The Idaho Financial Record Storage Chart is a comprehensive tool that aids individuals and organizations in effectively managing and storing financial records in the state of Idaho. This chart serves as a detailed reference guide to ensure compliance with legal requirements, streamline record organization, and optimize record storage. One type of Idaho Financial Record Storage Chart includes guidelines on the duration and storage method of various financial documents for individuals. These documents may include tax returns, bank statements, investment records, credit card statements, mortgage information, and more. The chart provides specific details on how long each document should be retained and the recommended storage method, such as physical copies in a secure filing cabinet or digital copies saved on encrypted devices or cloud storage. Another type of Idaho Financial Record Storage Chart caters to businesses and organizations, providing information on record retention and storage requirements specific to various financial transactions. These may encompass sales receipts, purchase records, payroll documents, expense reports, contracts, licenses, and permits, among others. The chart outlines legal obligations and best practices regarding the retention period and the most suitable storage medium, whether physical or electronic. Proper record management highlighted in the Idaho Financial Record Storage Chart is crucial for individuals and businesses alike. It ensures compliance with state and federal regulations, reduces the risk of data loss or theft, facilitates efficient record retrieval, and aids in case of audits or legal disputes. Furthermore, the chart provides relevant keywords to facilitate search optimization and content discovery. These keywords may include Idaho financial record storage, record retention guidelines, document storage rules, record management best practices in Idaho, compliance with Idaho financial regulations, secure record keeping in Idaho, digital record storage in Idaho, Idaho record retention periods, financial document management in Idaho, and more. By leveraging the Idaho Financial Record Storage Chart and incorporating relevant keywords, individuals and organizations can maintain organized, compliant, and secure financial records while streamlining their information retrieval processes.

Idaho Financial Record Storage Chart

Description

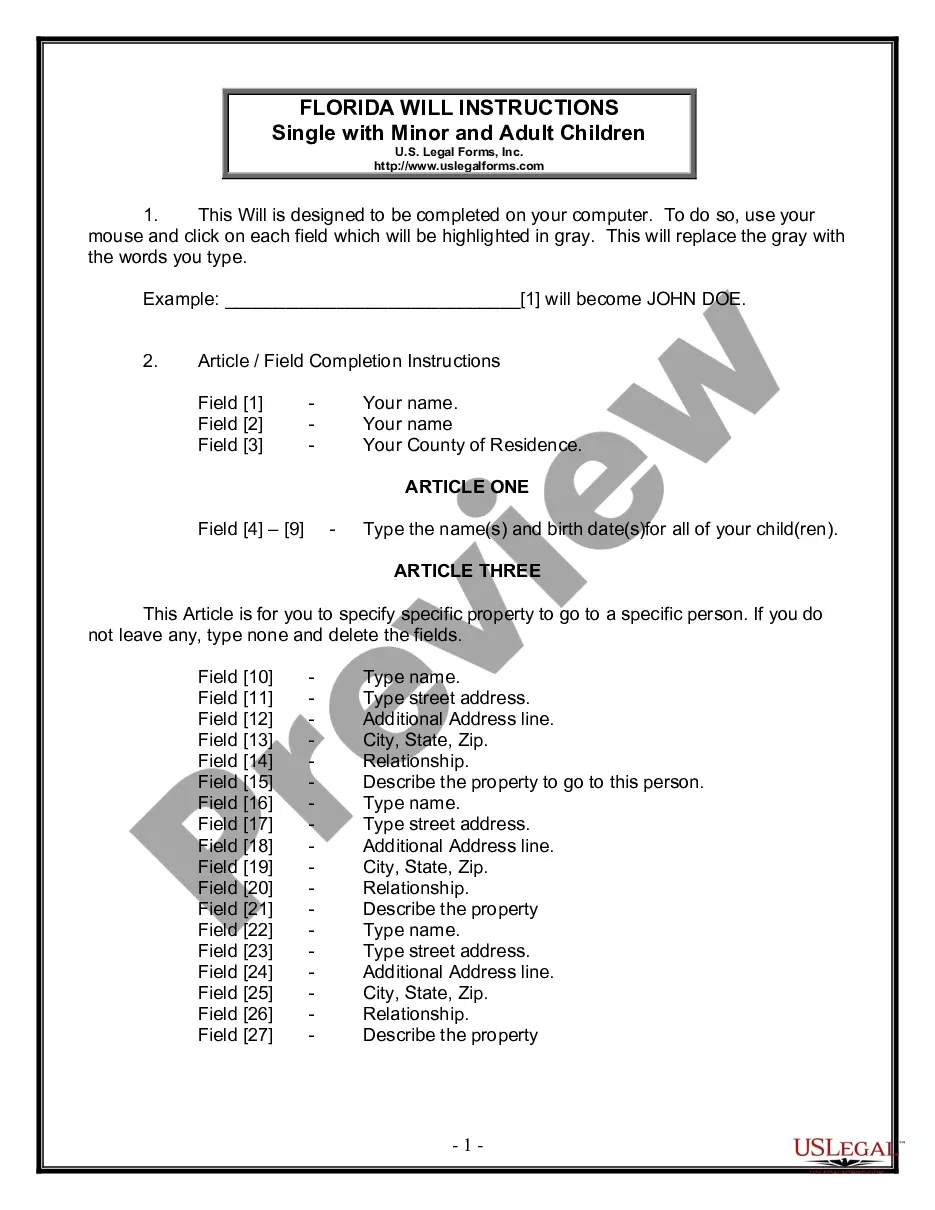

How to fill out Idaho Financial Record Storage Chart?

US Legal Forms - one of many biggest libraries of lawful kinds in the States - provides a variety of lawful document templates it is possible to obtain or printing. Making use of the web site, you may get a huge number of kinds for business and person reasons, sorted by classes, suggests, or search phrases.You can get the most up-to-date versions of kinds much like the Idaho Financial Record Storage Chart in seconds.

If you already have a membership, log in and obtain Idaho Financial Record Storage Chart in the US Legal Forms local library. The Down load option can look on every type you view. You have access to all earlier downloaded kinds within the My Forms tab of your own account.

If you want to use US Legal Forms initially, listed below are straightforward recommendations to help you started off:

- Ensure you have selected the best type for your town/area. Click on the Preview option to analyze the form`s information. Read the type information to actually have selected the right type.

- When the type does not match your specifications, utilize the Lookup industry on top of the screen to get the one that does.

- If you are satisfied with the form, validate your decision by clicking the Get now option. Then, opt for the pricing strategy you like and give your credentials to register for the account.

- Approach the transaction. Use your credit card or PayPal account to finish the transaction.

- Choose the structure and obtain the form on your own product.

- Make changes. Fill up, revise and printing and indication the downloaded Idaho Financial Record Storage Chart.

Every single web template you put into your account lacks an expiration time which is the one you have permanently. So, if you wish to obtain or printing one more backup, just check out the My Forms portion and click about the type you will need.

Get access to the Idaho Financial Record Storage Chart with US Legal Forms, by far the most substantial local library of lawful document templates. Use a huge number of expert and state-distinct templates that satisfy your small business or person requires and specifications.

Form popularity

FAQ

According to the Companies Act, you need to retain these records for six years from the end of the financial year in which the transaction was made.

You should store these hard copies in a fireproof safe or bank safe deposit box. But it's still a good idea to make digital copies of those records. There are other documents that you can keep solely in digital form.

Financial record-keeping is simply keeping records of all the financial transactions of your business, e.g., recording sales, entering vendor bills, and processing payroll. Basically, you will be tracking all movements of your money, both in and out of your bank account.

In practice, records management usually includes a records manager. This is the person responsible for records management within the organization, but that person often has a team of people working together to create and maintain systems.

More important documents should be kept in a fire-resistant file cabinet, safe, or safe-deposit box. If space is tight and you need to reduce clutter, you might consider electronic storage for some of your financial records. You can save copies of online documents or scan documents and convert them to electronic form.

Period of Limitations that apply to income tax returns Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

An accountant is a person whose job involves keeping financial records for a business. To be a great accountant, you've got to be good at math.

The Office of Finance and Treasury is the office of record for many financial document types including those listed below. Individual departments are not expected to maintain these records, but to entrust the Office of Finance and Treasury to maintain them according to established record retention policies.

When it comes to church records retention, the retention period typically falls into two time frames: seven years or permanently. Why seven? This goes back to protecting yourself and your ministry. If your church is somehow audited, the IRS can go back a maximum of seven years when performing their investigation.

Documents that fall into this category include non-tax-related bank and credit card statements, investment statements, pay stubs and receipts for large purchases. Keep these records on hand for a year if you need them to support your current-year tax preparation or as proof of income when making a large purchase.