A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

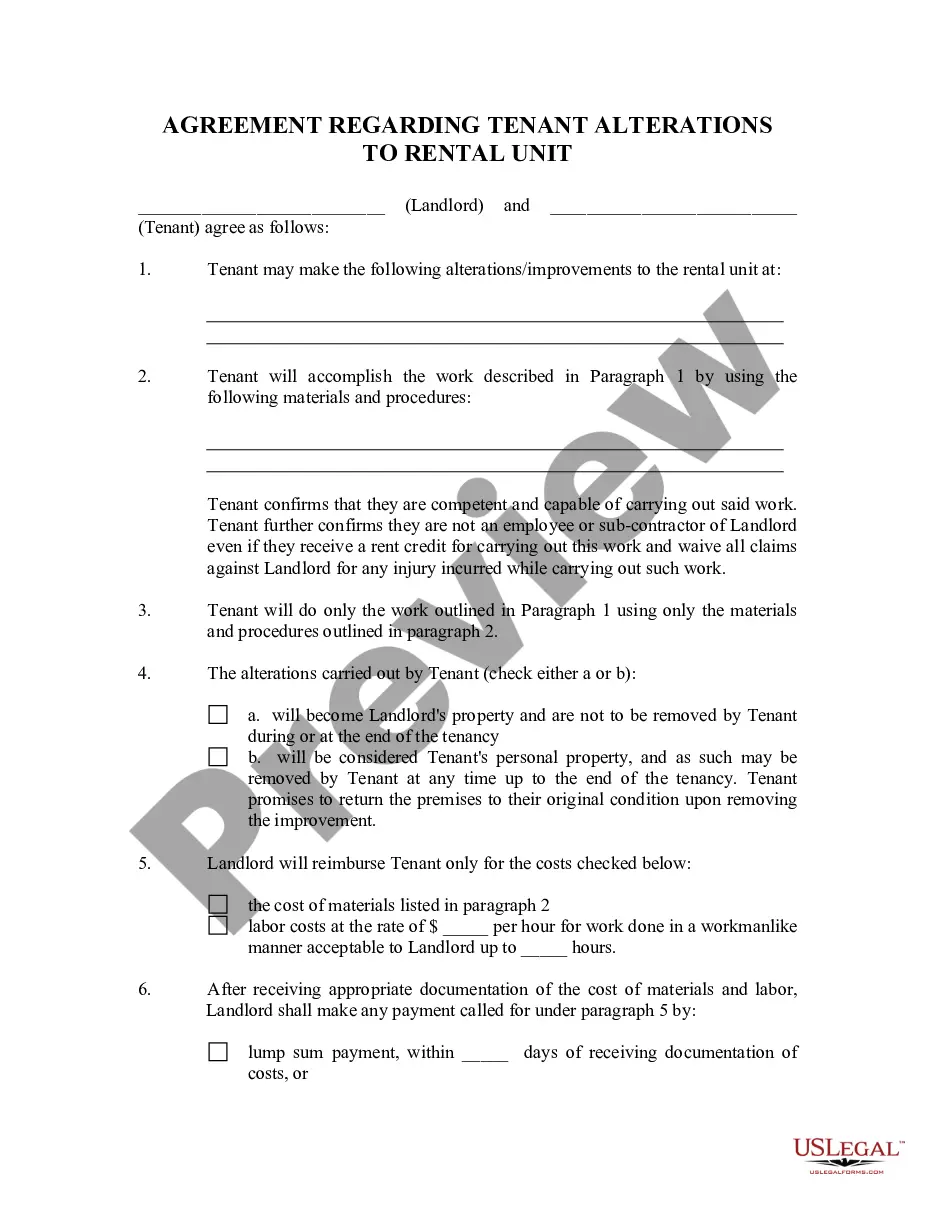

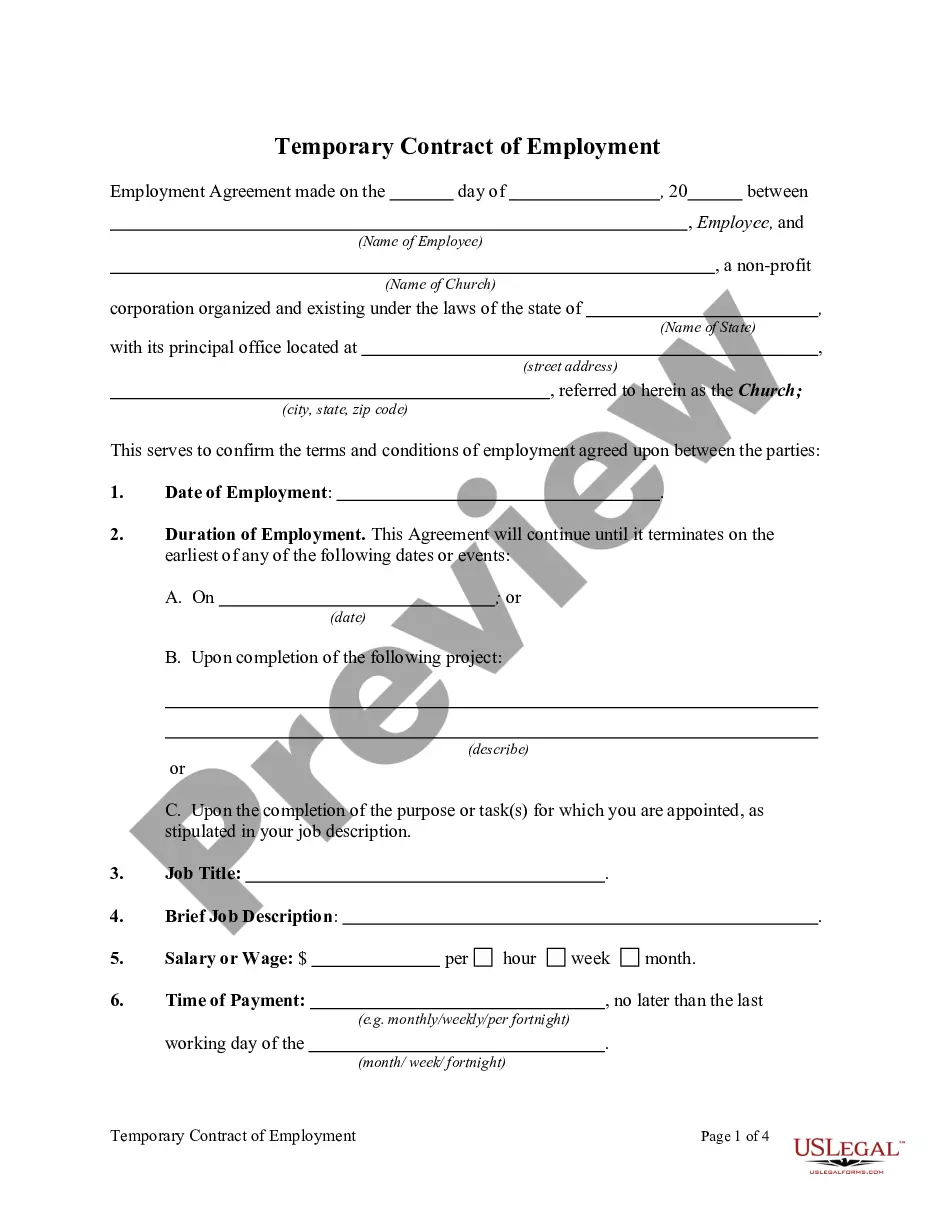

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

An Idaho Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal document that allows individuals to establish a trust for the financial security and welfare of their loved ones. This type of trust is irrevocable, meaning it cannot be changed or terminated once it is created, providing long-term protection for the designated beneficiaries. The primary purpose of an Idaho Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is to secure assets and ensure their proper distribution according to the granter's wishes. Such a trust can provide financial stability and protection from creditors, taxation issues, and potential disputes among family members. Keywords: Idaho trust agreement, irrevocable trust, benefit of spouse, benefit of children, benefit of grandchildren, financial security, welfare, long-term protection, designated beneficiaries, assets, distribution, granter's wishes, financial stability, protection from creditors, taxation issues, family disputes. Different types of Idaho Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren may include: 1. Health and Education Trust: This type of trust focuses primarily on providing financial support for the medical needs and education expenses of the beneficiaries. It aims to ensure that the spouse, children, and grandchildren have access to quality healthcare and educational opportunities. 2. Retirement Trust: This trust is specifically designed to secure the retirement needs of the beneficiaries. It allows the granter to set aside assets to provide ongoing financial support for the spouse, children, and grandchildren during their retirement years, ensuring a comfortable and worry-free future. 3. Special Needs Trust: A special needs trust is established to cater to the unique financial requirements of a beneficiary with special needs or disabilities. It aims to protect their eligibility for government benefits while providing additional funds for their care, thus ensuring their quality of life is maintained. 4. Wealth Preservation Trust: This type of trust focuses on preserving and protecting wealth for future generations. Its primary objective is to minimize estate taxes and other financial burdens, ultimately maximizing the assets that can be distributed to the beneficiaries, including the spouse, children, and grandchildren. 5. Charitable Trust: In this type of trust, a portion of the assets is dedicated to supporting charitable causes or organizations. It allows the granter to contribute to philanthropic endeavors while still ensuring the financial well-being of their spouse, children, and grandchildren. It is essential to consult with an experienced attorney specializing in estate planning and trust laws to determine the most appropriate type of Idaho Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren based on individual circumstances and goals.