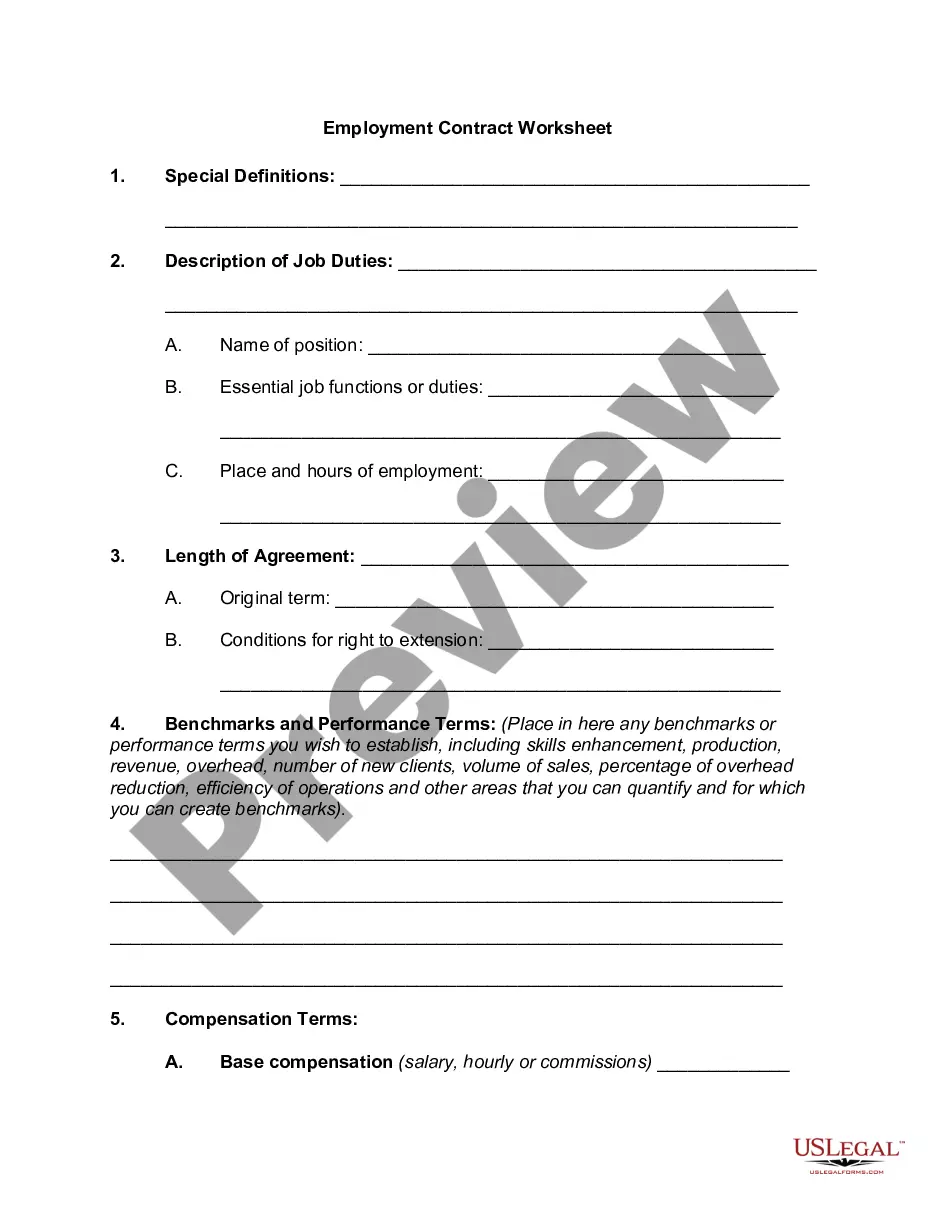

Idaho Worksheet - Contingent Worker

Description

How to fill out Worksheet - Contingent Worker?

Are you currently in a position where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a multitude of template forms, such as the Idaho Worksheet - Contingent Worker, which are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can retrieve the Idaho Worksheet - Contingent Worker template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

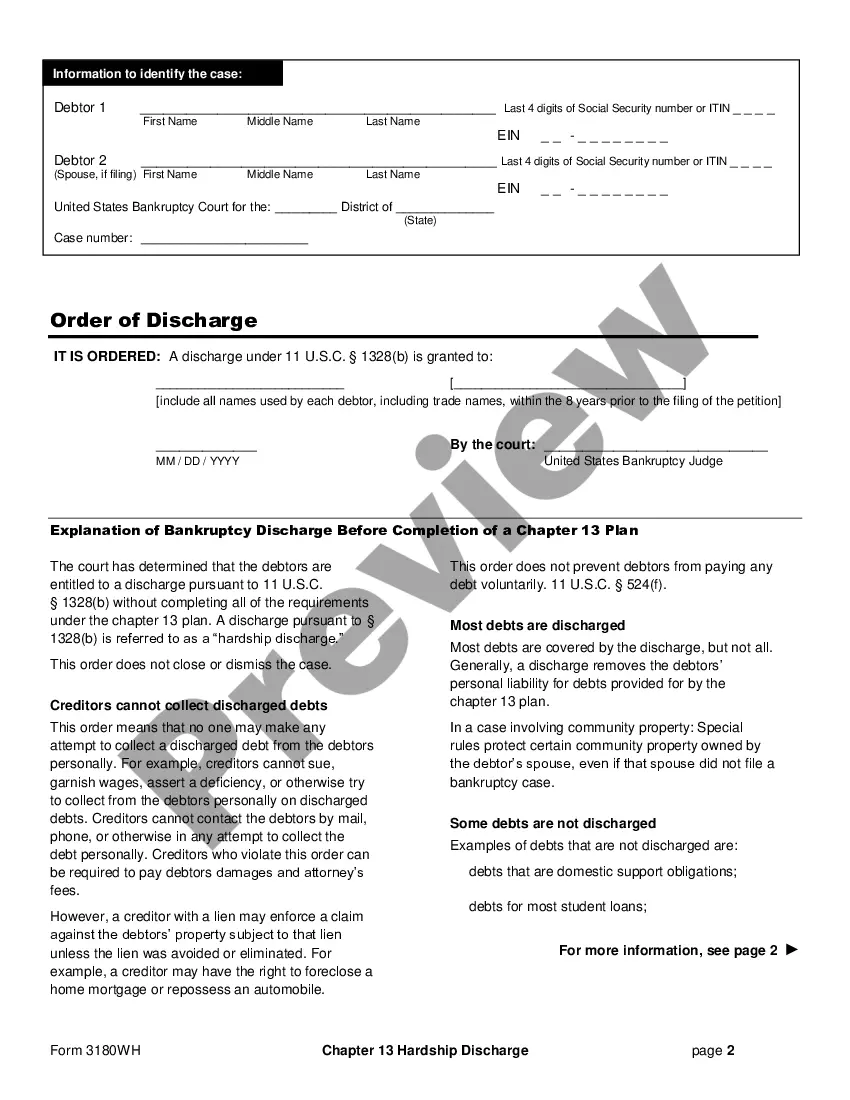

- Use the Review option to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, utilize the Search box to locate a form that matches your needs and requirements.

Form popularity

FAQ

A contingent worker is someone who is hired for a fixed period of time, often on a project basis. Examples of contingent workers are freelancers, consultants, part-timers, on-call workers, independent contractors, and people in other types of alternative work arrangements.

1099 Independent ContractorsThese contingent workers are self-employed and are not employees; therefore, companies are not responsible for the withholding, collecting or paying of taxes nor any other payments afforded full-time employees or Temporary W2 workers.

The U.S. Department of Labor defines contingent workers as independent contractors or freelancers as opposed to contracted employees. When a company hires an employee on a permanent or temporary basis, it becomes responsible for ensuring that taxes are deducted and paid for the employee.

Instead of receiving a W-2 for tax filing purposes, contract employees receive Form 1099. This is the form you submit along with Form 1040 for filing your taxes. Unlike an employee who has payroll taxes deducted from his paycheck, a contract employee is responsible for paying his own taxes.

As a category, contingent workers may include temporary employees, part-time employees, independent contract workers, employees of the temporary help industry ("temps"), consultants, seasonal employees, and interns. In contrast, full-time, permanent employees frequently are referred to as core employees.

If your client wants to hire a contingent worker, they generally do not need to handle employment taxes. Contingent workers who are independent contractors are responsible for paying their own taxes because they are self employed. Contract workers are on the Employer of Record's payroll, not your client's.

Like all contingent workers, consultants are non-employees who aren't on your payroll. Unlike temporary workers, however, consultants typically work with a high level of independence and, while they offer guidance on strategy, they usually don't execute the work required to carry it out.

For instance, contingent workers' tax liability and reporting fall under a 1099-M instead of a W-2. The worker is responsible for the employment taxes generally covered by an organization for a traditional employee.

Who are contingent workers? Independent contractors, on-call workers, freelancers, contract workers, and any other type of individual hired on a per-project basis are examples of contingent staffing. In most cases, contingent workers have specialized skills, like an accountant or electrician.

Contingent workers are individuals hired by a company to do role- or project-based work on its behalf, but not as traditional employees. They could include independent contractors, consultants, freelancers, temps, or other outsourced labor such as gig workers.