Idaho Termination of Trust by Trustee

Description

How to fill out Termination Of Trust By Trustee?

If you aim to gather, obtain, or generate legal document templates, utilize US Legal Forms, the largest array of legal documents available online.

Employ the site's straightforward and user-friendly search function to locate the documents you need. A wide range of templates for commercial and personal uses are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Idaho Termination of Trust by Trustee with just a few clicks.

Every legal document template you purchase belongs to you indefinitely. You have access to each document you downloaded in your account. Go to the My documents section and select a document to print or download again.

Compete and acquire, and print the Idaho Termination of Trust by Trustee with US Legal Forms. There are countless professional and state-specific documents you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the Idaho Termination of Trust by Trustee.

- You can also access documents you have previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

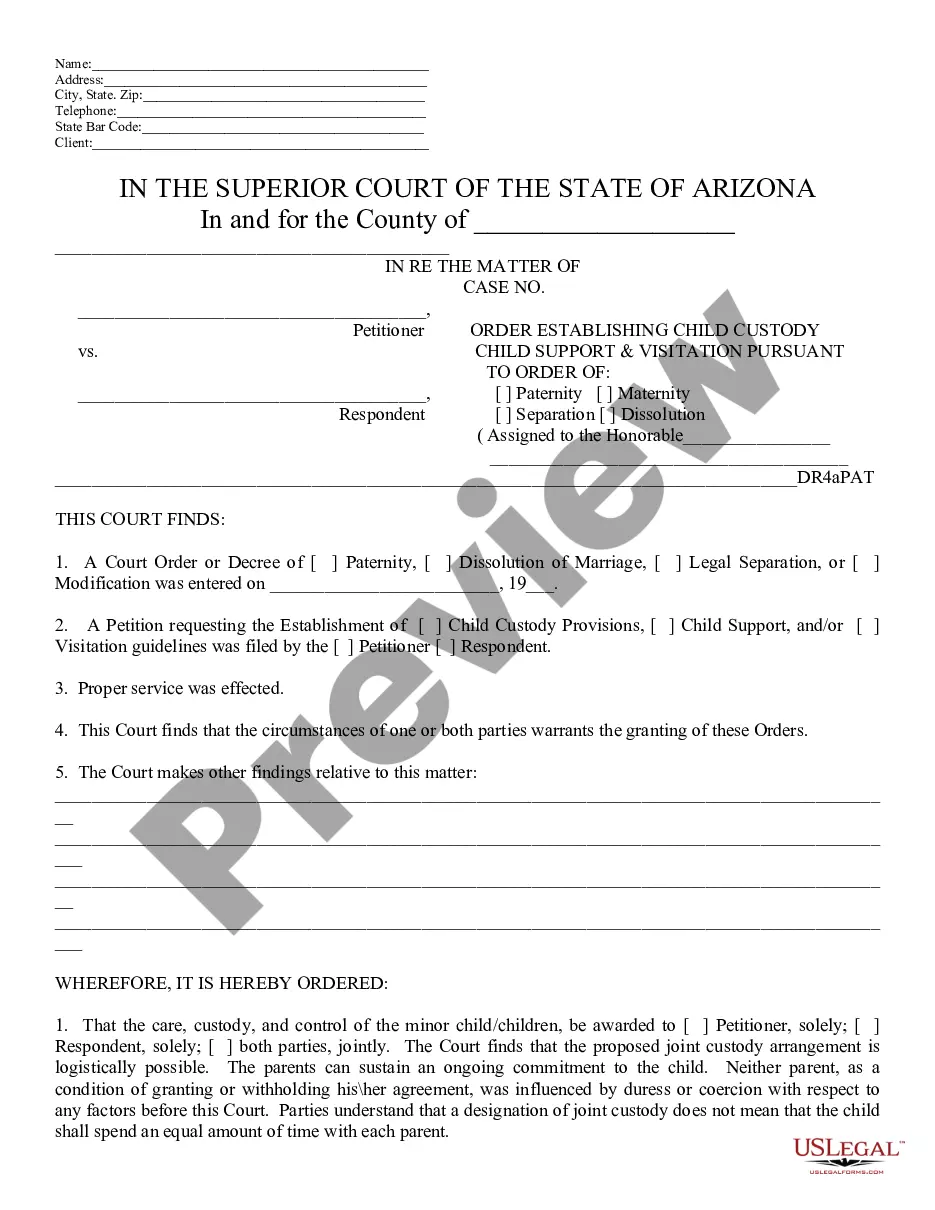

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the document, take advantage of the Search field at the top of the screen to find other types in the legal document category.

- Step 4. Once you have identified the document you need, click on the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Termination of Trust by Trustee.

Form popularity

FAQ

If the trust is intact at the time of your passing, exactly when it will terminate will depend upon the circumstances. For example, if you instruct the trustee to liquidate the property and distribute all of it as soon as possible, the trust would terminate when all the assets were distributed to the beneficiaries.

Ways a Trust Can EndIf the trust property was cash or stocks, this can happen when all of the money, plus interest, gets paid to beneficiary. If the property was some other asset, like a house, then the trust may end when the house is destroyed or the trust itself comes to an end.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Petitioning Court for Removal A petition for removal of a trustee can be filed by either a co-trustee or a beneficiary. This process can be further complicated if beneficiaries are also designated as trustees. The petition may also seek financial damages from the trustee.

A trust can be terminated for the following reasons: The trust assets have been fully distributed, making it uneconomical to continue with the trust. The money remaining in the trust makes it uneconomical to continue with the trust. The trust has served its purpose in terms of its stated objective.

A trust can also be terminated if it involves illegal conduct or if it cannot operate properly as a trust due to its small size. Additionally, beneficiaries can only terminate a trust if they are all in agreement. Unless specified in the trust, trustees are never allowed to terminate a trust.

On the termination of the trust the trustees are under a duty to distribute the trust assets to the right beneficiaries. Failure to distribute to the correct beneficiary can subject the trustees to liability for breach of trust. See Practice Note: Termination of trustsbeneficiaries.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. This procedure involves changing titles, deeds, or other legal documents to transfer ownership from the asset of trust back to the trust's grantor.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

How a trust can be dissolved will depend on the trust in question. Some trusts will be terminated by the occurrence of a particular event (for example, on the death of a beneficiary or when they come of age) whereas others will be terminated by the actions of the trustees or beneficiaries.