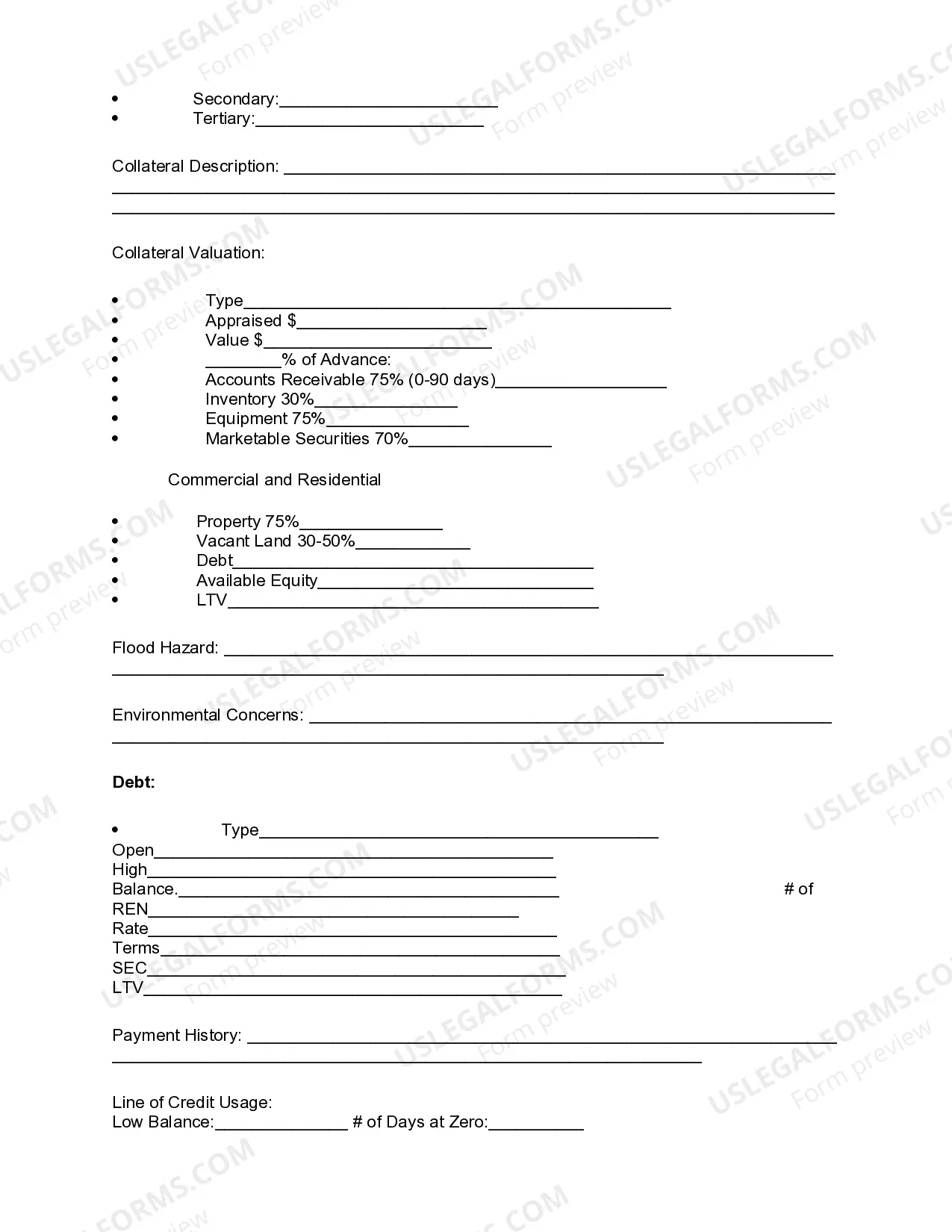

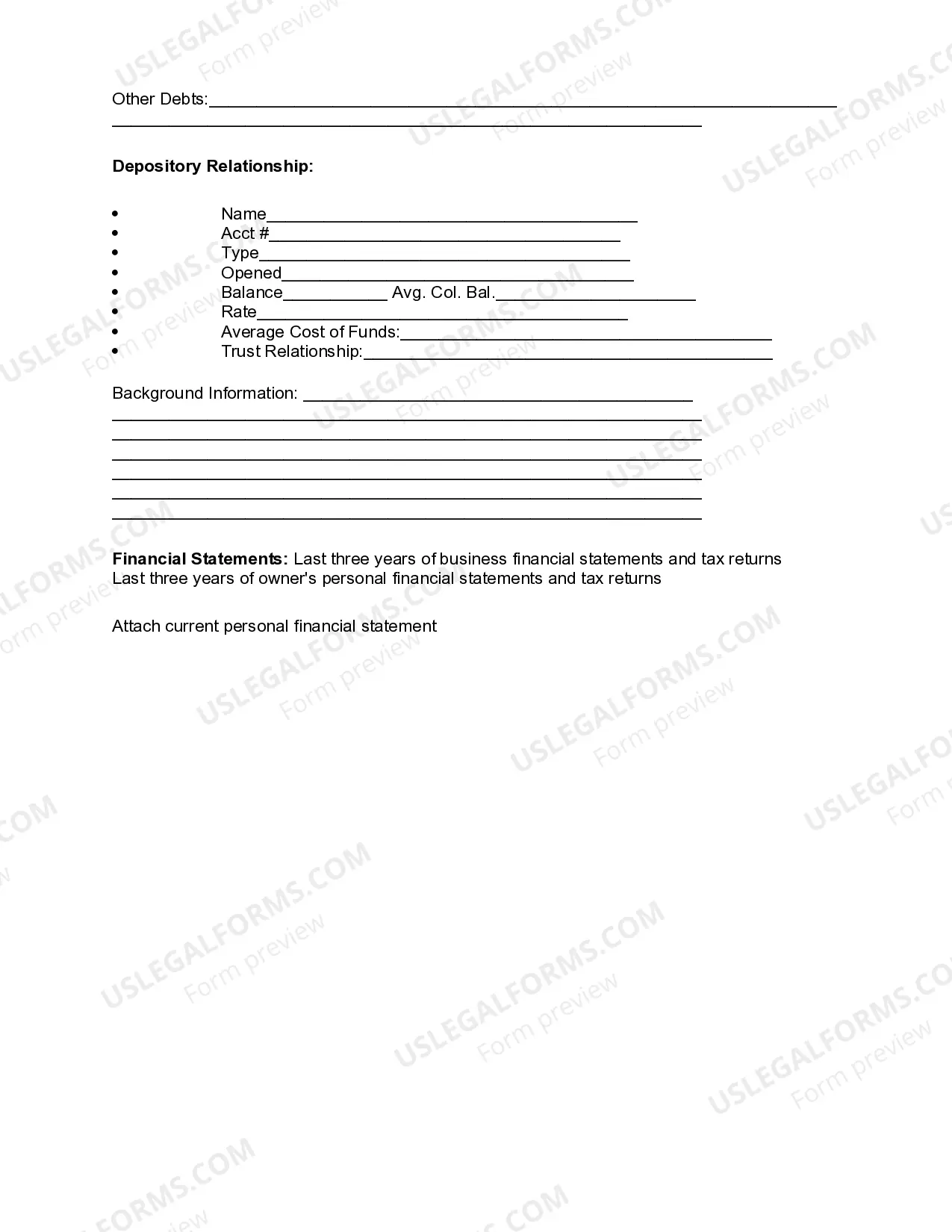

Idaho Review of Loan Application is a comprehensive evaluation process conducted by financial institutions in the state of Idaho to assess the eligibility and creditworthiness of applicants seeking loans. This thorough examination ensures that borrowers are financially capable of repaying the loan amount while complying with all legal requirements. The Idaho Review of Loan Application involves an in-depth analysis of various factors such as the applicant's credit history, income, current debt obligations, employment stability, and collateral, if applicable. Financial institutions aim to minimize the risk associated with lending money by meticulous scrutiny of these important aspects. There are several types of Idaho Review of Loan Application, each tailored to different loan applications. Some common types include: 1. Personal Loan Application Review: This type of review is conducted when individuals seek loans for personal purposes, such as debt consolidation, medical expenses, or home improvements. Lenders assess the borrower's creditworthiness, income stability, and financial history to determine the appropriate loan amount and interest rate. 2. Mortgage Loan Application Review: This review is specific to individuals applying for home loans. Lenders thoroughly examine the applicant's credit score, income, employment history, outstanding debts, and the value of the property being purchased. Additionally, mortgage lenders consider the loan-to-value ratio, which compares the loan amount to the property's appraised value. 3. Business Loan Application Review: Financial institutions employ this type of review when businesses seek funding for expansion, working capital, or equipment purchase. Lenders consider the financial health of the company, its business plan, cash flow projections, industry outlook, and creditworthiness of the business owners. Collateral may also be evaluated to mitigate risks. 4. Auto Loan Application Review: When individuals apply for auto loans, lenders conduct this review to determine their creditworthiness and the loan terms. The review primarily focuses on the borrower's credit history, income stability, and the value of the car being purchased. Lenders may also consider the borrower's down payment and trade-in value, if applicable. 5. Student Loan Application Review: This review is typically conducted by educational institutions or private lenders to assess applicants for student loans. Factors such as the applicant's educational background, future earning potential, and credit history may be taken into consideration. In some cases, a cosigner or collateral is required to secure the loan. Overall, Idaho Review of Loan Application processes are crucial to ensure responsible lending practices, protect both borrowers and lenders, and maintain a stable financial landscape within the state. As loan requirements and criteria may vary based on the type of loan sought, potential applicants should thoroughly research and prepare their financial documents accordingly to increase their chances of approval.

Idaho Review of Loan Application

Description

How to fill out Idaho Review Of Loan Application?

You may spend several hours on the web trying to find the lawful file template that suits the state and federal demands you will need. US Legal Forms gives a huge number of lawful varieties which can be reviewed by experts. You can easily obtain or print out the Idaho Review of Loan Application from the assistance.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Obtain key. Afterward, it is possible to complete, revise, print out, or sign the Idaho Review of Loan Application. Each and every lawful file template you purchase is your own property for a long time. To get yet another backup of any obtained form, go to the My Forms tab and then click the related key.

If you use the US Legal Forms site the first time, adhere to the basic recommendations listed below:

- First, be sure that you have selected the proper file template for your county/town of your liking. See the form outline to ensure you have picked the proper form. If available, utilize the Review key to appear throughout the file template at the same time.

- In order to get yet another edition from the form, utilize the Look for discipline to discover the template that meets your needs and demands.

- After you have identified the template you desire, simply click Buy now to move forward.

- Pick the prices strategy you desire, type your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can utilize your bank card or PayPal profile to fund the lawful form.

- Pick the structure from the file and obtain it to the system.

- Make modifications to the file if required. You may complete, revise and sign and print out Idaho Review of Loan Application.

Obtain and print out a huge number of file templates utilizing the US Legal Forms website, which offers the greatest selection of lawful varieties. Use skilled and state-distinct templates to deal with your small business or individual requires.