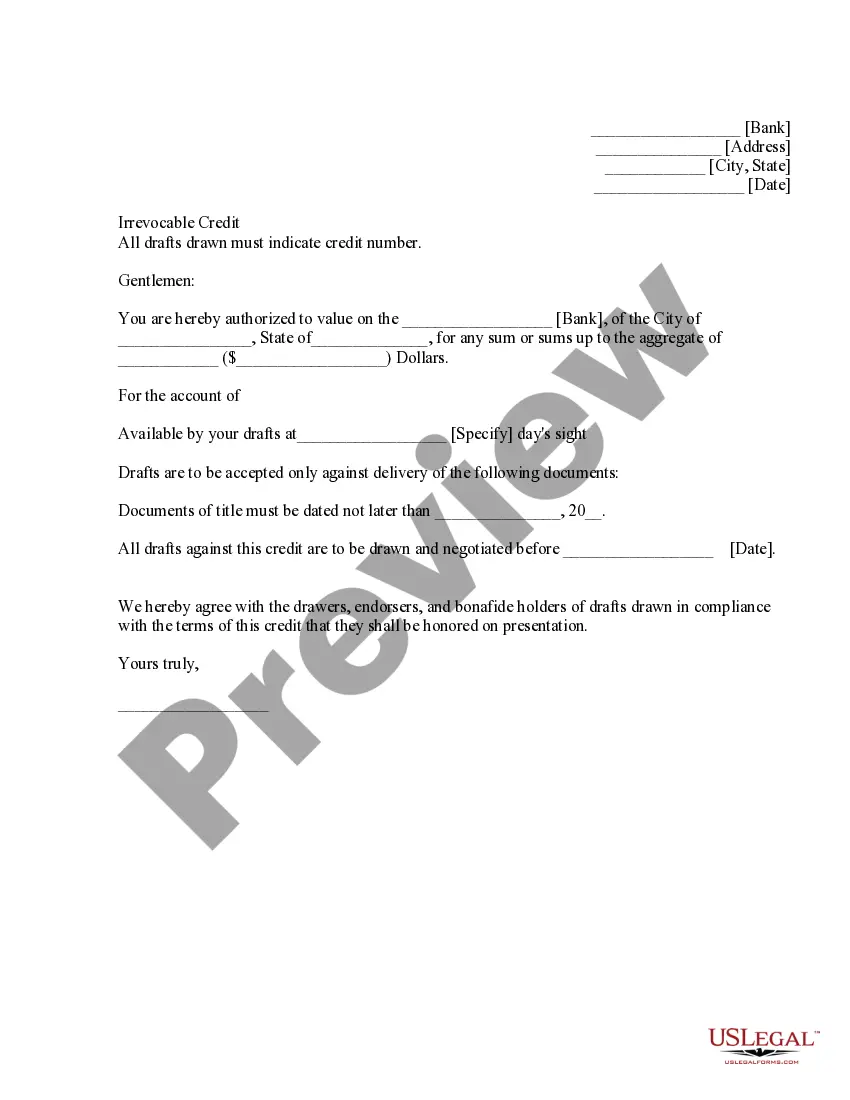

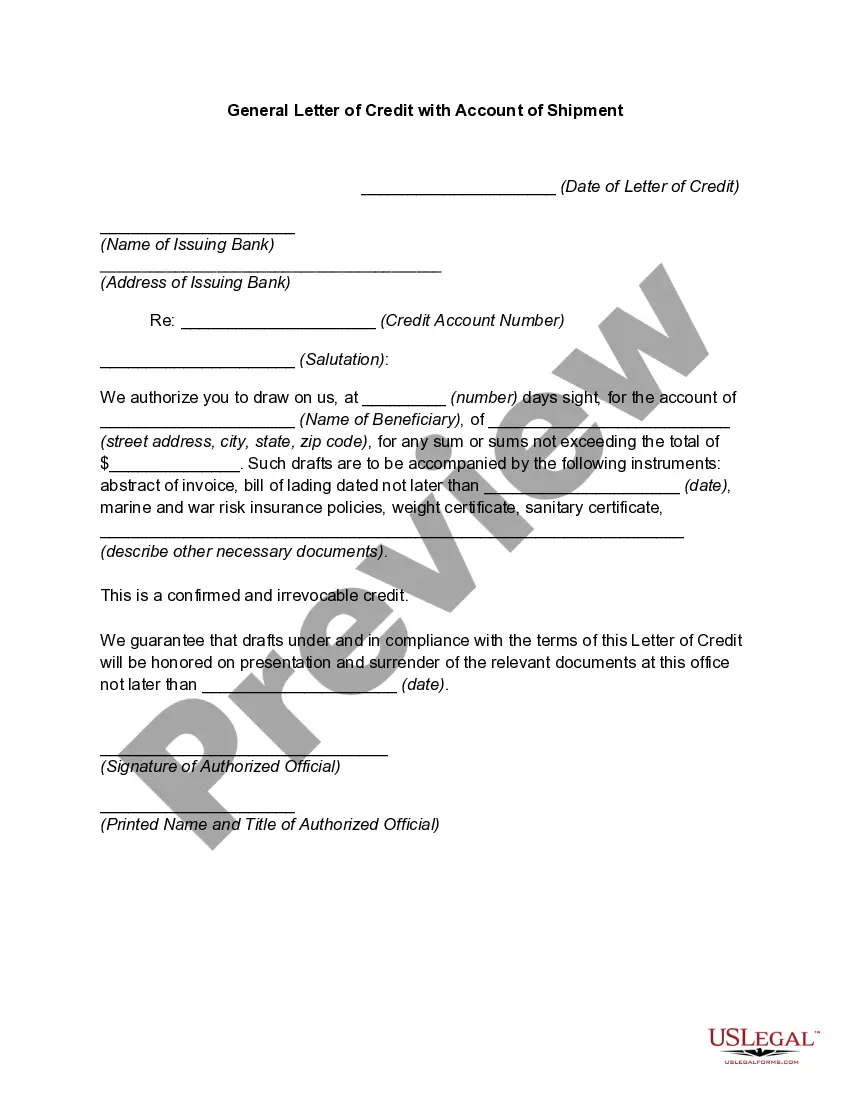

Idaho General Letter of Credit with Account of Shipment

Description

How to fill out General Letter Of Credit With Account Of Shipment?

Discovering the right authorized record design could be a have a problem. Needless to say, there are a variety of themes available on the Internet, but how would you discover the authorized type you need? Utilize the US Legal Forms site. The assistance delivers thousands of themes, such as the Idaho General Letter of Credit with Account of Shipment, that you can use for organization and private requirements. All the types are checked out by professionals and fulfill federal and state requirements.

When you are presently registered, log in in your bank account and then click the Obtain switch to have the Idaho General Letter of Credit with Account of Shipment. Make use of your bank account to check through the authorized types you might have purchased previously. Proceed to the My Forms tab of your bank account and acquire yet another version from the record you need.

When you are a new customer of US Legal Forms, allow me to share basic guidelines for you to adhere to:

- Initial, make sure you have chosen the proper type to your city/area. You may look over the form using the Review switch and browse the form information to ensure it is the best for you.

- In the event the type does not fulfill your preferences, use the Seach area to obtain the right type.

- Once you are positive that the form is proper, click the Acquire now switch to have the type.

- Choose the pricing plan you would like and enter the essential information. Design your bank account and pay money for the transaction using your PayPal bank account or Visa or Mastercard.

- Choose the data file file format and down load the authorized record design in your product.

- Full, change and printing and sign the received Idaho General Letter of Credit with Account of Shipment.

US Legal Forms may be the greatest local library of authorized types in which you can see a variety of record themes. Utilize the service to down load appropriately-produced documents that adhere to status requirements.

Form popularity

FAQ

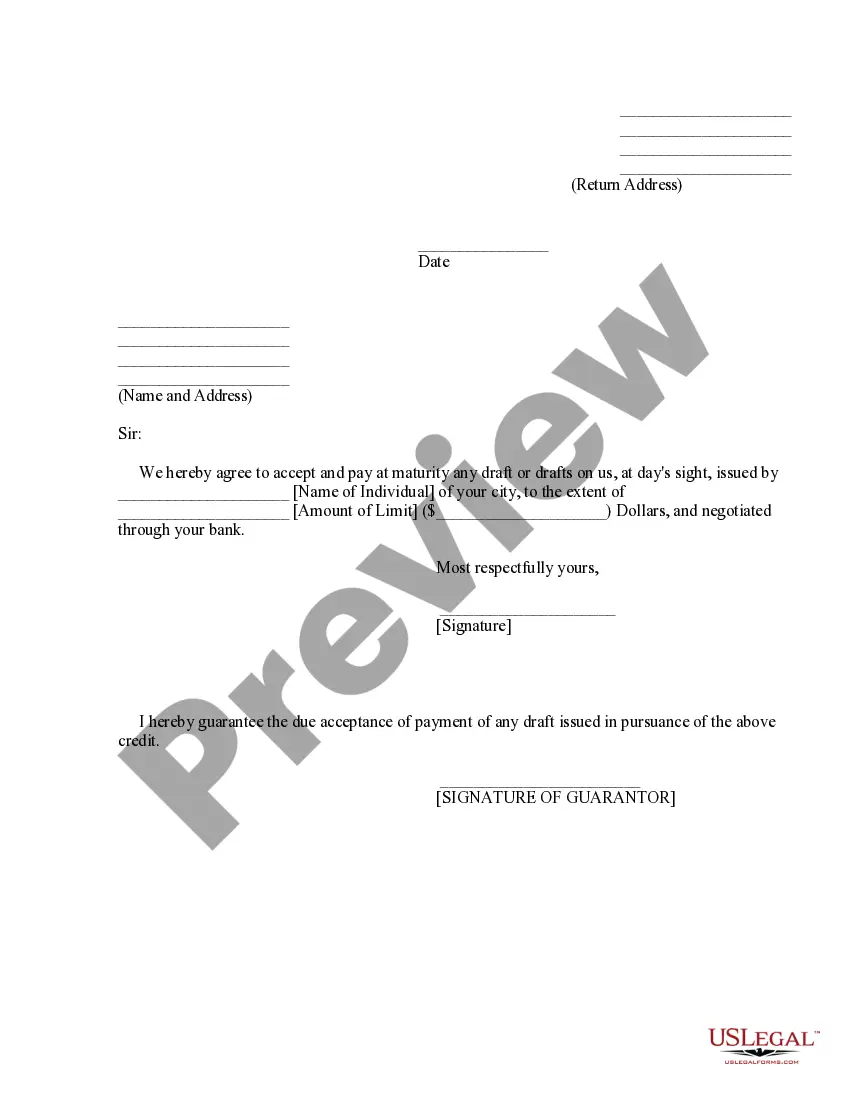

A letter of credit or LC is a written document issued by the importer's bank (opening bank) on importer's behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit.

Banks typically require a pledge of securities or cash as collateral for issuing a letter of credit. Because a letter of credit is typically a negotiable instrument, the issuing bank pays the beneficiary or any bank nominated by the beneficiary.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

A letter of credit can be used only once. A line of credit is used by businesses to help with cash flow. The bank will issue an amount of money that the business can use at any time for almost anything. Once the money is used, the borrower must pay it back either immediately or over time with interest.