Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

Idaho Partnership Agreement Between Accountants

Description

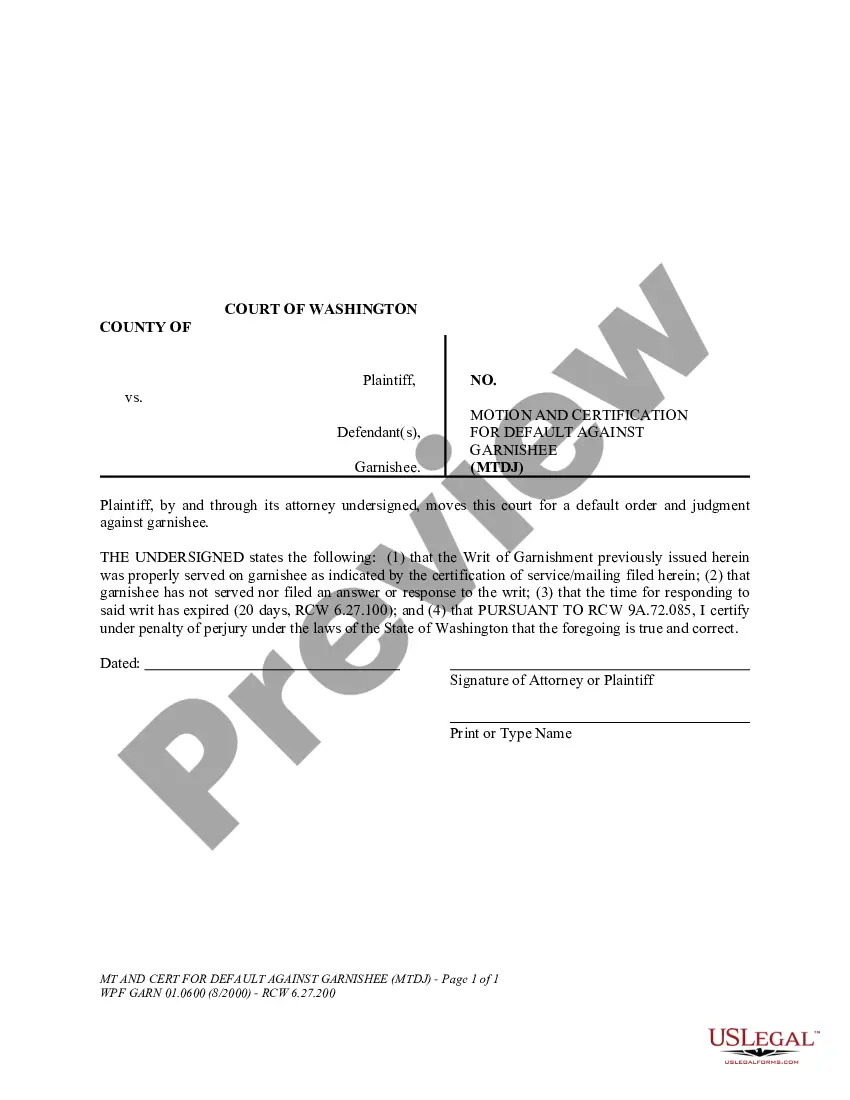

How to fill out Partnership Agreement Between Accountants?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal forms that you can download or print.

By utilizing the website, you can access thousands of forms for personal and business purposes, organized by type, state, or keywords.

You can find the latest forms, such as the Idaho Partnership Agreement Between Accountants, in just a few minutes.

Read the form description to confirm that you have chosen the correct document.

If the form does not meet your criteria, use the Search feature at the top of the page to find one that does.

- If you have an account, Log In to download the Idaho Partnership Agreement Between Accountants from the US Legal Forms library.

- The Download button will be visible on every form you access.

- You can view all previously obtained forms under the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you select the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Partnerships generally progress through four stages: forming, storming, norming, and performing. During the forming stage, partners come together and set goals. As they move into the storming phase, they may face conflicts that require resolution. The norming stage brings collaboration, while the performing stage focuses on achieving shared objectives. Creating an Idaho Partnership Agreement Between Accountants can provide a roadmap to navigate these stages successfully.

Key partnerships can be categorized into four types: strategic alliances, joint ventures, supplier partnerships, and distribution partnerships. Each type offers unique benefits and risks, so understanding them will help you navigate your partnership landscape. When drafting an Idaho Partnership Agreement Between Accountants, recognizing the nature of your partnership is essential for aligning goals and expectations.

In partnerships, you typically encounter four types of partners: general partners, limited partners, silent partners, and nominal partners. General partners manage the business and face personal liability, while limited partners invest but limit their liability. Understanding these distinctions is essential when formulating an Idaho Partnership Agreement Between Accountants to define each partner’s role and investment clearly.

To obtain a partnership agreement, you can draft one yourself or seek assistance from a legal professional. Using a platform like US Legal Forms can simplify this process; you can find templates specifically designed for an Idaho Partnership Agreement Between Accountants. By utilizing these resources, you can create a tailored agreement that meets your business needs efficiently.

A successful partnership includes four key elements: a clear intent to form a partnership, a shared purpose, an agreement on how profits and losses will be divided, and the responsibilities of each partner. Understanding these elements is crucial when drafting an Idaho Partnership Agreement Between Accountants. By clearly defining roles and expectations, partners can avoid conflicts and ensure smooth operations within the business.

Two crucial conditions that should be included in an Idaho Partnership Agreement Between Accountants are the distribution of profits and the process for resolving disputes. Clearly documenting how profits and losses will be allocated helps prevent misunderstandings among partners. Additionally, having a defined dispute resolution process can save time and resources if disagreements arise, fostering a healthier partnership dynamic.

The accounting standard for partnerships typically involves the uniform application of GAAP principles, especially in financial reporting and disclosures. An Idaho Partnership Agreement Between Accountants can highlight the specific standards that will govern the partnership’s financial practices. This clarity helps in setting expectations among partners and promotes trust within the partnership.

The accounting rules for partnerships, as outlined in an Idaho Partnership Agreement Between Accountants, focus on revenue recognition, expense tracking, and capital accounts. Partnerships must record transactions accurately and report their financial position, including assets and liabilities, on an annual basis. Adhering to these rules helps ensure that partners understand their rights and obligations clearly.

Generally Accepted Accounting Principles, or GAAP, apply to partnerships in the U.S., including those formed under an Idaho Partnership Agreement Between Accountants. While partnerships may have more flexibility than corporations in terms of financial reporting, adhering to GAAP ensures consistency and reliability in financial statements. Following these guidelines can enhance the partnership's credibility in the eyes of stakeholders and tax authorities.

Accounting requirements for a partnership require careful documentation of financial transactions, maintaining accurate records, and preparing financial statements. An Idaho Partnership Agreement Between Accountants should specify how profits and losses are shared among partners, as well as the methods for tracking capital contributions. Compliance with these requirements helps maintain transparency and accountability within the partnership.