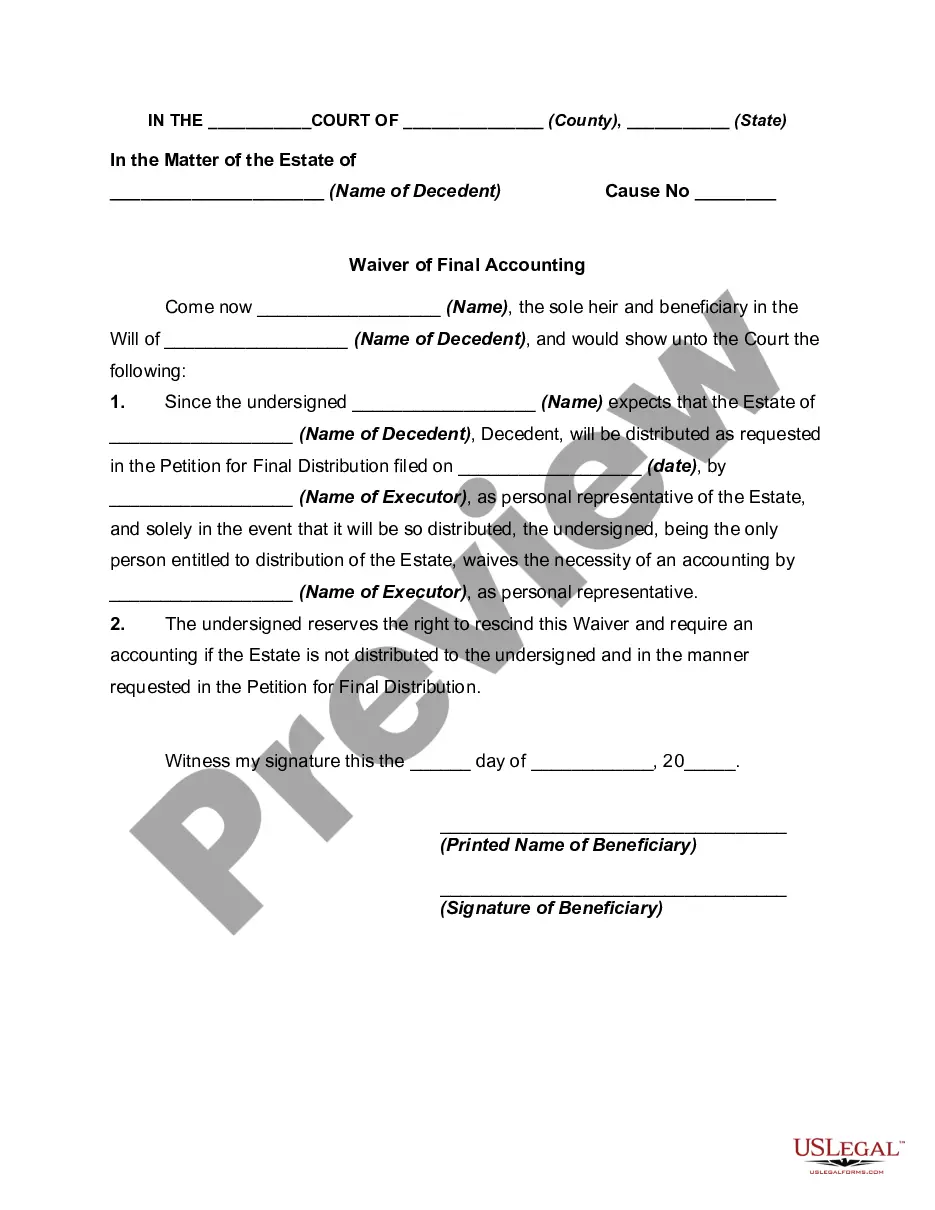

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

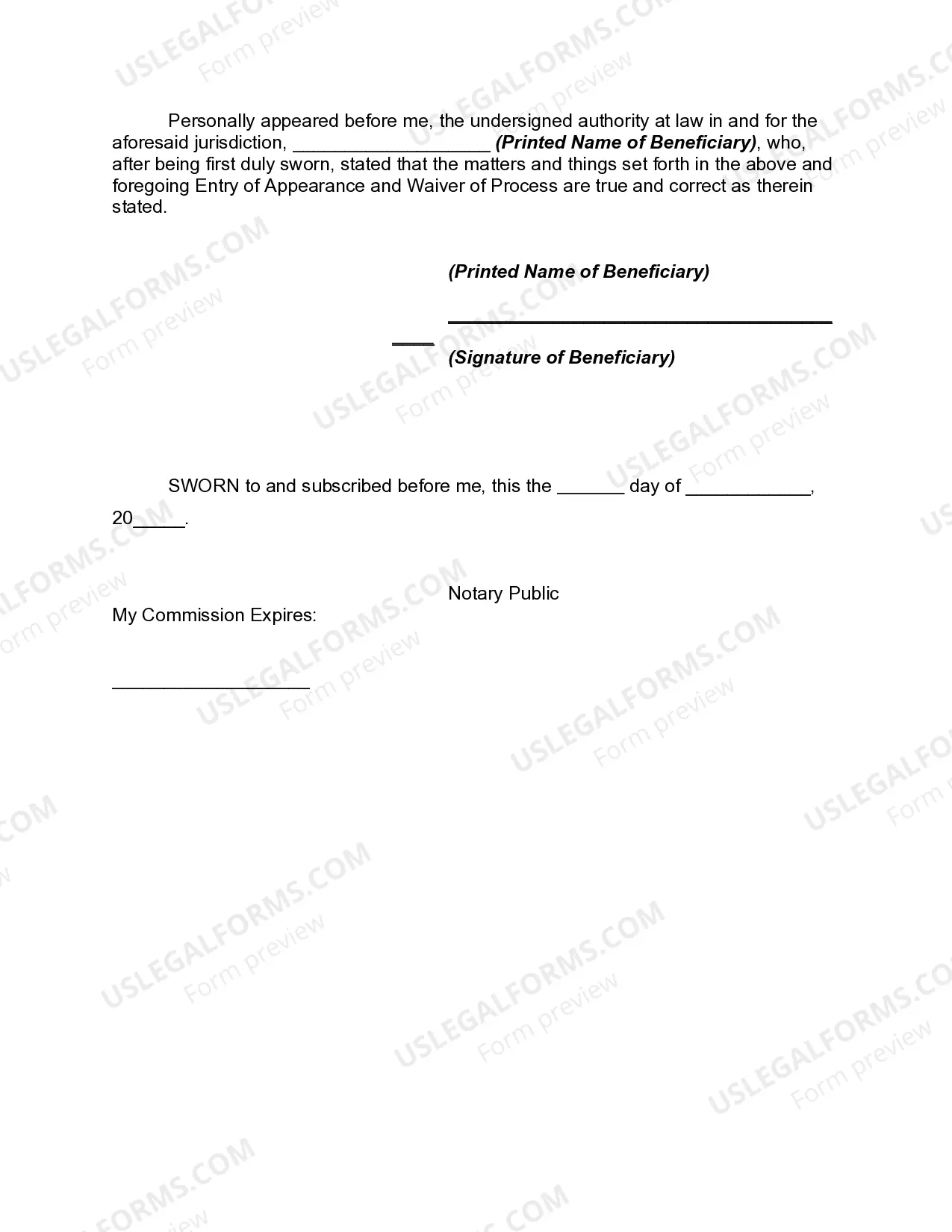

The Idaho Waiver of Final Accounting by Sole Beneficiary refers to a legal document that relieves the executor or personal representative from the obligation of providing a detailed final accounting of a deceased person's estate to the sole beneficiary. This waiver is applicable in the state of Idaho and provides flexibility to both parties involved. Here is a more in-depth description of this waiver: When a person passes away, their estate goes through a probate process to distribute their assets to the rightful beneficiaries. Typically, the executor or personal representative is required to prepare a final accounting, which includes listing all the assets, liabilities, and transactions related to the estate. However, in some cases, there might be only one beneficiary who is entitled to inherit the entire estate. The Idaho Waiver of Final Accounting by Sole Beneficiary comes into play when the sole beneficiary acknowledges their understanding of the estate's assets and liabilities and voluntarily waives their right to receive a formal, detailed accounting of the final distribution. By signing this waiver, the beneficiary is essentially stating that they trust the executor to handle the estate's affairs appropriately, without the need for a comprehensive breakdown of financial transactions. The purpose of this waiver is to streamline the probate process and avoid unnecessary expenses and delays. It allows the executor to distribute the estate's assets without the burden of completing and presenting a formal final account to the beneficiary. Different types of Idaho Waiver of Final Accounting by Sole Beneficiary may include variations based on individual circumstances. For example, the waiver could be modified to specify certain assets or liabilities the beneficiary wishes to be included in the final accounting or outline specific conditions under which the executor must provide a detailed account. However, it is crucial to consult with an attorney to ensure that any modifications to the waiver comply with Idaho state laws and protect the interests of the beneficiary. In summary, the Idaho Waiver of Final Accounting by Sole Beneficiary is a legal document that allows the sole beneficiary of an estate to forgo the requirement of a detailed final accounting. It simplifies the probate process and grants the executor the ability to distribute the assets promptly. However, it is important for both parties involved to fully understand their rights and obligations before signing the waiver, and seek professional legal advice if needed.The Idaho Waiver of Final Accounting by Sole Beneficiary refers to a legal document that relieves the executor or personal representative from the obligation of providing a detailed final accounting of a deceased person's estate to the sole beneficiary. This waiver is applicable in the state of Idaho and provides flexibility to both parties involved. Here is a more in-depth description of this waiver: When a person passes away, their estate goes through a probate process to distribute their assets to the rightful beneficiaries. Typically, the executor or personal representative is required to prepare a final accounting, which includes listing all the assets, liabilities, and transactions related to the estate. However, in some cases, there might be only one beneficiary who is entitled to inherit the entire estate. The Idaho Waiver of Final Accounting by Sole Beneficiary comes into play when the sole beneficiary acknowledges their understanding of the estate's assets and liabilities and voluntarily waives their right to receive a formal, detailed accounting of the final distribution. By signing this waiver, the beneficiary is essentially stating that they trust the executor to handle the estate's affairs appropriately, without the need for a comprehensive breakdown of financial transactions. The purpose of this waiver is to streamline the probate process and avoid unnecessary expenses and delays. It allows the executor to distribute the estate's assets without the burden of completing and presenting a formal final account to the beneficiary. Different types of Idaho Waiver of Final Accounting by Sole Beneficiary may include variations based on individual circumstances. For example, the waiver could be modified to specify certain assets or liabilities the beneficiary wishes to be included in the final accounting or outline specific conditions under which the executor must provide a detailed account. However, it is crucial to consult with an attorney to ensure that any modifications to the waiver comply with Idaho state laws and protect the interests of the beneficiary. In summary, the Idaho Waiver of Final Accounting by Sole Beneficiary is a legal document that allows the sole beneficiary of an estate to forgo the requirement of a detailed final accounting. It simplifies the probate process and grants the executor the ability to distribute the assets promptly. However, it is important for both parties involved to fully understand their rights and obligations before signing the waiver, and seek professional legal advice if needed.