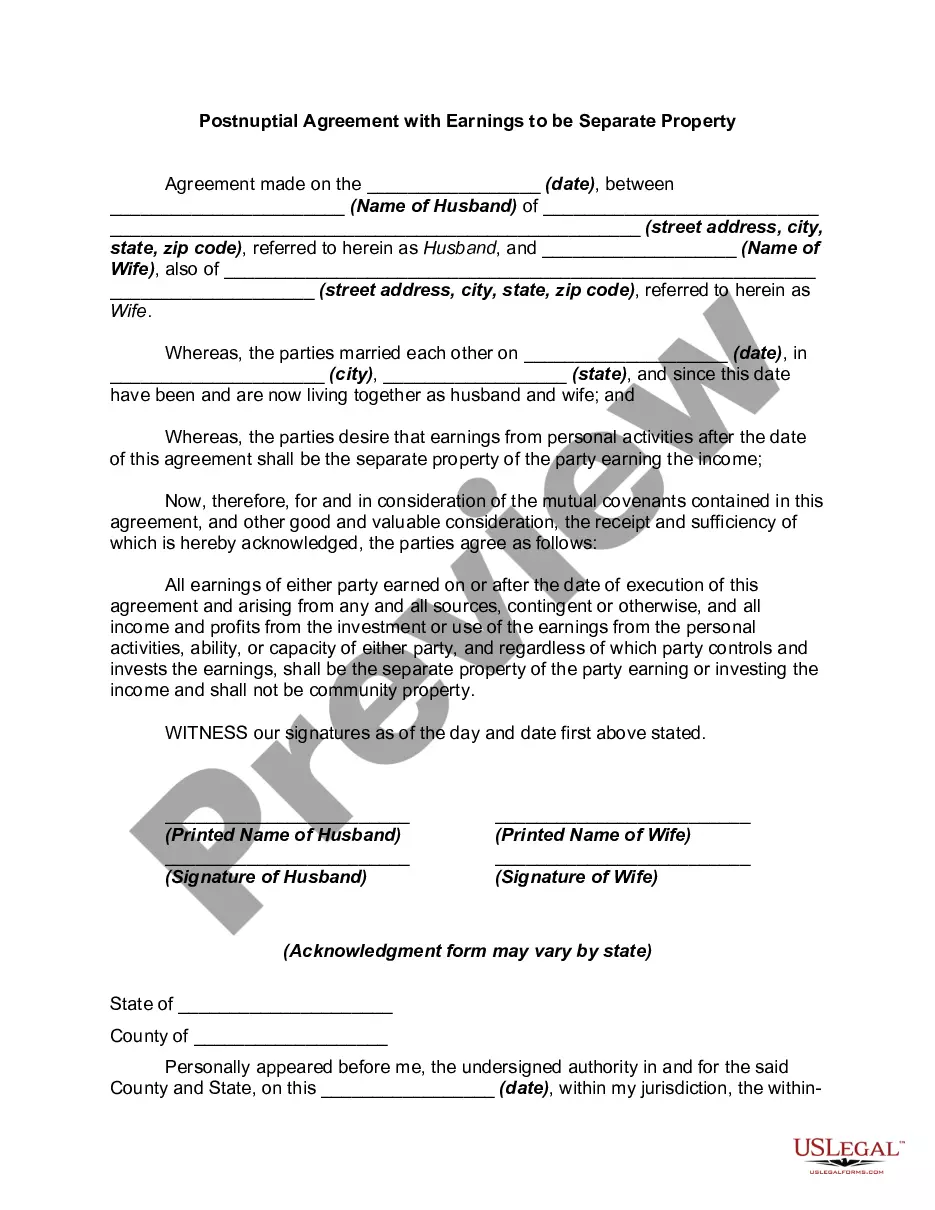

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.