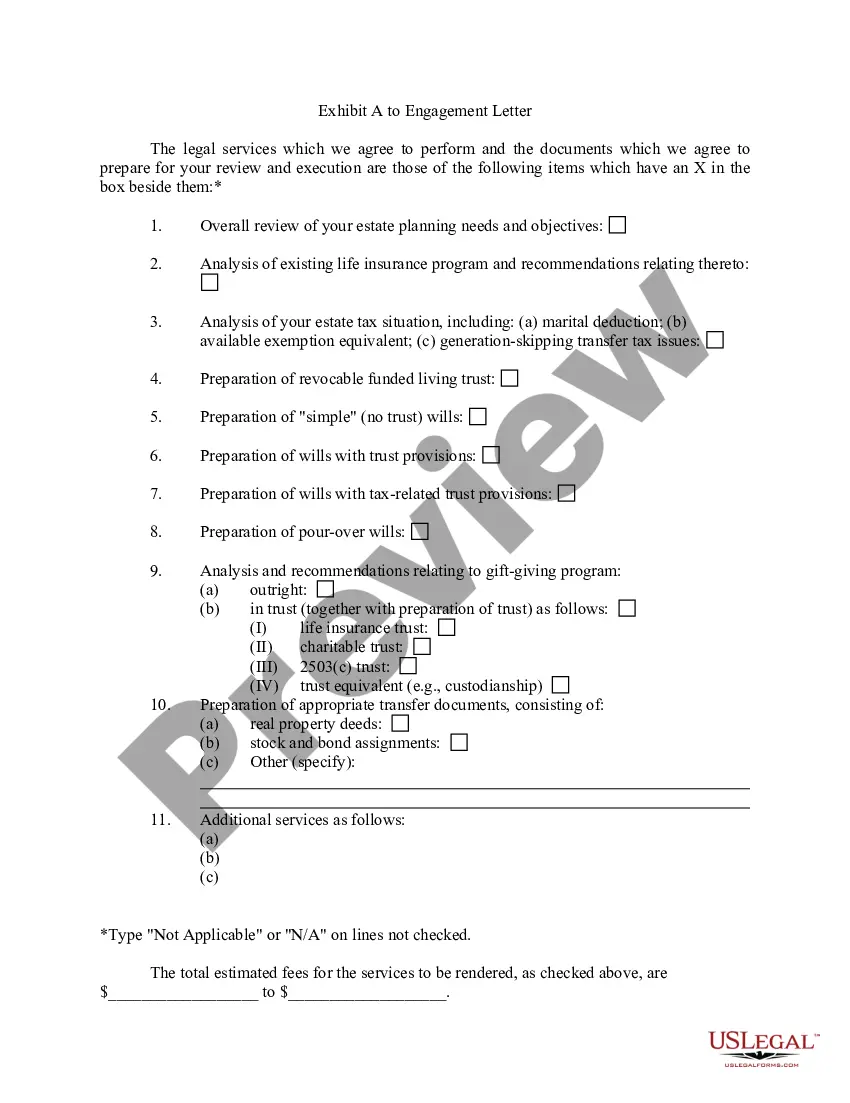

Idaho Estate Planning Data Letter: A Comprehensive Guide to Protecting Your Assets The Idaho Estate Planning Data Letter is a crucial legal document designed to safeguard your estate and ensure smooth administration of your assets after your passing. This personalized letter, also known as an Estate Planning Information Sheet, collects vital information about your estate, which is then utilized by your attorney, executor, or trustee to carry out your wishes effectively. When creating an Idaho Estate Planning Data Letter, various essential details are typically included. This document comprises key personnel information such as your full legal name, date of birth, and social security number. It lists your current and previous addresses, contact details, and any alternate names you have used. Additionally, it is crucial to provide the names, birthdates, and social security numbers of your spouse, children, beneficiaries, or other parties relevant to your estate planning. Furthermore, the Idaho Estate Planning Data Letter requires a comprehensive inventory of your assets, including real estate properties, bank accounts, investments, retirement accounts, and insurance policies. You will need to provide detailed descriptions, locations, and approximate values for each asset to ensure accurate estate distribution and minimize potential conflicts. By specifying your intentions regarding specific items or sentimental possessions, you can further alleviate potential disputes and ensure your legacy is managed in accordance with your wishes. It is essential to keep in mind that estate planning is an ongoing process, and as your circumstances change, updating your Idaho Estate Planning Data Letter becomes imperative. By regularly reviewing and revising this document, you can accommodate any alterations in your family, financial situation, or estate plan objectives. Comprehensive and up-to-date estate information is invaluable during probate proceedings and will significantly reduce stress for your loved ones during a difficult time. Employment Agreement with Client: Ensuring a Positive and Transparent Professional Relationship An Employment Agreement with a Client is a contract drafted to outline the terms and conditions of a professional engagement. This agreement serves as a foundation for establishing a harmonious working relationship, clearly defining the expectations, responsibilities, and compensation structure between both parties. In Idaho, various types of Employment Agreements can be used based on the specific nature of the employment arrangement. Some common variations include: 1. Standard Employment Agreement: This encompasses the general terms and conditions of employment, including job responsibilities, working hours, compensation, benefits, and grounds for termination. It applies to traditional employer-employee relationships, ensuring a mutual understanding between the employer and the client. 2. Freelancer/Independent Contractor Agreement: This agreement is designed for temporary or project-based engagements. It outlines the scope of work to be completed, payment terms, project timelines, and intellectual property ownership. It also explicitly states that the individual is not considered an employee and is responsible for their own taxes, benefits, and liability insurance. 3. Non-Disclosure Agreement (NDA): An NDA may be included as part of the Employment Agreement if the client requires protection of sensitive information or trade secrets. This ensures that confidential information shared during the employment relationship remains secured and prevents the employee from disclosing it to third parties. In all types of Employment Agreements with clients, transparency and clarity are paramount. By clearly articulating the rights and responsibilities of both parties, potential misunderstandings and disputes can be minimized. Seeking legal advice when drafting or reviewing an Employment Agreement is advisable to ensure compliance with Idaho employment laws and regulations. Overall, an Idaho Estate Planning Data Letter is critical for comprehensive estate planning, ensuring that your wishes are fulfilled accurately. Similarly, an Employment Agreement with a Client establishes a solid foundation for a successful professional collaboration, protecting the interests of both parties involved.

Idaho Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

If you wish to total, download, or print lawful document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and personal purposes are categorized by types and states or keywords.

Step 4. Once you have found the form you want, click the Get now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to locate the Idaho Estate Planning Information Letter and Client Employment Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Idaho Estate Planning Information Letter and Client Employment Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you’re using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

An estate planner requires thorough information to provide you with effective planning strategies. They need to understand your financial situation, which includes income sources, assets, and liabilities. Moreover, you should share your family dynamics, beneficiaries, and any specific desires you have for the distribution of your estate. This information is vital for crafting an Idaho Estate Planning Data Letter and Employment Agreement with Client that truly reflects your intentions.

When planning your estate, it’s essential to gather specific information that will streamline the process. You will need details about your assets, including property, investments, and bank accounts. Additionally, document your debts and any existing wills or trusts. Having this information ready allows you to create a comprehensive Idaho Estate Planning Data Letter and Employment Agreement with Client, ensuring your wishes are clearly articulated.

The two key documents used for preparing an estate plan are a will and a durable power of attorney. A will specifies how your assets are to be distributed after death, while a durable power of attorney allows someone you trust to handle your financial matters if you are unable to do so. With the Idaho Estate Planning Data Letter and Employment Agreement with Client, you can ensure that these documents are comprehensive and tailored to your needs.

Yes, you can write your own will and have it notarized in Idaho, provided it meets the state requirements for being legally valid. However, it is advisable to ensure that your will clearly reflects your intentions and is compliant with Idaho law. Incorporating the Idaho Estate Planning Data Letter and Employment Agreement with Client can offer peace of mind, as it guides you to consider all necessary elements for a valid will.

The two main components of estate planning are asset distribution and healthcare decisions. Estate planning allows you to specify how your assets should be distributed, while also designating a person to make healthcare decisions on your behalf if necessary. This comprehensive approach is highlighted in the Idaho Estate Planning Data Letter and Employment Agreement with Client, ensuring that your wishes are clearly communicated.

An essential document for estate planning is a will, as it outlines your wishes regarding asset distribution after your passing. Without proper documentation, managing assets can become complicated for your loved ones. When you use the Idaho Estate Planning Data Letter and Employment Agreement with Client, you ensure that all necessary documents are prepared efficiently and accurately, protecting your interests.

The Tedra statute in Idaho refers to legislation that governs the administration of estates. This law provides a framework for resolving disputes among heirs and beneficiaries, ensuring fairness in the estate distribution process. If you're navigating estate planning, the Tedra statute plays a crucial role in the Idaho Estate Planning Data Letter and Employment Agreement with Client, guiding you through potential conflicts that may arise.

In Idaho, a spouse does not automatically inherit everything if their partner dies without a will. The intestate laws determine how the estate is divided among surviving spouses and children. To avoid confusion, an Idaho Estate Planning Data Letter and Employment Agreement with Client can ensure that your spouse is adequately provided for, according to your desires.

An estate planning letter is a document that outlines your wishes regarding your assets and healthcare decisions after your passing. This letter serves as a guide for your family and helps clarify your intentions, reducing potential conflicts. By using an Idaho Estate Planning Data Letter and Employment Agreement with Client, you can ensure that your wishes are clearly articulated and legally supported.

TEDRA, or the Termination of Employment Data Requirement Act, is used in Idaho for dealing with disputes related to estate management and fiduciary responsibilities. It provides a legal framework for resolving issues efficiently and fairly. When you incorporate an Idaho Estate Planning Data Letter and Employment Agreement with Client, it can streamline the communication and understanding between all parties involved in the estate.