Idaho Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

Selecting the optimal legal document template might be challenging. Naturally, there are numerous designs accessible online, but how do you find the specific legal form you need? Utilize the US Legal Forms platform.

The service provides a vast selection of templates, such as the Idaho Purchase Agreement by a Corporation for Assets of a Partnership, that you can utilize for both business and personal purposes. All of the forms are verified by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to access the Idaho Purchase Agreement by a Corporation for Assets of a Partnership. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require.

In summary, edit, print, and sign the received Idaho Purchase Agreement by a Corporation for Assets of a Partnership. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to acquire professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

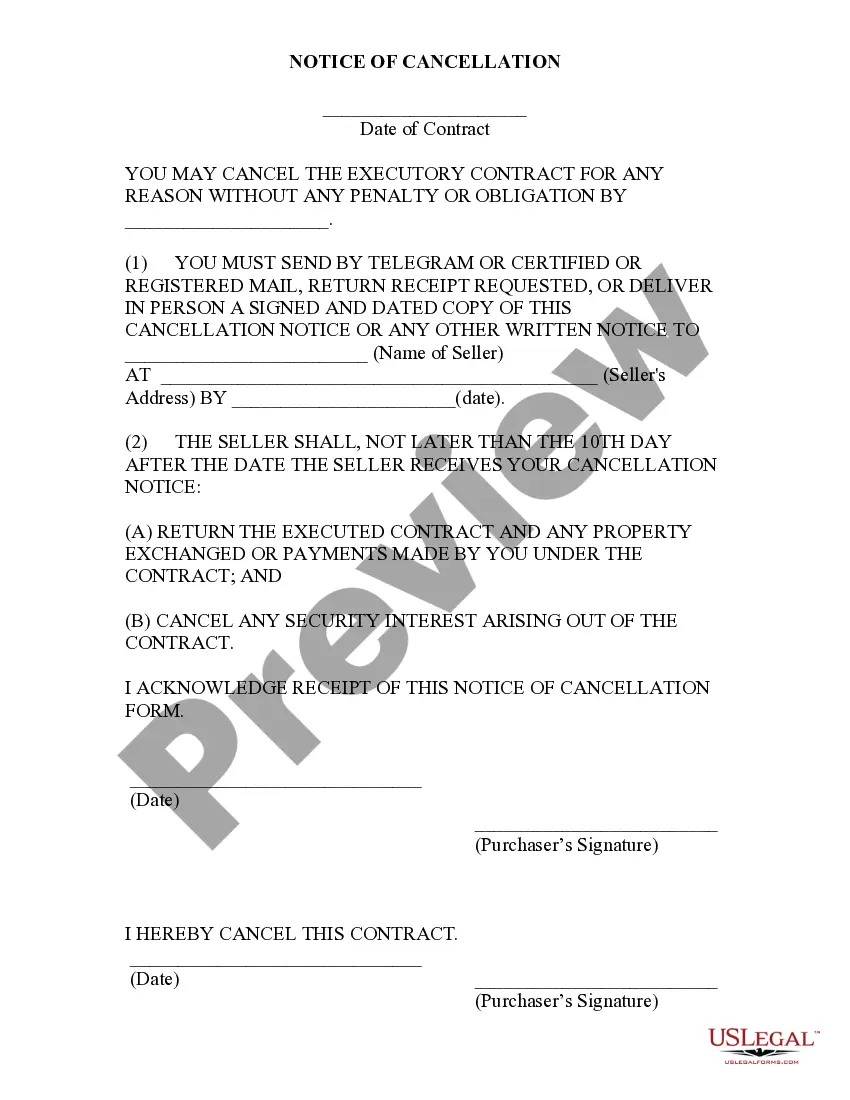

- First, ensure you have selected the correct form for your location/region. You can view the form using the Preview button and read the form description to confirm that this is the right choice for you.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate form.

- Once you are certain that the form is suitable, click on the Purchase now button to acquire the form.

- Choose the pricing plan you prefer and fill in the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

First and foremost, a purchase agreement must outline the property at stake. It should include the exact address of the property and a clear legal description. Additionally, the contract should include the identity of the seller and the buyer or buyers.

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

An Agreement of Purchase and Sale is a written contract between a seller and a buyer for the purchase and sale of a particular property. In the Agreement, the buyer agrees to purchase the property for a certain price, provided that a number of terms and conditions are satisfied.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An LLC Membership Purchase Agreement is a document used when a member of an LLC (a limited liability company) wishes to sell their interest, or a portion of their interest, to another party.

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...