This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

If you need to full, obtain, or printing authorized file themes, use US Legal Forms, the biggest selection of authorized kinds, which can be found on-line. Use the site`s basic and practical search to find the papers you will need. Different themes for business and specific uses are sorted by types and states, or key phrases. Use US Legal Forms to find the Idaho Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage within a handful of click throughs.

When you are currently a US Legal Forms buyer, log in to your account and then click the Download key to have the Idaho Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. You can also entry kinds you formerly acquired in the My Forms tab of your respective account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the proper town/country.

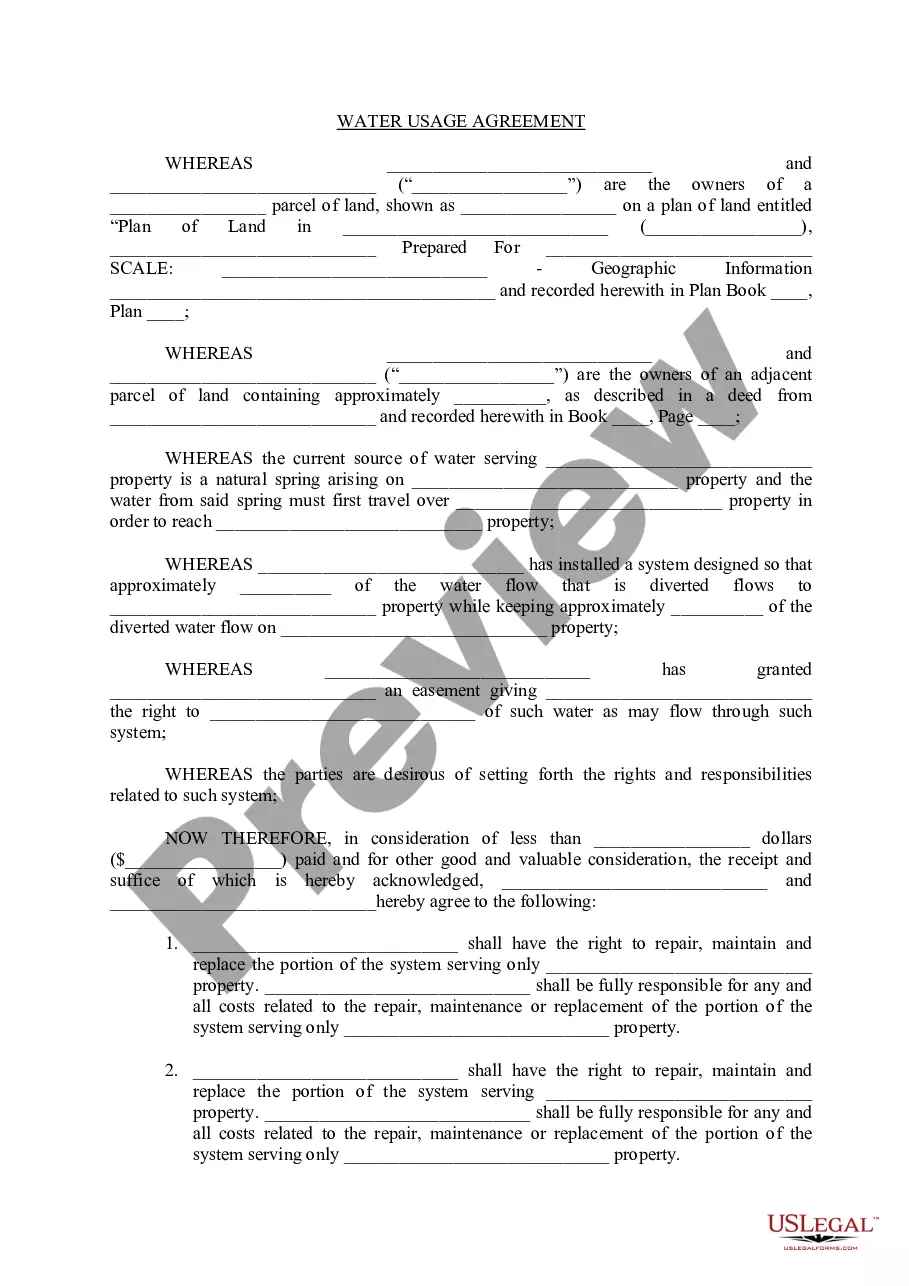

- Step 2. Utilize the Review method to check out the form`s content material. Never overlook to see the information.

- Step 3. When you are unsatisfied with the form, use the Search discipline at the top of the display to get other variations in the authorized form web template.

- Step 4. When you have found the form you will need, go through the Buy now key. Pick the costs plan you favor and put your references to register for an account.

- Step 5. Approach the purchase. You may use your bank card or PayPal account to perform the purchase.

- Step 6. Choose the structure in the authorized form and obtain it in your system.

- Step 7. Total, change and printing or sign the Idaho Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

Every authorized file web template you purchase is the one you have eternally. You have acces to each and every form you acquired inside your acccount. Select the My Forms section and select a form to printing or obtain once more.

Remain competitive and obtain, and printing the Idaho Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage with US Legal Forms. There are millions of skilled and condition-specific kinds you can utilize for your business or specific demands.

Form popularity

FAQ

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

Defamation is any statement, whether written or oral, that injures the good name or reputation of another person. For a statement to be defamatory, it must not be true.

45-1502. Definitions ? Trustee's charge. As used in this act: (1) "Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest, and who shall not be the trustee.

The ?Trustor? is the person who borrowed the money (the Payor of the Note) The ?Beneficiary? is the person who is lending the money (the Payee of the Note) The ?Trustee? is the neutral 3rd party who will issue the release of the loan once it is paid in full.

45-1504. TRUSTEE OF TRUST DEED --- WHO MAY SERVE --- SUCCESSORS. (d) A licensed title insurance agent or title insurance company authorized to transact business under the laws of the state of Idaho. (2) The trustee may resign at its own election or be replaced by the beneficiary.

If Mortgagee fails to satisfy of record, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit. Acknowledgment: An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

Any person who handles, uses or operates any firearm in a careless, reckless or negligent manner, or without due caution and circumspection, whereby the same is fired or discharged and maims, wounds or injures any other person or persons, is guilty of a misdemeanor, and upon conviction thereof shall be punished by a ...

Answer: ing to Idaho Code § 74-403(4), a conflict of interest occurs when a legislative official takes official action or makes an official decision or recommendation, the effect being to the ?private pecuniary benefit? of such person, the person's household or business.