Idaho Subrogation Agreement between Insurer and Insured is a legally binding contract that outlines the rights and obligations of both parties involved in a subrogation claim. Subrogation refers to the process where an insurance company, after paying for damages or losses incurred by an insured party, seeks to recover the amount from a third party responsible for causing the harm. In Idaho, there are two main types of Subrogation Agreement between Insurer and Insured: 1. Property Subrogation Agreement: This type of agreement is commonly used in property insurance claims. It allows the insurance company to recover the payment made to the insured for property damage caused by a third party. The agreement establishes the insurer's right to pursue legal action or negotiate with the responsible party to recoup the amount paid out. 2. Personal Injury Subrogation Agreement: This type of agreement comes into play when an insured individual suffers personal injury due to the negligence or fault of a third party. The insurer pays for the medical expenses, lost wages, and other related costs on behalf of the insured. The agreement enables the insurance company to seek reimbursement from the responsible party, either through negotiation or legal proceedings. In both types of Subrogation Agreements, certain essential elements and clauses are typically included. These may consist of: 1. Identification of Parties: The agreement will clearly identify the insurer and the insured party involved in the claim. 2. Description of the Claim: The agreement will detail the nature of the claim, outlining the specific damages or losses for which the insured was compensated by the insurer. 3. Assignment of Rights: The insured party typically assigns their rights to the insurer, allowing them to pursue the recovery process. This includes the right to initiate legal action, negotiate settlements, or engage in alternative dispute resolution methods. 4. Cooperation and Information Exchange: Both parties agree to cooperate fully throughout the subrogation process, providing necessary documentation, evidence, and information to support the claim. 5. Reimbursement Priority: The agreement may establish the order in which the recovered funds will be distributed. For instance, the insurer may first recover their expenses, including legal fees, before the insured party receives any remaining amount. 6. Indemnification: The agreement may include provisions for indemnification, aiming to protect the insured from any potential legal liabilities or expenses involved in the subrogation process. Overall, an Idaho Subrogation Agreement between Insurer and Insured is a vital tool to facilitate the recovery of funds for an insurance company while protecting the rights and interests of the insured. It serves to strengthen the insurer's ability to safeguard against losses and maintain affordable premiums for policyholders.

Idaho Subrogation Agreement between Insurer and Insured

Description

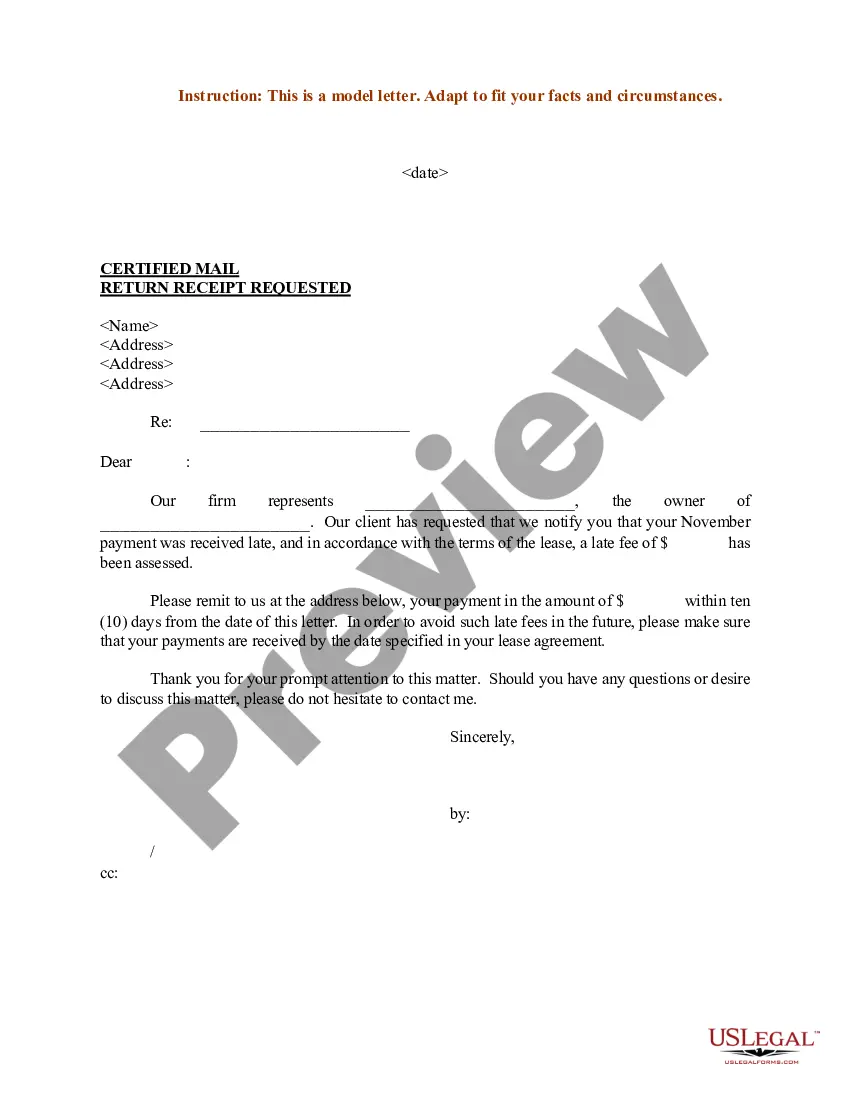

How to fill out Idaho Subrogation Agreement Between Insurer And Insured?

US Legal Forms - one of the largest libraries of authorized varieties in America - offers a variety of authorized document layouts it is possible to acquire or produce. While using internet site, you may get a huge number of varieties for company and specific functions, categorized by classes, states, or keywords and phrases.You can get the most up-to-date types of varieties such as the Idaho Subrogation Agreement between Insurer and Insured in seconds.

If you already possess a registration, log in and acquire Idaho Subrogation Agreement between Insurer and Insured from the US Legal Forms library. The Download button will show up on every kind you see. You get access to all previously downloaded varieties in the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, listed below are basic guidelines to obtain started off:

- Ensure you have picked out the best kind for the town/county. Go through the Review button to check the form`s information. Browse the kind description to actually have selected the right kind.

- In case the kind does not fit your requirements, utilize the Look for field on top of the screen to obtain the one which does.

- Should you be pleased with the form, confirm your decision by visiting the Acquire now button. Then, pick the pricing strategy you favor and provide your credentials to sign up to have an profile.

- Process the deal. Make use of your bank card or PayPal profile to finish the deal.

- Pick the formatting and acquire the form on the system.

- Make changes. Load, revise and produce and sign the downloaded Idaho Subrogation Agreement between Insurer and Insured.

Every single web template you put into your bank account lacks an expiry day and it is the one you have permanently. So, if you would like acquire or produce one more copy, just go to the My Forms portion and click around the kind you want.

Get access to the Idaho Subrogation Agreement between Insurer and Insured with US Legal Forms, the most substantial library of authorized document layouts. Use a huge number of skilled and condition-certain layouts that meet up with your business or specific requirements and requirements.

Form popularity

FAQ

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

Disadvantages of Subrogation On the downside, subrogation claims can sometimes result in delays. Recovering costs from the at-fault party can take time, especially if the case goes to court.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

Negotiate the claim. If you and your lawyer are unable to stop the subrogation claim altogether, it is possible to negotiate. Most insurance companies are willing to negotiate because they want to settle claims quickly and get their money.

An insurer shall mail or deliver to the named insured, at the last known mailing address, written notice of a total premium increase greater than ten percent (10%) which is the result of a comparable increase in premium rates, changes in deductibles, reductions in limits, or reductions in coverages at least thirty (30) ...

6-1606. Prohibiting double recoveries from collateral sources.

Idaho Statutes Subrogation. (1) If a claimant seeks compensation under this chapter and compensation is awarded, the account is entitled to full subrogation against a judgment or recovery received by the claimant against the offender or from or against any other source for all compensation paid under this chapter.

When factoring comparative negligence and improper referrals, the recovery rate should be somewhere in the range of 85-90%. This requires adjusters properly identifying subrogation, assessing comparative negligence and pursuing only what they are entitled to.