It's essential to understand how income distribution works in your specific trust setup, as it impacts tax obligations and financial planning strategies.

Whether married couples should have separate revocable trusts depends on their specific circumstances. In some cases, having an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to may provide a unified approach that ensures both partners' interests are protected. However, separate trusts can offer more individualized control over distinct assets. Consulting a legal professional can help you determine the best option for your situation.

Yes, putting your house in an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to can provide significant benefits. This trust can help avoid probate, allowing for a smoother transition of property ownership upon death. Additionally, it offers flexibility, as either spouse can amend or revoke the trust at any time while both are alive. Overall, this approach simplifies estate management and protects your assets.

Joint revocable trusts pose potential issues, such as complications during asset management and disagreements between spouses. When establishing an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to, the blend of assets can sometimes lead to conflicts over distribution. Additionally, if one spouse becomes incapacitated, it may create confusion about managing the trust. Seeking professional advice can help mitigate these challenges and clarify roles.

Suze Orman often emphasizes the importance of revocable trusts for estate planning. According to her insights, an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to provides flexibility and helps avoid probate, which simplifies the transfer of assets. Moreover, she advocates for clear communication between trustors to ensure the trust functions according to their wishes. Such guidance can empower couples to make informed decisions about their estate.

A joint revocable trust may limit flexibility and control for each spouse. In an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to, one spouse’s wishes could overshadow the other's preferences during management or distribution. Additionally, joint trusts may complicate the process for heirs if one spouse passes away. Evaluating your family's needs can help you decide whether a joint trust aligns with your goals.

Husband and wife can benefit from separate revocable trusts depending on their financial situation. A separate Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to can provide flexibility in managing individual assets, tax planning, and estate distribution. However, creating individual trusts may complicate the management process and increase administrative costs. Consider consulting with a legal expert to determine the best approach for your specific circumstances.

A joint revocable trust is generally taxed as income is received, and taxes are filed under the trustors' social security numbers during their lifetime. After the trustors pass away, the trust may become irrevocable, changing the tax implications. Understanding the tax treatment of an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to can assist in your financial planning.

A joint trust may lead to potential complications, such as differing opinions between spouses on asset management. Additionally, it can limit flexibility if one spouse wants to change the terms or beneficiaries. Evaluating the benefits and disadvantages of an Idaho Revocable Trust Agreement with Husband and Wife as Trustors and Income to is crucial in determining the best structure for your needs.