Idaho Invoice Template for Aviator

Description

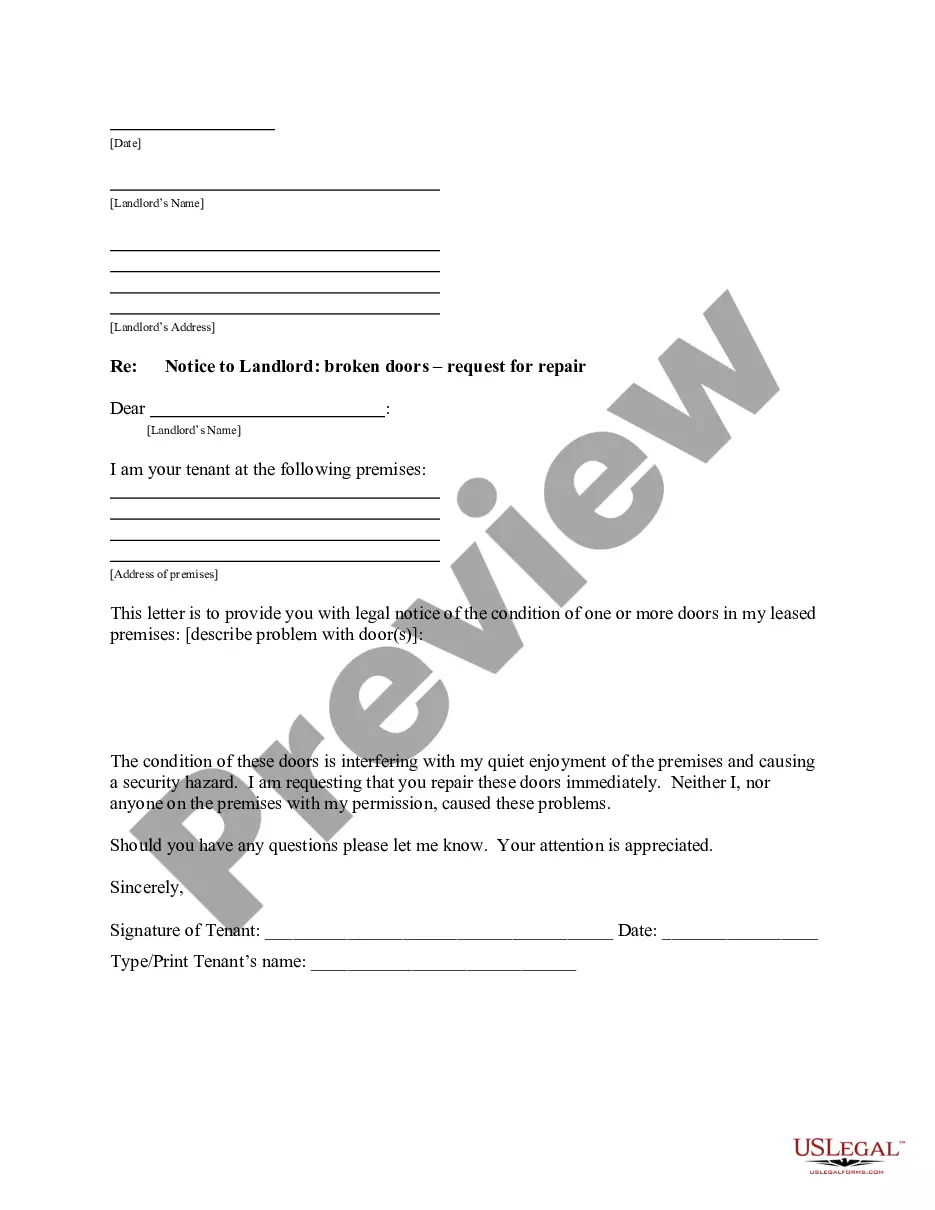

How to fill out Invoice Template For Aviator?

Selecting the appropriate valid document template can be challenging. Naturally, there are numerous designs accessible online, but how do you find the authentic form you require? Utilize the US Legal Forms website.

The service offers a multitude of formats, such as the Idaho Invoice Template for Aviator, suitable for both commercial and personal purposes. All documents are vetted by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Idaho Invoice Template for Aviator. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Complete, modify, print, and sign the acquired Idaho Invoice Template for Aviator. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain professionally crafted papers that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not align with your requirements, utilize the Search field to find the appropriate form.

- Once you are sure the form is correct, click the Get now button to acquire the form.

- Select the pricing plan you want and fill in the required information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legitimate document template for your device.

Form popularity

FAQ

Google Forms does not directly provide an invoice template, but you can create a custom form to collect relevant invoice information. This method allows you to gather data efficiently, which you can then use to generate an invoice. However, using the Idaho Invoice Template for Aviator from US Legal Forms is often more effective for creating fully formatted and compliant invoices.

To design your own invoice, start with a clear header that includes your company name and contact information. Choose a clean layout that highlights the services or goods provided and their prices. If you prefer a professional look, the Idaho Invoice Template for Aviator available at US Legal Forms can serve as a great foundation for your custom invoice design.

Google does not offer a dedicated invoicing program, but you can utilize Google Workspace tools like Sheets to create your invoices. Many users find success integrating their invoices with tools from third-party providers. For a more tailored solution, consider the Idaho Invoice Template for Aviator on US Legal Forms, designed specifically for your invoicing needs.

To create a freight invoice, begin by including your business information, such as name and address, along with the customer’s details. Next, itemize the services rendered or goods transported, including description and costs. Using the Idaho Invoice Template for Aviator from US Legal Forms simplifies this process, providing you with a professional format that meets industry standards.

The correct format for an invoice includes the sender's information, client's details, date of issue, unique invoice number, and a list of services or products with their prices. Payment terms should also be specified, ensuring clarity for both parties. Employing the Idaho Invoice Template for Aviator ensures that your invoices follow an organized and professional format.

To complete an invoice for payment, include your payment terms and methods clearly. List all services or goods provided, and ensure to show the total amount due. Utilizing the Idaho Invoice Template for Aviator allows for straightforward filling out, ensuring accuracy in your billing process.

Filling out an invoice template involves entering your details like name, address, and invoice number. Next, list your products or services with corresponding prices. The Idaho Invoice Template for Aviator is user-friendly and ensures you don’t miss essential information while customizing it for your needs.

To fill out a contractor's invoice, start by adding your business information, along with the client's details. Clearly itemize your services, including the hours worked and rates charged. The Idaho Invoice Template for Aviator simplifies this process, allowing you to create detailed invoices effortlessly.

At the bottom of your invoice, you should include a summary of the total amount due, along with payment terms and methods. Including a polite thank you note can enhance customer relationships. Moreover, using the Idaho Invoice Template for Aviator helps ensure that you cover all necessary components seamlessly.

Filling out an invoice sheet requires entering essential details such as your and your client's contact information, listing the products or services provided, and calculating the total amount due. The Idaho Invoice Template for Aviator simplifies this process with designated fields for each necessary aspect, allowing you to complete your invoice efficiently while ensuring no critical information is overlooked.