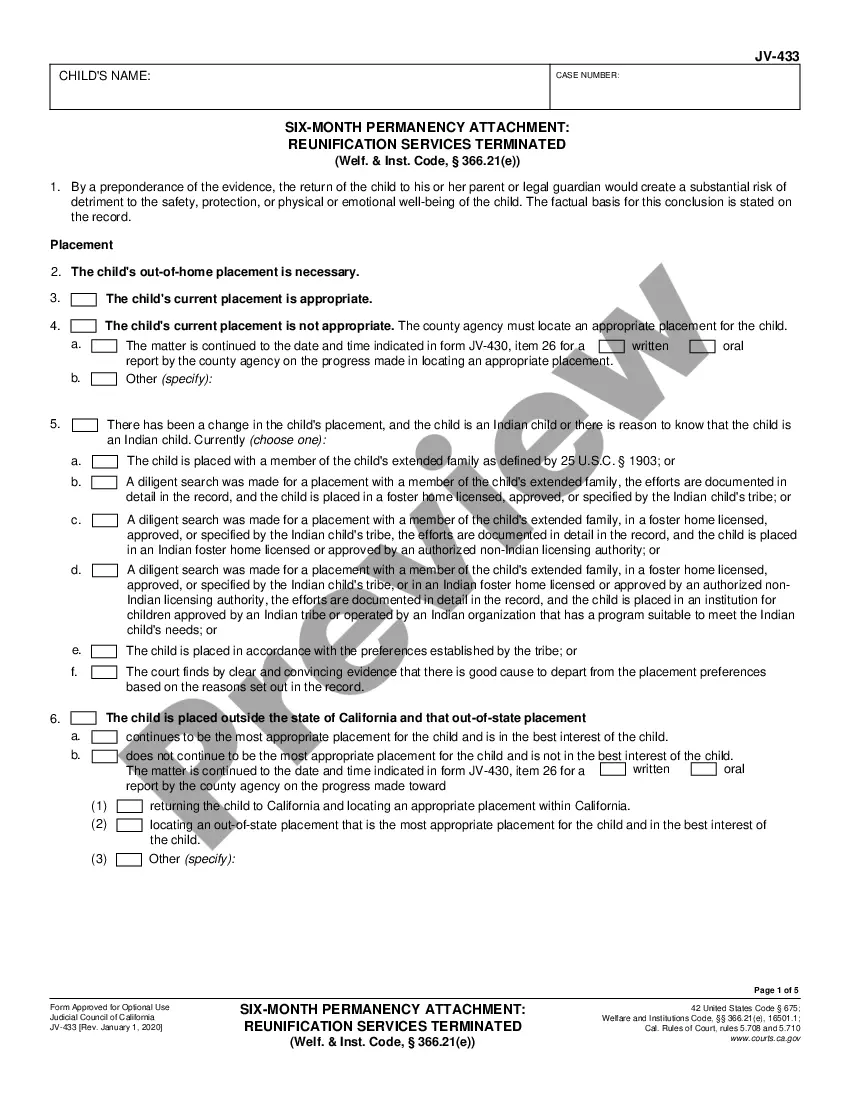

Idaho Invoice Template for Self Employed: Streamline Your Billing Process For self-employed professionals in Idaho, having a well-organized invoicing system is crucial to ensure timely payments and maintain a professional image. An Idaho Invoice Template for Self Employed can be a valuable tool to simplify your billing process while adhering to local regulations. Let's delve into the features, benefits, and types of Idaho Invoice Templates designed specifically for self-employed individuals. Features of an Idaho Invoice Template for Self Employed: 1. Professional Design: An Idaho Invoice Template for Self Employed comes with a polished and customizable layout, allowing you to add your logo, contact details, and branding elements. This professional design enhances your credibility and gives a cohesive look to your invoices. 2. Essential Contact Details: The template includes space to input your name or company name, address, email, phone number, and website. Including these details ensures that clients can easily reach out to you for any clarifications or future business opportunities. 3. Invoice Numbering: Each invoice generated using the template will have a unique invoice number. This sequential numbering system aids in easy identification, tracking, and reference when communicating with clients or for legal purposes. 4. Itemized Billing: The template offers designated sections to itemize the services provided, along with their quantities, rates, and subtotals. This breakdown helps your clients understand the cost distribution and promotes transparency. 5. Tax Calculation: Idaho Invoice Templates for Self Employed often allow for automatic tax calculations based on the applicable sales tax rates in the state. This feature eliminates the need for manual calculations and reduces the chances of errors while ensuring compliance with Idaho tax laws. 6. Payment Terms and Methods: The template enables you to clearly specify your preferred payment terms, such as due date, payment methods accepted (e.g., cash, check, or online payment), and any late payment penalties if applicable. This information sets clear expectations for clients and helps you receive payments promptly. 7. Notes and Terms: You can include additional notes or terms specific to your services or business in the template. This section allows you to communicate any special instructions, refund policies, or disclaimers that clients should be aware of before making payment. Types of Idaho Invoice Templates for Self Employed: 1. Basic Idaho Invoice Template: This template includes all the essential elements necessary for creating professional invoices in Idaho. It is suitable for various self-employed individuals, such as consultants, freelance writers, designers, photographers, or tradespeople. 2. Hourly Rate Idaho Invoice Template: Ideal for professionals who charge their clients on an hourly basis, this template allows you to specify the number of hours worked along with your hourly rate. It automatically calculates the total due, saving you time and effort. 3. Project-Based Idaho Invoice Template: If you work on fixed-price projects, this template lets you break down the project into milestones or phases, clearly stating the services provided and corresponding costs for each stage. It helps you maintain transparency and invoice accurately. 4. Recurring Billing Idaho Invoice Template: For entrepreneurs providing ongoing services with regular billing intervals (e.g., monthly retainers), this template is the go-to option. It conveniently generates invoices automatically at the specified interval, allowing you to focus on your work. Incorporating an Idaho Invoice Template for Self Employed into your business processes ensures professionalism, efficiency, and compliance with Idaho invoicing standards. Choose the template that best suits your industry and start streamlining your billing process today.

Self Employed Invoice Template

Description

How to fill out Idaho Invoice Template For Self Employed?

Finding the right legal record design can be quite a battle. Of course, there are tons of themes available on the net, but how would you obtain the legal form you will need? Utilize the US Legal Forms site. The services offers a large number of themes, like the Idaho Invoice Template for Self Employed, which can be used for enterprise and private requires. All the kinds are checked by experts and satisfy state and federal requirements.

Should you be currently authorized, log in in your account and click the Down load option to obtain the Idaho Invoice Template for Self Employed. Utilize your account to appear through the legal kinds you have ordered formerly. Visit the My Forms tab of your account and obtain one more version in the record you will need.

Should you be a brand new customer of US Legal Forms, listed here are basic directions that you can adhere to:

- First, be sure you have chosen the appropriate form for your town/state. You may look through the shape using the Review option and look at the shape explanation to make certain it is the right one for you.

- If the form fails to satisfy your expectations, take advantage of the Seach area to get the correct form.

- When you are certain the shape is acceptable, click the Purchase now option to obtain the form.

- Pick the costs program you would like and enter the needed info. Create your account and pay money for the order making use of your PayPal account or Visa or Mastercard.

- Choose the submit file format and acquire the legal record design in your device.

- Comprehensive, modify and print out and indicator the received Idaho Invoice Template for Self Employed.

US Legal Forms is definitely the greatest collection of legal kinds in which you can find numerous record themes. Utilize the company to acquire professionally-produced files that adhere to state requirements.

Form popularity

FAQ

The "Send" button gives you the option to send your invoice via PayPal or by yourself. In the latter case, PayPal will generate a link you can send to anyone through email or other chat services.

The following details should definitely be included in a freelancer's invoice:Title.Name and logo.Contact details.Client's name and client's information.Invoice date.Invoice number.List of services with the rate charged (before tax)Tax rate and amount, if applicable.More items...?09-Nov-2021

Here's a detailed step-by-step guide to making an invoice from a Word template:Open a New Word Document.Choose Your Invoice Template.Download the Invoice Template.Customize Your Invoice Template.Save Your Invoice.Send Your Invoice.Open a New Blank Document.Create an Invoice Header.More items...?28-Mar-2019

If you own or are a partner for more than one business, you may invoice yourself for services rendered. For example, your construction business contracts work from your house painting business now you need an invoice to document the transaction and keep track of payments.

As long as you are the only owner, your business starts when your business activities start. In the United States of America, you are automatically a sole proprietor and are therefore free to invoice clients as necessary.

To create a simple invoice for your self-employed or freelance business, you will want to download a professional invoice template and include a unique invoice number. Having a professional business invoice helps your company stand out from the crowd, and keeps things in order for you and your business services.

Microsoft Word also offers a few free templates. You can find them from File > New and then searching/selecting from the available invoice templates.

You work hard for your clients, so make sure your Google Docs invoice works just as hard to get you paid! Download the invoice template. It's fast and easy to do and best of all it's absolutely free!

How to Create a Simple InvoiceDownload the basic Simple Invoice Template in PDF, Word or Excel format.Open the new invoice doc in Word or Excel.Add your business information and branding, including your business name and logo.Customize the fields in the template to create your invoice.Name your invoice.Save

Check out these free invoice creators:Simple Invoicing.Zoho Online Free Invoice Generator.FreshBooks Invoice Generator.Invoiced Free Invoice Generator.PayPal Online Invoicing.Free Invoice Maker.Invoice Ninja.Invoice-o-matic. This free invoice generator has a beautiful user interface.More items...?02-Nov-2020