Idaho Disputed Accounted Settlement

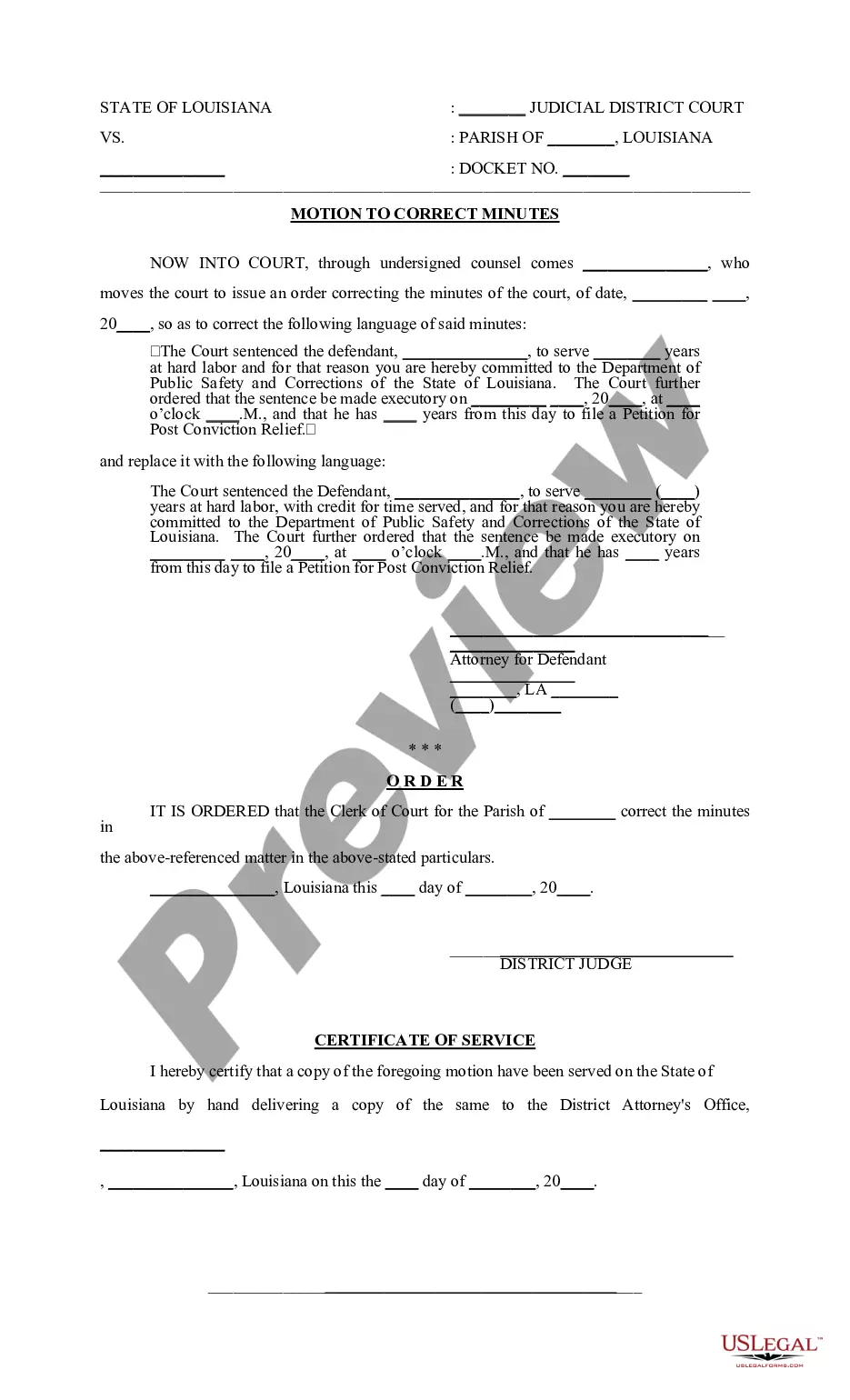

Description

How to fill out Disputed Accounted Settlement?

Are you currently inside a placement the place you will need documents for both organization or individual uses virtually every day? There are a lot of lawful record web templates available on the net, but finding kinds you can trust isn`t effortless. US Legal Forms gives 1000s of type web templates, just like the Idaho Disputed Accounted Settlement, which can be created to satisfy federal and state specifications.

When you are presently knowledgeable about US Legal Forms site and also have an account, basically log in. Next, you can down load the Idaho Disputed Accounted Settlement design.

If you do not come with an account and wish to begin using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is for your appropriate city/county.

- Utilize the Review switch to examine the shape.

- Read the explanation to ensure that you have chosen the appropriate type.

- When the type isn`t what you`re looking for, take advantage of the Search industry to obtain the type that suits you and specifications.

- Whenever you get the appropriate type, simply click Get now.

- Choose the prices strategy you want, complete the desired information to generate your account, and pay money for the order utilizing your PayPal or credit card.

- Choose a convenient file file format and down load your duplicate.

Discover all the record web templates you may have purchased in the My Forms food list. You can aquire a extra duplicate of Idaho Disputed Accounted Settlement anytime, if necessary. Just click the necessary type to down load or produce the record design.

Use US Legal Forms, probably the most extensive selection of lawful varieties, to save lots of time and steer clear of faults. The service gives skillfully created lawful record web templates that can be used for a variety of uses. Generate an account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Idaho will consider as unfair practices those acts, omissions, or methods that consist of: Misrepresenting facts in insurance policy related to coverages. Failing to act reasonably and promptly upon communication with respect to insurance claims. Failing to conduct a reasonable investigation.

This normally would be 5 years for a written contract and 4 years for an oral contract. Our experiences is that the 5 year statute of limitations normally applies. With this kind of debt, normally the entire amount of debt must be paid off before any distribution can be made to the decedent's family or loved ones.

Search Idaho Statutes (2) A person is guilty of a misdemeanor if he knowingly gives or causes to be given false information regarding his or another's identity to any law enforcement officer investigating the commission of an offense. History: [18-5413, added 1995, ch. 275, sec.

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt.

For collection of a debt on an account, where there is an agreement in writing, the statute of limitations is five years. (Refer to §5-216.) For collection of a debt on an account, where there is an oral agreement, the statute of limitations is four years. (Refer to §5-217.)

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The driver of any vehicle which collides with any unattended vehicle shall immediately stop, and then and there either locate and notify the operator or owner of the vehicle of the name and address of the driver and owner of the vehicle striking the unattended vehicle, or shall leave in a conspicuous place in or on the ...

Statutes of limitations for each state (in number of years) StateWritten contractsOpen-ended accounts (including credit cards)Idaho54Illinois105Indiana66Iowa10547 more rows ?