An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

Another factor to be considered is the connection and regularity of business between the independent contractor and the hiring party. Important factors to be considered are separate advertising, procurement of licensing, maintenance of a place of business, and supplying of tools and equipment by the independent contractor. If the service rendered is to be completed by a certain time, as opposed to an indefinite time period, a finding of an independent contractor status is more likely.

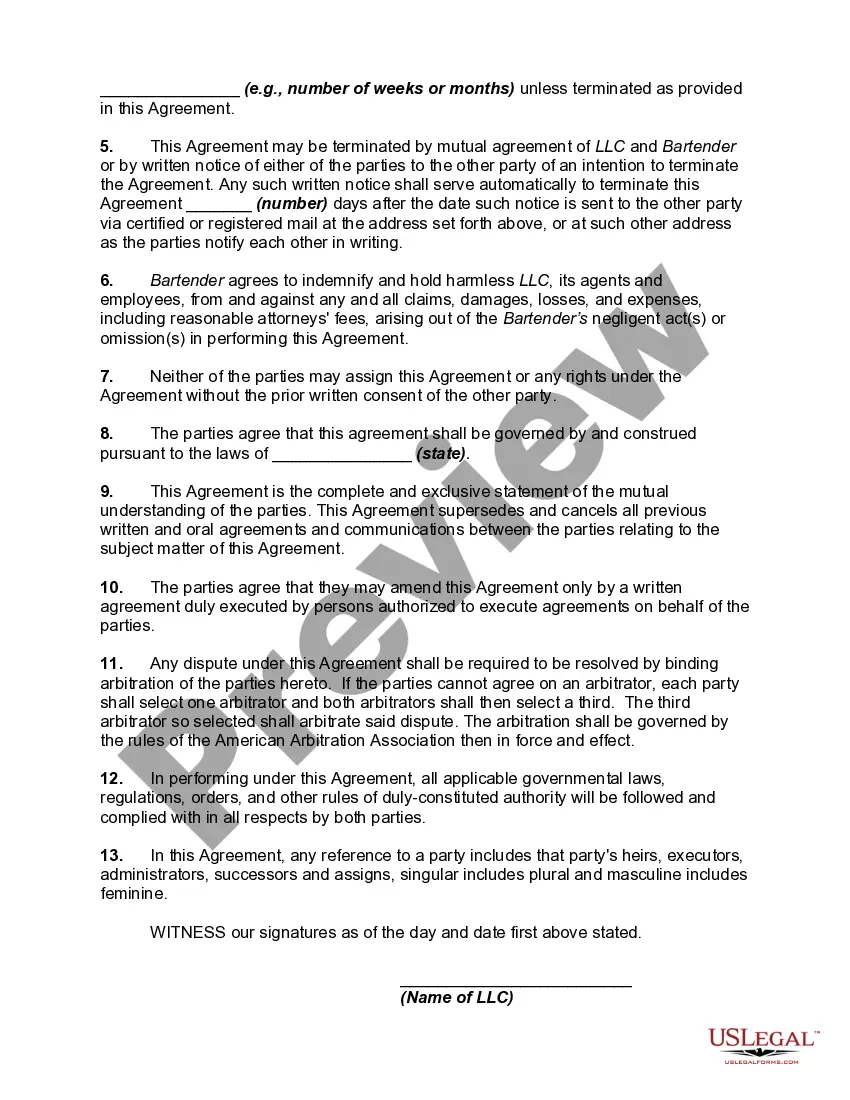

Idaho Agreement Between a Bartender — as an IndependenContractto— - and a Business that Supplies Bartenders to Parties and Special Events Introduction: In Idaho, the Agreement Between a Bartender — as an Independent Contractor — and a Business that Supplies Bartenders to Parties and Special Events is a legally binding document that outlines the terms and conditions between an independent contractor bartender and a business that provides bartending services for parties and special events. This agreement aims to establish a clear understanding of the rights, responsibilities, compensation, and liabilities of both parties involved. Key Clauses: 1. Identification of Parties: Clearly state the full legal names and addresses of both the bartender (independent contractor) and the business that supplies bartenders for parties and special events. 2. Services: Describe the services the bartender will provide, such as mixing and serving beverages, ensuring compliance with alcohol regulations, maintaining cleanliness of the bar area, and any other relevant duties. 3. Schedule and Availability: Define the agreed-upon schedule for the bartender's services and mention any flexibility in availability requirements for parties and events. 4. Compensation: Specify how the bartender will be compensated, whether it's on an hourly basis or commission basis and detailing the payment terms, including how and when payment will be made. 5. Taxes and Insurance: Clarify that the bartender is responsible for their own taxes, including income and self-employment taxes. Highlight that the bartender must provide proof of liability insurance coverage when requested by the business. 6. Independent Contractor Relationship: Clearly state that the bartender is an independent contractor and not an employee of the business. Emphasize that the bartender is responsible for their own equipment, transportation, professional licenses, and relevant certifications. 7. Conduct and Appearance: Establish guidelines for the bartender's professional conduct, including dress code, grooming standards, and adherence to local and state laws and regulations related to the serving of alcohol. 8. Confidentiality: Include a confidentiality clause that prohibits the bartender from disclosing any business-related information, trade secrets, or client information acquired during their engagement. 9. Termination: Outline the circumstances under which either party can terminate the agreement, such as breach of contract, failure to perform duties as agreed, or violation of any terms and conditions stated in the agreement. 10. Governing Law and Jurisdiction: Specify Idaho law as the governing law for the agreement and designate the county or district court for any disputes arising out of the agreement. Types of Idaho Agreements: There may be variations or additional clauses in different Idaho agreements between a bartender as an independent contractor and a business that supplies bartenders for parties and special events. Some common types can include: 1. Single-event Agreements: These agreements are designed specifically for a one-time event and generally have a fixed term. 2. Ongoing Agreements: These are longer-term agreements that establish an ongoing arrangement between the bartender and the business, covering multiple parties and special events over an extended period. 3. Exclusive Agreements: These agreements ensure that the bartender exclusively provides services to the business, restricting them from working for other similar businesses or clients during the agreement's duration. By considering these key clauses and understanding the different types of Idaho agreements, both the bartender and the business can protect their rights, establish a fair working relationship, and ensure smooth operations at parties and special events.