Title: Idaho Sample Letter for New Business with Credit Application: A Comprehensive Guide Introduction: Welcome to our guide on writing a detailed description of an Idaho Sample Letter for New Business with Credit Application. This versatile document serves as a formal introduction for businesses seeking credit facilities from prospective lenders in Idaho. In this guide, we will explore various types of Idaho Sample Letters for New Business with Credit Application, discussing their formats, important sections, and key keywords to ensure successful applications. Types of Idaho Sample Letters for New Business with Credit Application: 1. Idaho Sample Letter for New Business with Credit Application — General: This type of letter is suitable for businesses that are new to applying for credit facilities. It covers all essential information required by lenders, including business details, credit request, financial information, and contact details. 2. Idaho Sample Letter for New Business with Credit Application — Specific Purpose: This type of letter is tailored for businesses requiring credit facilities for specific purposes, such as purchasing equipment, expanding operations, or launching a new product line. It provides additional details related to the intended use of the credit and how it will benefit the business. 3. Idaho Sample Letter for New Business with Credit Application — Follow-up: This letter is used when following up with lenders regarding a credit application that has already been submitted. It highlights the importance of the credit request, outlines any additional information or documents provided, and expresses the applicant's eagerness for a response. Content Format and Relevant Keywords: To ensure a well-structured and enticing Idaho Sample Letter for New Business with Credit Application, here are some relevant keywords to include in the different sections: 1. Company Introduction: — Nambusinesseses— - Business address — TypebussuSSn—ss - Length of time in operation (if applicable) — Unique selling proposition (USP— - Market presence or current customer base 2. Credit Request Details: — Requested crediamountun— - Purpose of credit (e.g., working capital, machinery, inventory) — Explanation of how credit will be utilized to benefit the business — Repayment terms and proposed schedule 3. Financial Information: — Business financial statements (balance sheet, income statement) — Cash floanalysissi— - Proof of business ownership (licenses or permits) — Past credit history (if applicable— - Summary of business assets and liabilities 4. Contact Information: — Full name of thapplicantan— - Position/title within the company — Contact phonnumberbe— - Email address - Preferred method of communication Conclusion: Writing an Idaho Sample Letter for New Business with Credit Application requires careful attention to detail and an understanding of the lender's requirements. By using the appropriate format and including relevant keywords, applicants can increase their chances of success. Remember to tailor the letter to your specific needs, whether it's a general application or one for a specific purpose.

Idaho Sample Letter for New Business with Credit Application

Description

How to fill out Idaho Sample Letter For New Business With Credit Application?

It is possible to invest hrs on the Internet looking for the legal record template that meets the federal and state specifications you require. US Legal Forms provides 1000s of legal forms that are reviewed by experts. You can actually obtain or produce the Idaho Sample Letter for New Business with Credit Application from the support.

If you already possess a US Legal Forms accounts, you may log in and then click the Down load option. Afterward, you may full, modify, produce, or indication the Idaho Sample Letter for New Business with Credit Application. Each and every legal record template you acquire is your own permanently. To obtain yet another backup for any acquired kind, go to the My Forms tab and then click the related option.

If you are using the US Legal Forms internet site the first time, follow the basic instructions listed below:

- Initially, ensure that you have selected the proper record template for the state/area of your choice. Read the kind outline to make sure you have selected the proper kind. If readily available, make use of the Preview option to search with the record template also.

- If you wish to find yet another variation in the kind, make use of the Search discipline to find the template that suits you and specifications.

- Once you have found the template you need, click Purchase now to continue.

- Pick the rates strategy you need, type your references, and register for a free account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal accounts to pay for the legal kind.

- Pick the file format in the record and obtain it to your product.

- Make changes to your record if needed. It is possible to full, modify and indication and produce Idaho Sample Letter for New Business with Credit Application.

Down load and produce 1000s of record layouts while using US Legal Forms website, that provides the greatest assortment of legal forms. Use skilled and status-particular layouts to deal with your company or person requires.

Form popularity

FAQ

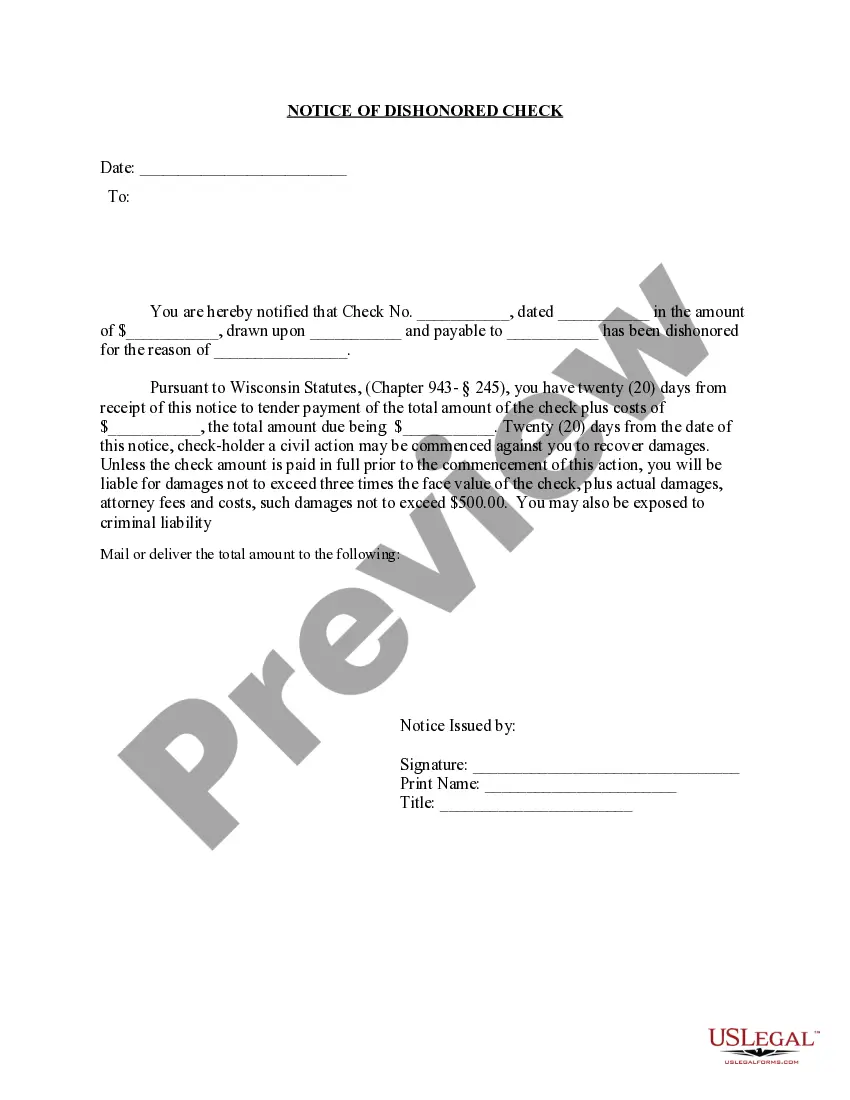

The most common contemporary letters of credit are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several others.

To write a letter of request, start by greeting the recipient with Dear, followed by the person's last name and title, or To Whom It May Concern. Then, briefly explain who you are and why you're writing in the 1st paragraph. Next, provide additional context and details about your request in the 2nd paragraph.

How to Format a Business LetterWrite the date and your recipient's name, company, and address.Choose a professional greeting, like Dear,.Craft a compelling introduction.State your intent in the letter's body text.End your letter with a strong call-to-action.Choose a professional closing, like Sincerely,.More items...?

A letter of credit, or "credit letter," is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

With due respect, I beg to say that I am in dire need of money. Despite gathering all of my savings and collecting all loans I am still unable, to sum up, the required amount of cash. (show your actual cause or other reason). I need this money for a family event which is very important to me.

Please respond as quickly as possible, so that we may begin taking in machine work again soon.Write Your Letter Step-by-Step. Make your request.State the reasons for your request. Example Sentences for Step 2.State why you are a good credit risk. If possible, give credit references.Ask for an immediate response.

Sub: Request for CreditI am totally satisfied with your services and security policies. (Describe all about the situation). I would be grateful to you if you could provide me details on my latest transactions and give me up to date credit report. I would need the same for tax purposes.

Applicant: The party who requests the letter of credit. This is the person or organization that will pay the beneficiary. The applicant is often (but not always) an importer or buyer who uses the letter of credit to make a purchase.

A credit application is a form used by potential borrowers to get approval for credit from lenders. Today, many credit applications are filled out electronically and may be improved in only a short amount of time.

Letter of Credit Application means an application requesting such Issuing Lender to issue a Letter of Credit and a reimbursement agreement, in each case in the form specified by the applicable Issuing Lender from time to time.