This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

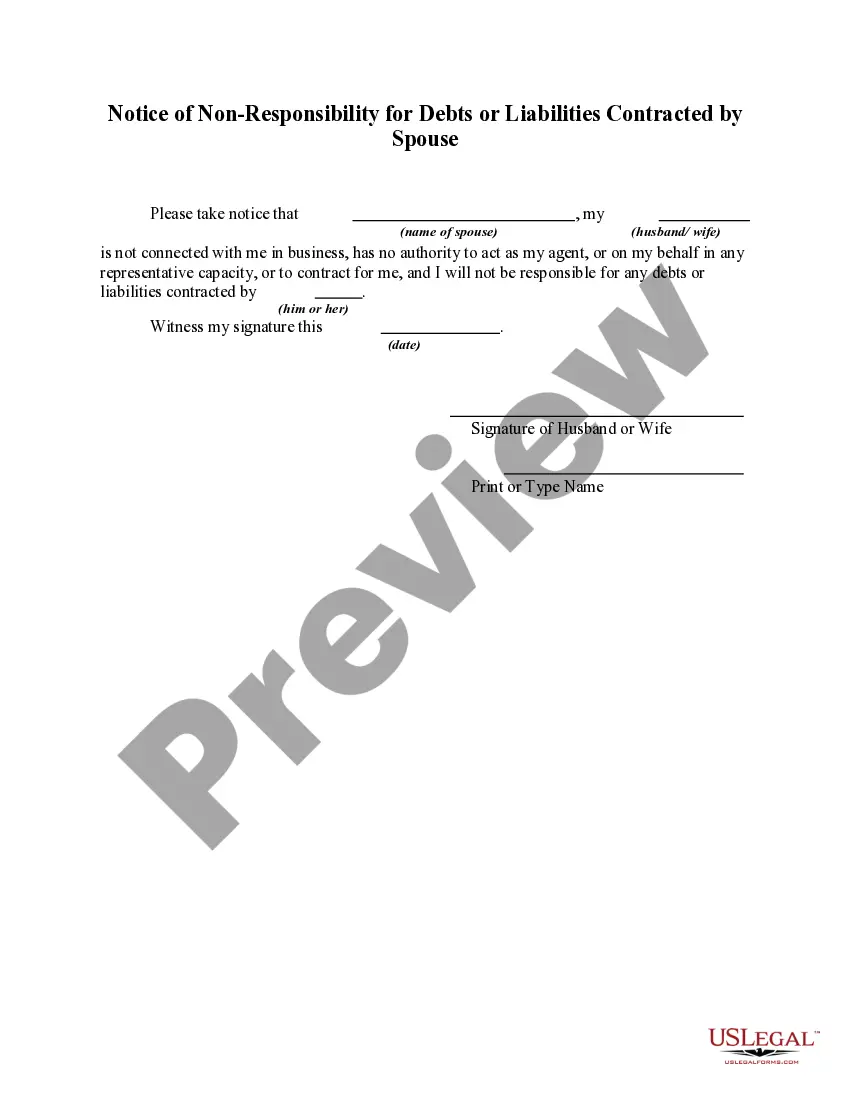

Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

US Legal Forms - one of the most notable collections of legal forms in the United States - offers a range of legal document templates you can download or print.

By utilizing the site, you will find numerous forms for business and personal purposes, organized by categories, states, or keywords. You can discover the most recent versions of forms such as the Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities in just a few moments.

If you already have an account, Log In and download the Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents tab of your account.

Finalize the transaction. Use your Visa or Mastercard or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities.

Every template you have added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just visit the My documents section and click on the form you desire.

Access the Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities with US Legal Forms, perhaps the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your state/region.

- Click the Review button to examine the form's content.

- Check the form details to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the display to find one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Buy now button.

- Then, select the pricing plan of your choice and enter your credentials to register for an account.

Form popularity

FAQ

To ensure you are not responsible for your spouse's debt, one effective approach is to file an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities. This document clearly states your non-responsibility for debts incurred by your spouse. Additionally, keeping finances separate and avoiding co-signing on loans can significantly reduce the risk of being held liable.

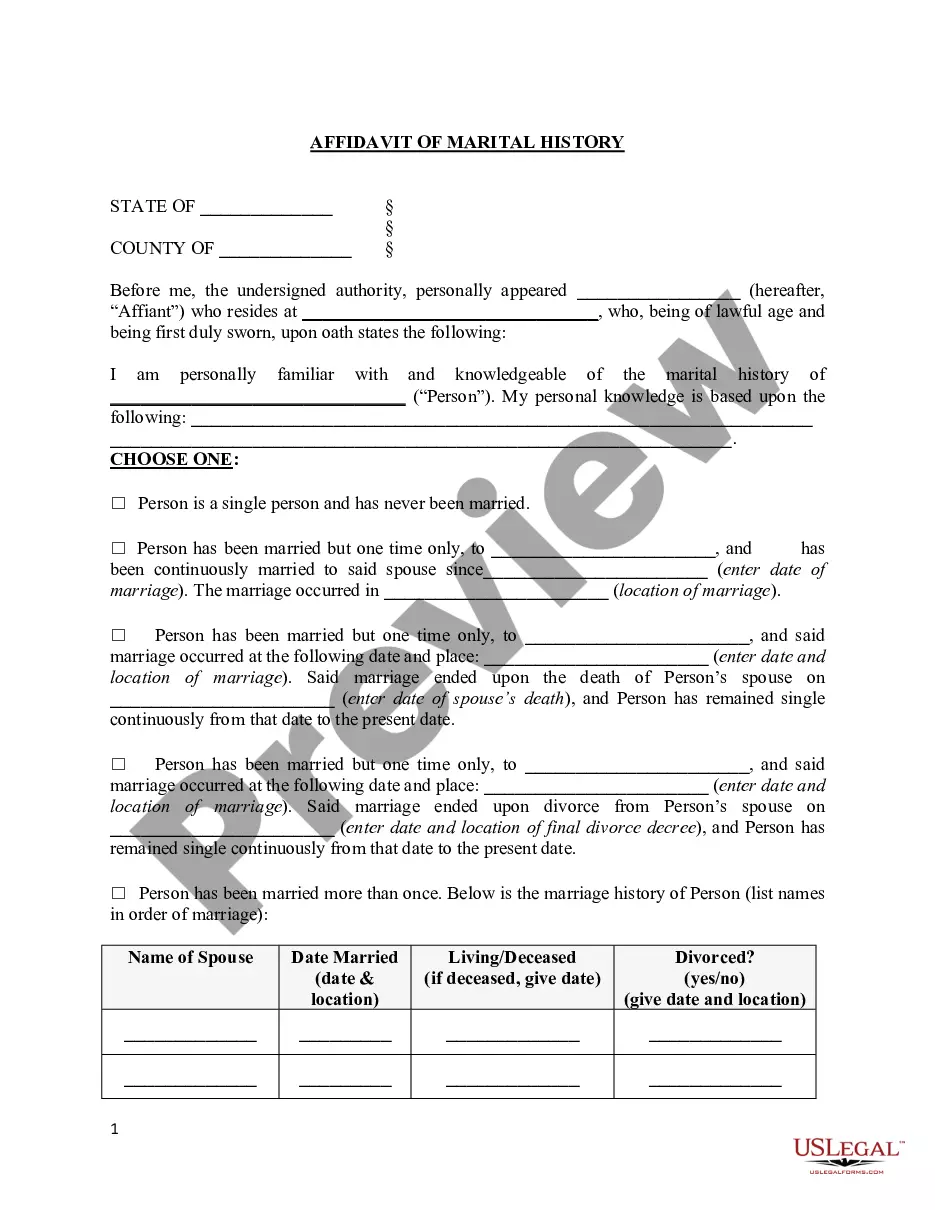

Debt does not automatically transfer to a spouse upon marriage. However, if the debt was accrued during the marriage and in certain community property states, both partners could be responsible. Considering an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities is helpful for clarifying individual liability and shielding yourself from unexpected financial burdens.

Generally, in a marriage, both spouses are not automatically responsible for each other's debts. Each state has different laws regarding the treatment of debts incurred during marriage. With an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities, you can further assert your position that you are not liable for your spouse's financial obligations.

To protect yourself from your husband's debt, you should consider obtaining a legal document that outlines your non-responsibility. Utilizing an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities is a proactive step that can help you shield your assets. Additionally, maintaining separate accounts and not co-signing loans are effective strategies to safeguard your finances.

Yes, in certain circumstances, a husband can be held responsible for his wife's debts. This usually happens if both spouses signed for the debt or if the debt occurred during the marriage and the state laws do not offer protection. However, using an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities can help clarify a wife's non-responsibility for her husband's debts.

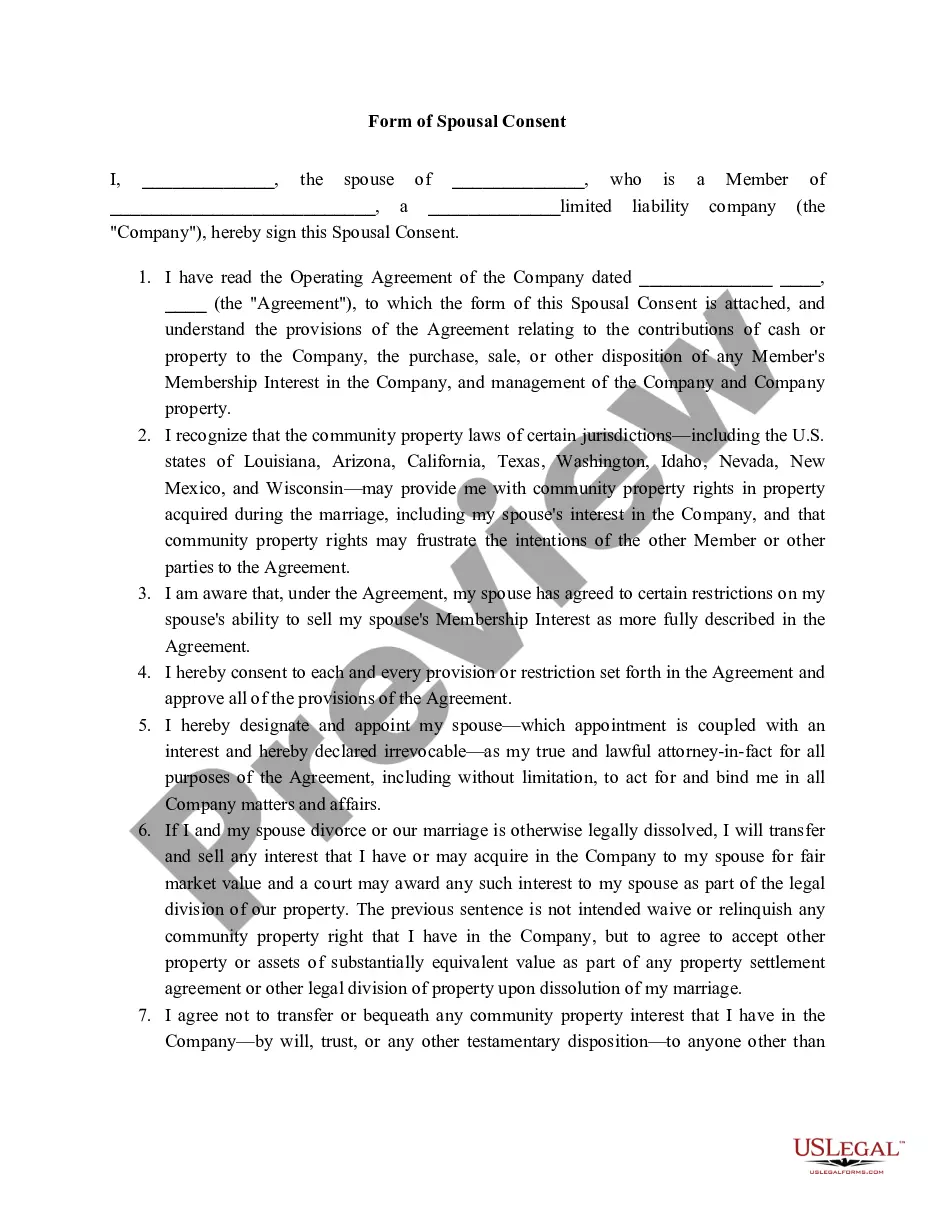

Idaho follows a community property law, meaning that any assets or debts acquired during the marriage are generally divided equally. However, separate property, such as gifts or items owned prior to marriage, usually remains with the original owner. Understanding these distinctions can prevent potential disputes, and implementing an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities can further clarify ownership rights.

If a spouse's name is not on the deed, they typically have no legal claim to the property unless otherwise established through marriage or joint agreements. This means that, in some cases, one spouse can sell or refinance the property without the other's consent. To safeguard your interests, consider using an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities for any financial matters related to the property.

Your wife does not need to be on the deed for you to maintain ownership of the property in Idaho. However, including her on the deed can provide her with certain legal rights and protection to the property in the event of a divorce. If the goal is to declare her non-responsibility for debts tied to the house, consider filing an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities.

In a divorce, you may not be responsible for your wife's personal debts incurred before or during the marriage. However, debts that benefit both spouses may be subject to division, depending on the circumstances. To protect yourself from unwanted liability, an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities can clarify your stance on her individual debts.

In Idaho, a house owned before marriage is generally considered separate property. This means it typically does not fall under marital property unless significant improvements or changes were made during the marriage. If you want to ensure your wife's non-responsibility for debts related to this property, consider filing an Idaho Notice of Non-Responsibility of Wife for Debts or Liabilities.