Idaho Sample Letter to Beneficiaries regarding Trust Money

Description

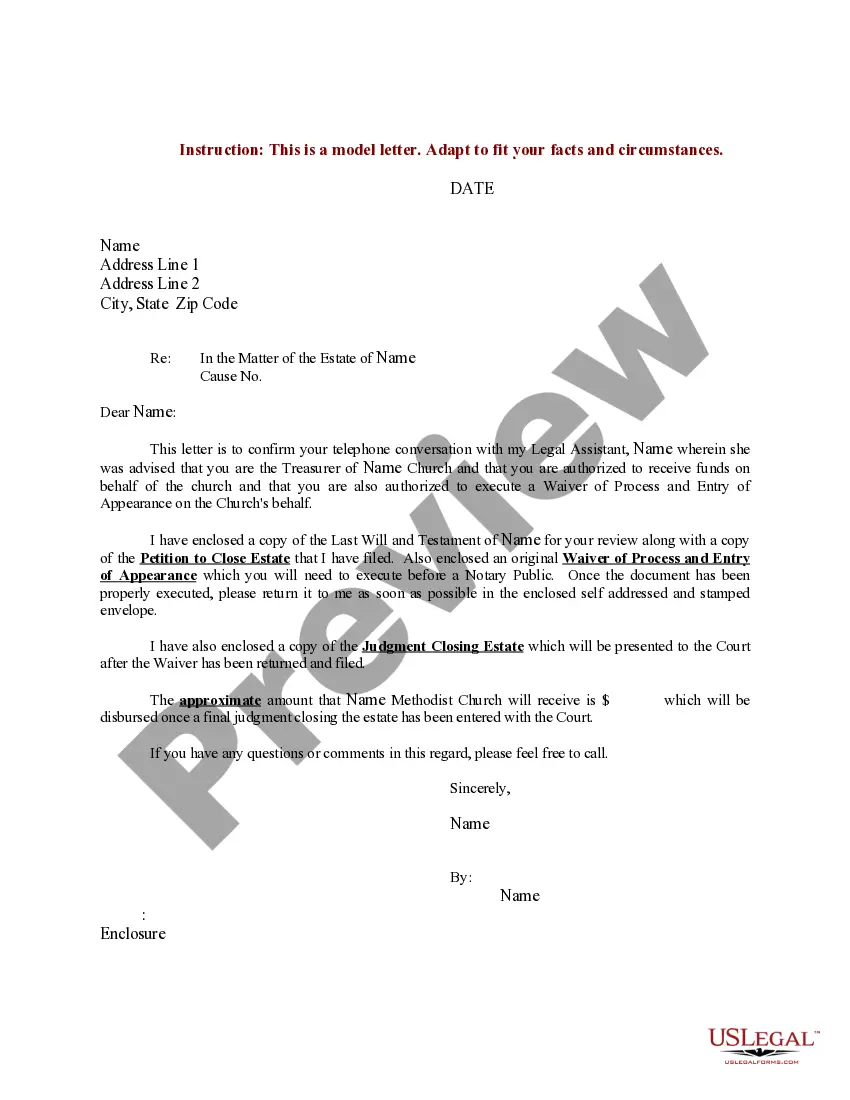

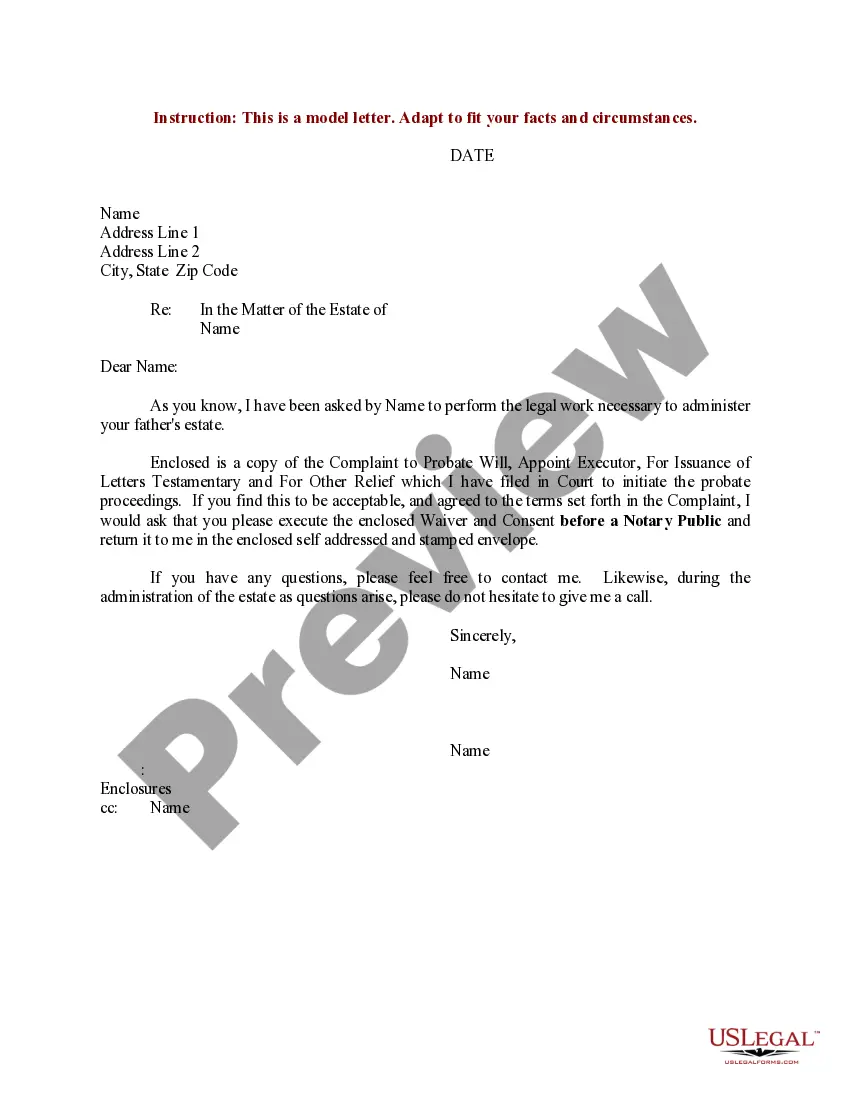

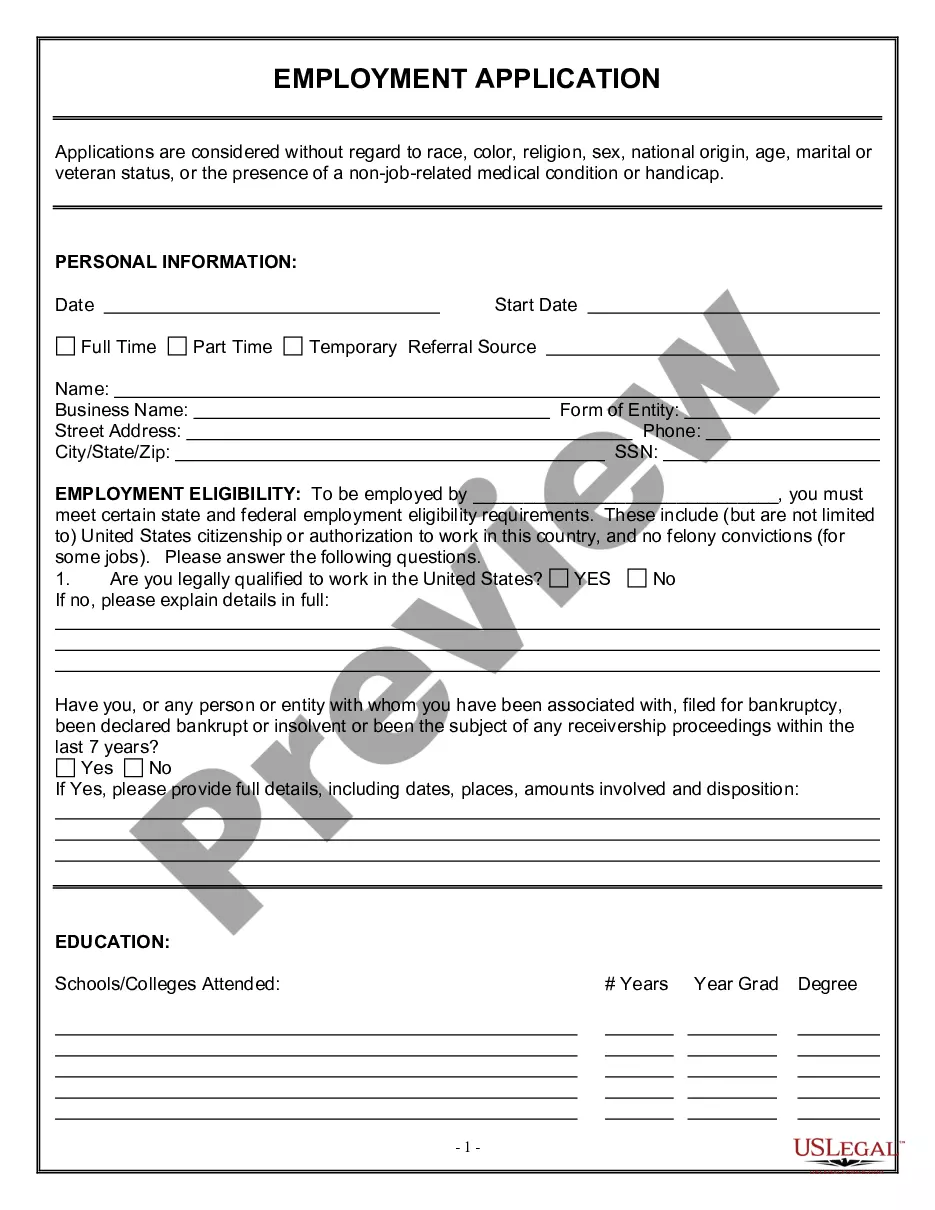

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

Are you currently inside a situation where you need paperwork for sometimes company or personal uses just about every time? There are plenty of lawful document layouts accessible on the Internet, but getting versions you can rely isn`t effortless. US Legal Forms gives a large number of type layouts, much like the Idaho Sample Letter to Beneficiaries regarding Trust Money, that happen to be composed to fulfill state and federal needs.

In case you are presently acquainted with US Legal Forms site and also have a merchant account, just log in. Afterward, you are able to download the Idaho Sample Letter to Beneficiaries regarding Trust Money design.

Should you not come with an accounts and need to start using US Legal Forms, adopt these measures:

- Obtain the type you want and make sure it is for the proper town/region.

- Take advantage of the Preview key to review the form.

- See the information to ensure that you have selected the right type.

- If the type isn`t what you are looking for, utilize the Search industry to find the type that suits you and needs.

- Once you get the proper type, click on Get now.

- Choose the pricing strategy you need, submit the necessary info to generate your money, and purchase an order utilizing your PayPal or charge card.

- Choose a convenient file formatting and download your duplicate.

Locate all the document layouts you may have bought in the My Forms menus. You can obtain a additional duplicate of Idaho Sample Letter to Beneficiaries regarding Trust Money whenever, if necessary. Just go through the essential type to download or printing the document design.

Use US Legal Forms, one of the most extensive assortment of lawful varieties, to save lots of some time and prevent mistakes. The service gives skillfully produced lawful document layouts which can be used for an array of uses. Make a merchant account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

Trustees have a legal duty to keep the beneficiaries of a trust informed about how the trust assets are being managed. If the beneficiaries don't have good, current information, they can't protect their rights. This responsibility lasts as long as you're serving as trustee.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Beneficiaries have the legal right to copies of trust documents. This right emerges when the Trust becomes irrevocable or after the passing of a Trust creator, known as a ?Grantor.? It's vital for beneficiaries to know their rights for trust transparency and proper administration.

A good first step for the beneficiary is to meet with the trustee who is tasked with executing the terms of the trust. It may be an individual, such as a CPA or lawyer, family member, or potentially a corporate trustee such as Wells Fargo Bank.

A 120-day Trust Letter (AKA Notification by Trustee pursuant to Probate Code 16061.7) is a document that is issued by a trustee to notify all beneficiaries of the trust and any other heirs of the deceased Settlor(s) that the trust is now irrevocable and of their right to file a claim against the trust within 120 days ...

In terms of content, an Estate distribution letter should include: the deceased's personal details; a detailed and complete list of all assets and liabilities; the Beneficiary names and the details of their respective inheritances; any details on debt settlement and creditor communication;

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.

How to write a beneficiary letter List important contact information. ... Give specific and clear instructions. ... Address your beneficiary personally. ... Keep multiple copies. ... Check the letter annually and update as needed.