Title: Understanding Idaho Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions Keywords: Idaho Articles of Incorporation, Not-for-Profit Organization, Tax Provisions, Types Introduction: In the state of Idaho, the Articles of Incorporation play a crucial role in establishing and governing not-for-profit organizations. These legal documents provide the necessary framework for the organization's formation, operation, and adherence to specific tax provisions. This article aims to provide a detailed description of Idaho Articles of Incorporation for Not-for-Profit Organizations, highlighting their importance and the different types associated with tax provisions. 1. Overview of Idaho Articles of Incorporation: The Idaho Articles of Incorporation is a legal document that formally creates a not-for-profit organization within the state. It sets forth the organization's purpose, structure, initial board members, and other essential details required for its operation. These articles act as a primary reference for state authorities to recognize and grant tax-exempt status to the organization. 2. Not-for-Profit Organization and Tax Exemption: A not-for-profit organization is established for purposes other than generating a profit for its members or shareholders. Depending on their activities and objectives, these organizations may seek tax-exempt status from federal and state governments. Tax provisions vary depending on the organization's nature, and complying with specific laws ensures continued exemption and compliance with tax regulations. 3. Types of Idaho Articles of Incorporation for Not-for-Profit Organizations: a) General Purpose Not-for-Profit Organization: This type of organization serves a broad range of purposes, such as religious, educational, scientific, or charitable activities. The articles must outline the organization's intention to operate solely for these purposes and comply with relevant tax provisions. b) Public Charity Not-for-Profit Organization: These organizations primarily rely on public donations and contributions to fulfill their mission. They engage in activities that directly benefit the public, such as educational programs, healthcare initiatives, or poverty alleviation. To maintain their tax-exempt status, they must meet specific IRS requirements. c) Private Foundation Not-for-Profit Organization: Private foundations generally operate through endowments or funds provided by a few individuals, families, or corporations. While they also fulfill charitable purposes, they have additional restrictions and obligations, such as mandatory minimum distributions, to ensure transparency and accountability with their financial resources. 4. Key Elements of Idaho Articles of Incorporation: When drafting Idaho Articles of Incorporation for a Not-for-Profit Organization with tax provisions, the following elements require careful consideration: — Organization's name and principal office address — Specific, clearly stated purpose or mission — Statement of non-profinatureur— - Membership structure (if applicable) — Board of Directors composition and duties — Dissolution provision— - Statement regarding tax-exempt status — Any additional provisions as required by state and federal laws Conclusion: Idaho Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions are vital legal documents that establish the framework for operating a tax-exempt entity. Understanding the different types of organizations and the specific tax provisions associated with each type is essential to ensure compliance with state and federal regulations. By adhering to these provisions properly, not-for-profit organizations can benefit from tax-exempt status while fulfilling their mission to serve the community.

Idaho Articles of Incorporation, Not for Profit Organization, with Tax Provisions

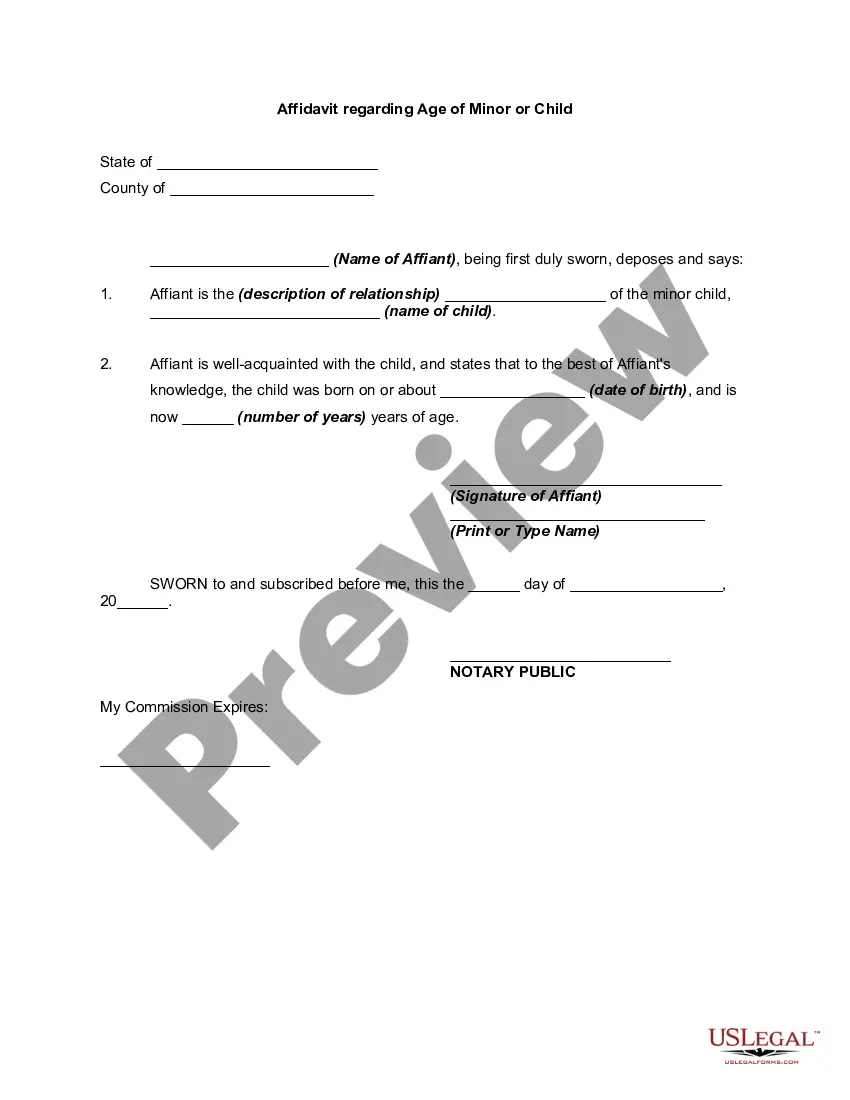

Description

How to fill out Idaho Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

US Legal Forms - one of the most significant libraries of legal kinds in the USA - delivers a variety of legal record themes you can download or print. Making use of the internet site, you will get thousands of kinds for company and specific uses, sorted by categories, suggests, or keywords and phrases.You will discover the latest models of kinds much like the Idaho Articles of Incorporation, Not for Profit Organization, with Tax Provisions in seconds.

If you already have a subscription, log in and download Idaho Articles of Incorporation, Not for Profit Organization, with Tax Provisions in the US Legal Forms catalogue. The Obtain option will appear on each type you view. You get access to all previously delivered electronically kinds within the My Forms tab of your own account.

If you wish to use US Legal Forms the first time, listed below are straightforward recommendations to obtain began:

- Ensure you have picked out the right type for the area/region. Click the Review option to examine the form`s articles. Browse the type description to ensure that you have selected the proper type.

- In the event the type does not satisfy your specifications, use the Lookup area near the top of the monitor to get the the one that does.

- If you are happy with the form, verify your decision by clicking the Get now option. Then, pick the pricing strategy you prefer and provide your credentials to sign up to have an account.

- Procedure the financial transaction. Make use of charge card or PayPal account to perform the financial transaction.

- Pick the formatting and download the form in your device.

- Make alterations. Fill up, revise and print and sign the delivered electronically Idaho Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Each web template you added to your money lacks an expiry particular date and is your own property forever. So, in order to download or print one more duplicate, just check out the My Forms section and then click in the type you need.

Get access to the Idaho Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms, probably the most considerable catalogue of legal record themes. Use thousands of expert and status-specific themes that meet up with your organization or specific requires and specifications.