Idaho Extended Date for Performance

Description

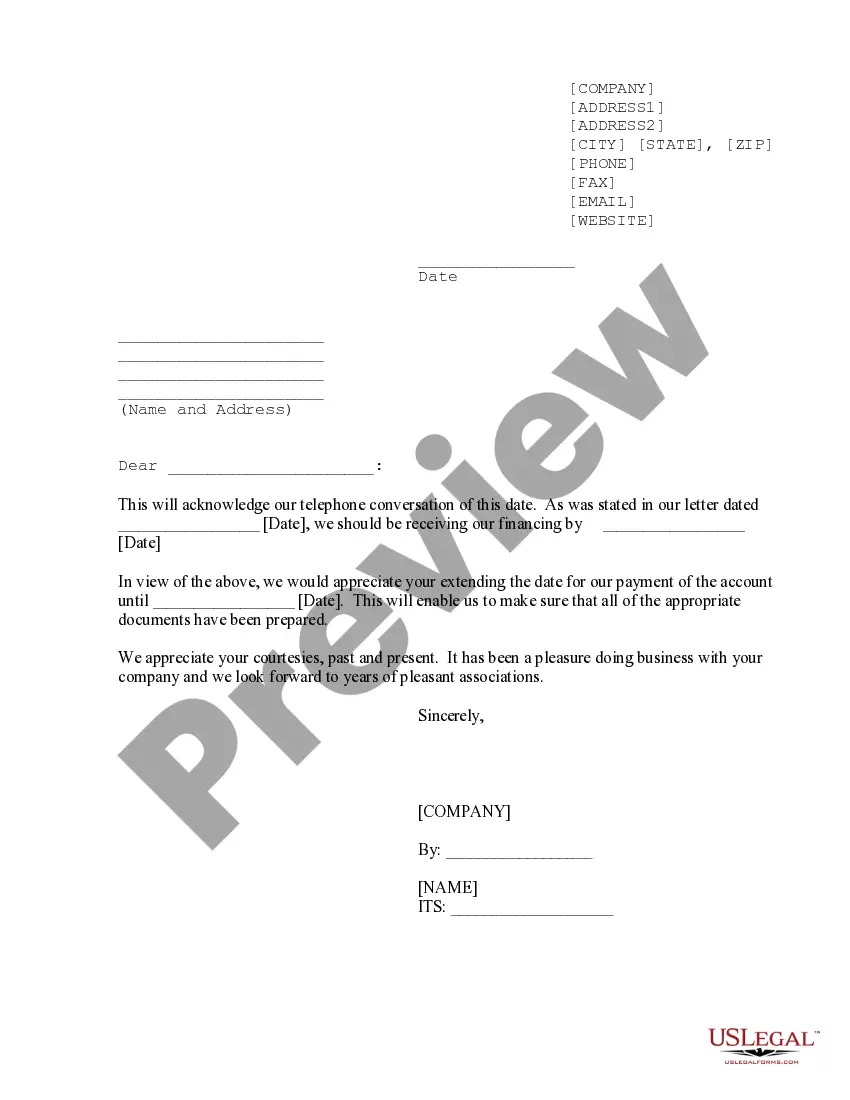

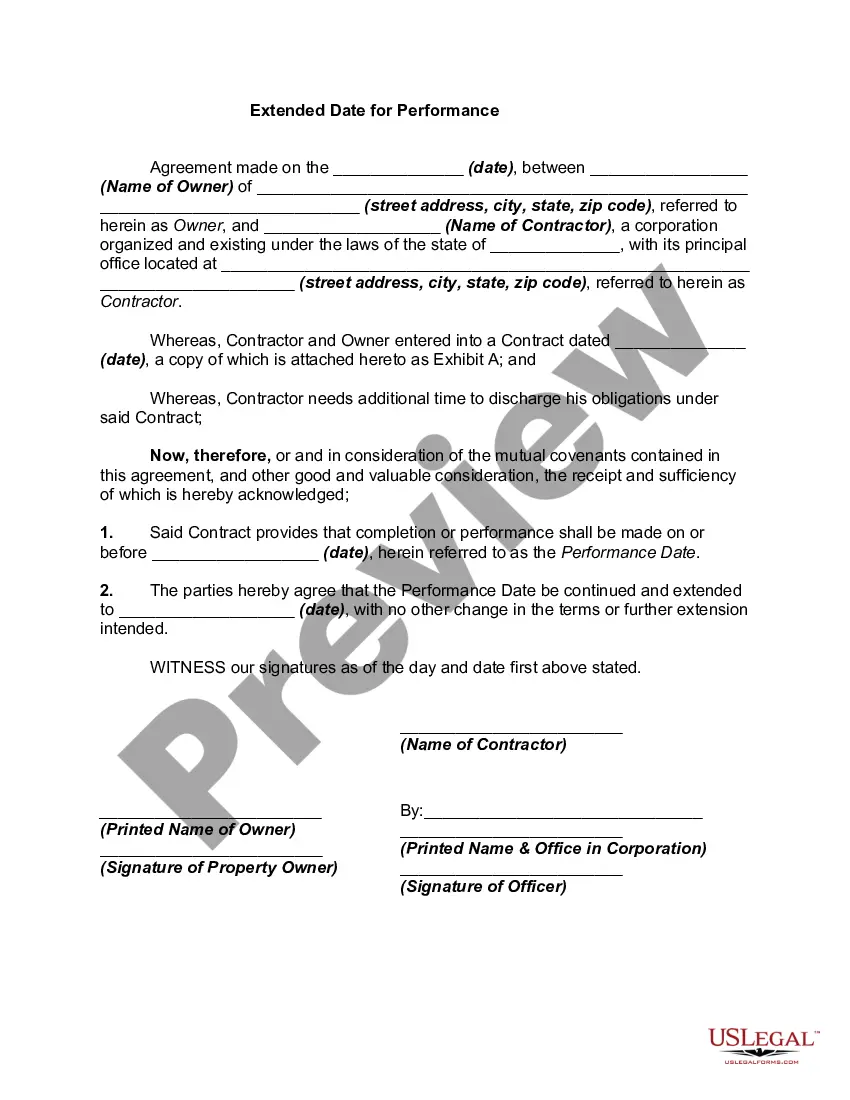

How to fill out Extended Date For Performance?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, claims, or keywords. You can obtain the most recent forms such as the Idaho Extended Date for Performance in a matter of minutes.

If you already hold a registration, Log In and retrieve the Idaho Extended Date for Performance from your US Legal Forms library. The Download button will appear on every form you view.

Then, choose the pricing plan you prefer and provide your details to create an account.

Process the transaction. Use your credit card or PayPal account to complete the payment. Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Idaho Extended Date for Performance.

Each template you add to your account does not expire and is yours permanently. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you want.

Access the Idaho Extended Date for Performance with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- You can access all previously acquired forms in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, here are straightforward instructions to assist you.

- Ensure you have selected the appropriate form for your region/area. Click the Review button to view the details of the form.

- Read the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Get now button.

Form popularity

FAQ

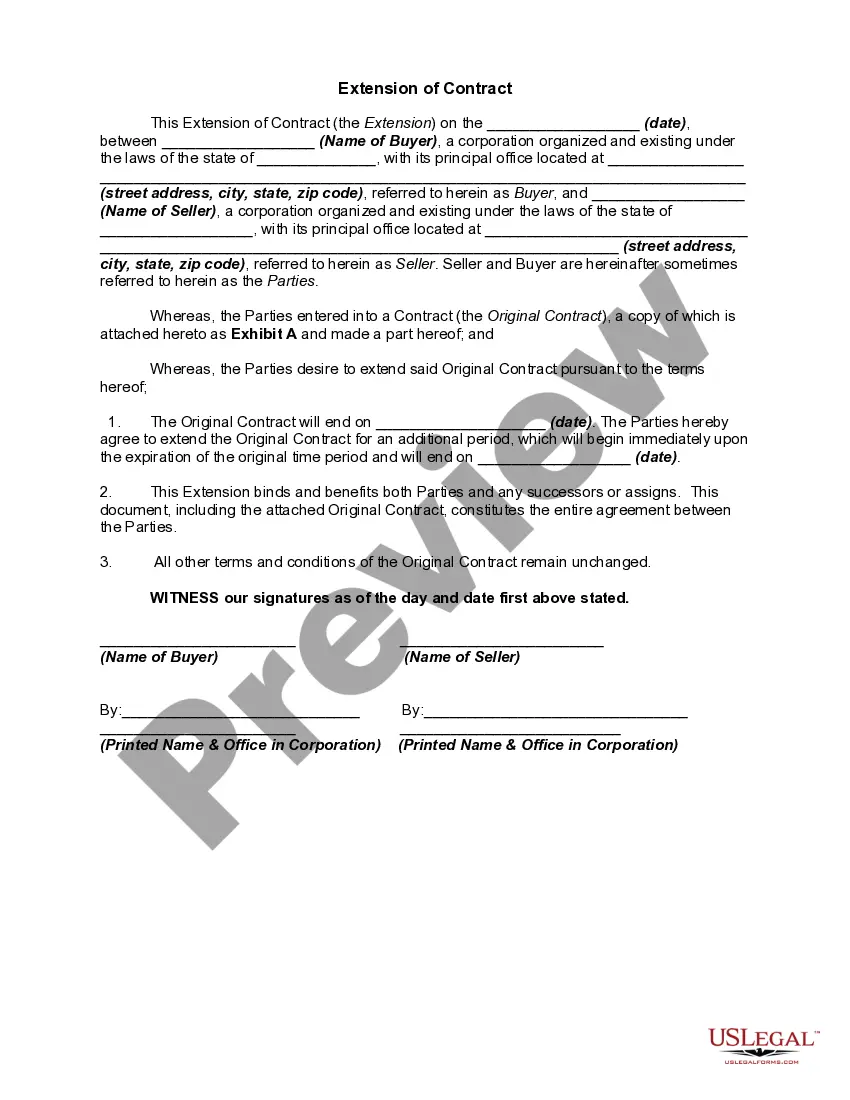

To file an extension form for the Idaho Extended Date for Performance, you first need to obtain the correct form from the Idaho Secretary of State's website. Once you have the form, fill it out completely, ensuring all required fields are accurate. After completing the form, you can submit it online or mail it to the designated office. For a smooth process, consider using the US Legal Forms platform; it can provide you with pre-filled templates and instructions tailored to your needs.

You can definitely file a tax extension online, which is both quick and convenient. Many states, including Idaho, allow you to apply for the extended date for performance electronically. USLegalForms offers a range of resources and forms that make your online application process straightforward and compliant with all regulations.

Yes, you can file an extension form online, making the process much easier and more efficient. Many authorities accept submissions through their online portals, including the Idaho Extended Date for Performance application. To simplify your experience, consider using USLegalForms, which provides access to pre-filled forms and helpful instructions to ensure you meet all requirements.

Filing an extension after the deadline requires a few specific steps. First, you need to contact the appropriate authorities to inform them of your situation. Additionally, if you're using the Idaho Extended Date for Performance option, make sure to gather all necessary documentation to support your request. Utilizing platforms like USLegalForms can streamline this process, helping you find the right forms and guidance.

Rule of Civil Procedure 41 in Idaho governs the dismissal of actions in civil court. It outlines the conditions under which a plaintiff may voluntarily dismiss their case without prejudice, preserving their right to re-file. When dealing with court matters, understanding this rule can be crucial, especially if you are considering the Idaho Extended Date for Performance for your filings.

Idaho does not impose an inheritance tax, so there is no need for an inheritance tax waiver form. However, if you are dealing with estate matters, you might need to handle various other forms and documents. If you're uncertain about the processes involved, uslegalforms offers solutions to guide you effectively.

In Idaho, seniors may qualify for property tax relief programs that can reduce or eliminate their property tax liabilities. To be eligible for these programs, individuals typically need to be at least 65 years old. Many seniors benefit from the Idaho Extended Date for Performance to complete applications for such relief.

Idaho Form 41 is the state income tax return form for corporations. This form is essential for corporations doing business in Idaho to report their income and calculate tax liability. If you require additional time to file, submitting an extension will allow you to benefit from the Idaho Extended Date for Performance.

Idaho does grant automatic extensions, but these extensions usually apply to state income tax returns. It is important to file the extension request by the deadline to ensure you qualify for the Idaho Extended Date for Performance. Always check with the Idaho State Tax Commission for the most current policies and forms.

To file an extension in Idaho, you need to complete the appropriate extension form, typically available through the Idaho State Tax Commission website. You can submit your extension either online or by mailing it to the designated office. If you file an extension for your tax return, remember that Idaho allows for an Idaho Extended Date for Performance, which provides you additional time to submit your documents.