A Grantor Charitable Lead Annuity Trust (CLAT) is an irrevocable split-interest trust that provides for a specified amount to be paid to one or more charitable beneficiaries during the term of the trust. The principal remaining in the trust at the end of the term is paid over to, or held in a continuing trust for, a non-charitable beneficiary or beneficiaries identified in the trust. If the terms of a CLAT created during the donor's life satisfy the applicable statutory and regulatory requirements, a gift of the charitable lead annuity interest will qualify for the gift tax charitable deduction under § 2522(c)(2)(B) and/or the estate tax charitable deduction under § 2055(e)(2)(B). In certain cases, the gift of the annuity interest may also qualify for the income tax charitable deduction under § 170(a). The value of the remainder interest is a taxable gift by the donor at the time of the donor's contribution to the trust.

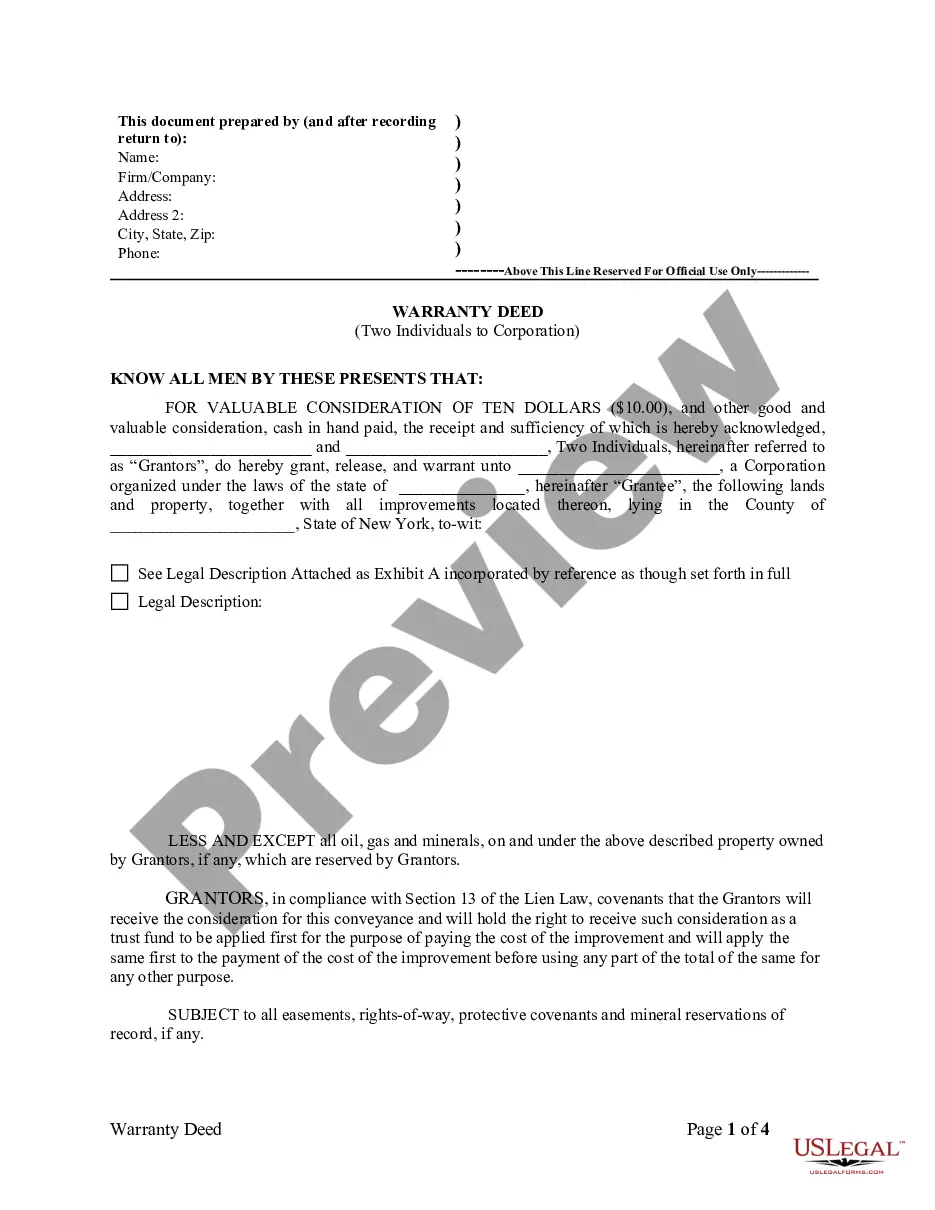

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Idaho Inter Vivos Granter Charitable Lead Annuity Trust (IL IDC) is a specific type of trust arrangement used for charitable purposes in the state of Idaho. This carefully structured trust provides individuals with the opportunity to benefit both the charities they support and their own financial goals. Here is a detailed description of this trust and its different variations: 1. Overview of Idaho Inter Vivos Granter Charitable Lead Annuity Trust: The Idaho Inter Vivos Granter Charitable Lead Annuity Trust is a legal agreement wherein the granter (the individual establishing the trust) transfers assets to the trust, which then generates income for charitable causes. It is classified as an inter vivos trust, meaning it is created during the granter's lifetime. 2. Purpose and Function: The primary purpose of an Idaho Inter Vivos Granter Charitable Lead Annuity Trust is to provide financial support to charitable organizations while keeping certain benefits for the granter or other non-charitable beneficiaries. The trust operates by paying a fixed amount (the annuity) annually to one or more qualified charitable organizations for a predetermined period. Once that period ends, the remaining trust assets are distributed to non-charitable beneficiaries, such as family members or friends. 3. Different Types of Idaho Inter Vivos Granter Charitable Lead Annuity Trust: a. Standard IL IDC Trust: This is the primary type of Idaho Inter Vivos Granter Charitable Lead Annuity Trust, where the annuity payments to charitable organizations are fixed throughout the term. The duration of this trust may be either for a specific number of years or based on the life of one or more individuals. b. Idaho Inter Vivos Granter Charitable Lead Unit rust (ILLICIT): This variation allows for annuity payments to vary annually based on the net fair market value of the trust's assets. The trust term and distribution to non-charitable beneficiaries remain similar to the standard IL IDC Trust. 4. Benefits and Advantages: — Individuals who establish an Idaho Inter Vivos Granter Charitable Lead Annuity Trust can make substantial charitable contributions during their lifetime while retaining control over the trust assets. — The trust may qualify for certain tax benefits, such as income tax deductions for the charitable annuity payments. — Non-charitable beneficiaries ultimately receive the remaining trust assets, potentially reducing estate taxes or probate costs. — The trust allows individuals to leave a lasting philanthropic legacy in a structured and controlled manner. In conclusion, the Idaho Inter Vivos Granter Charitable Lead Annuity Trust provides individuals with a valuable tool to support charitable organizations while also meeting their financial goals and preserving assets for their loved ones. Both the standard IL IDC Trust and the Idaho Inter Vivos Granter Charitable Lead Unit rust offer unique variations to suit individual preferences and needs.