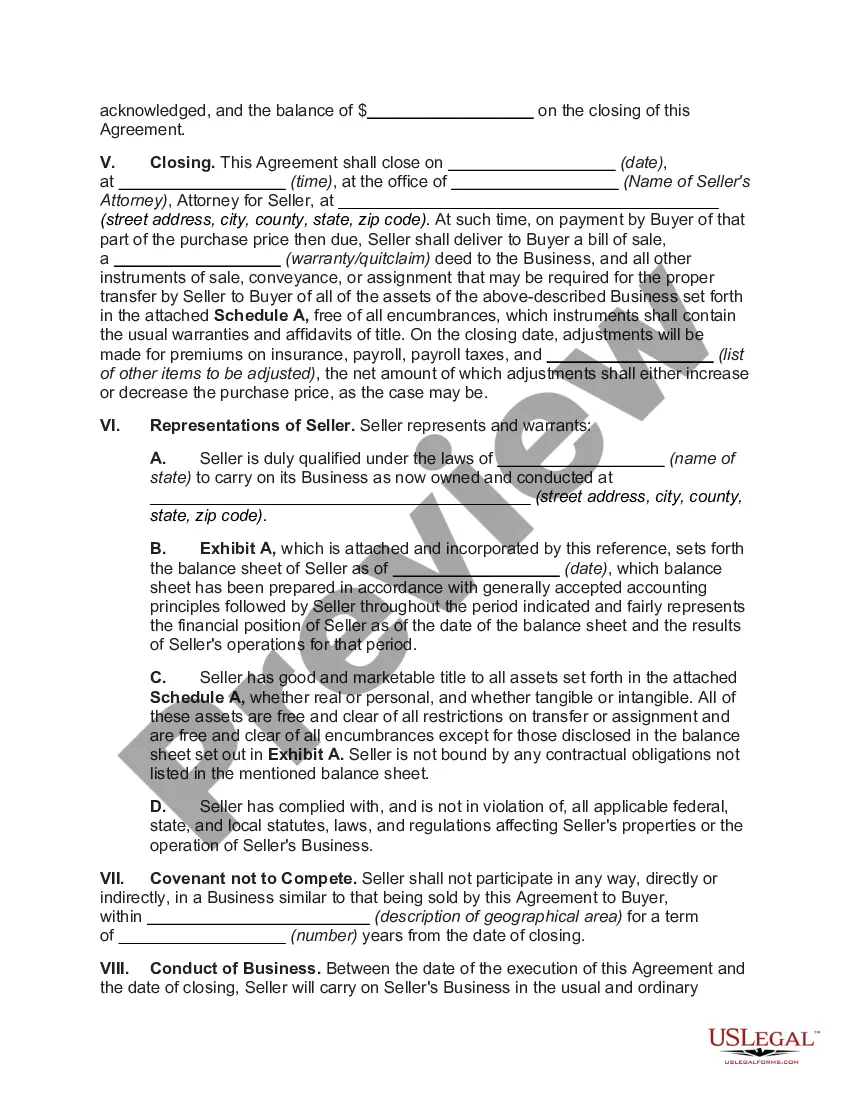

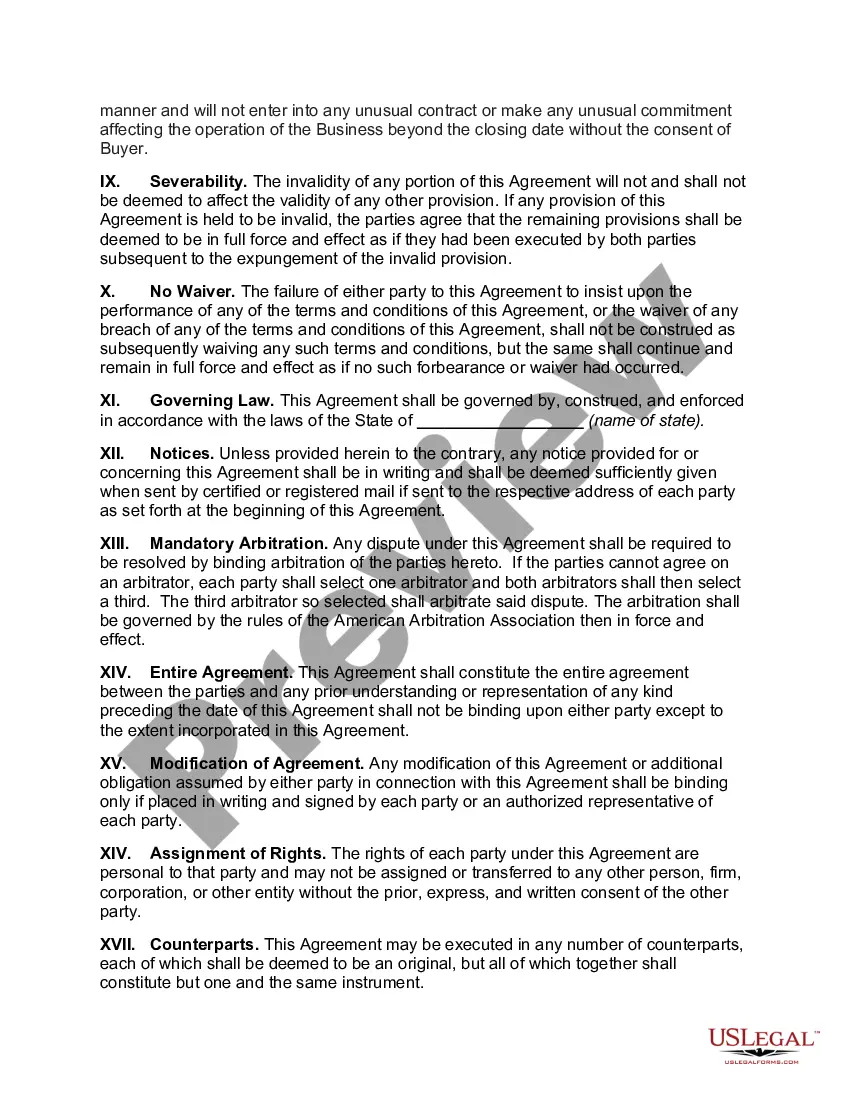

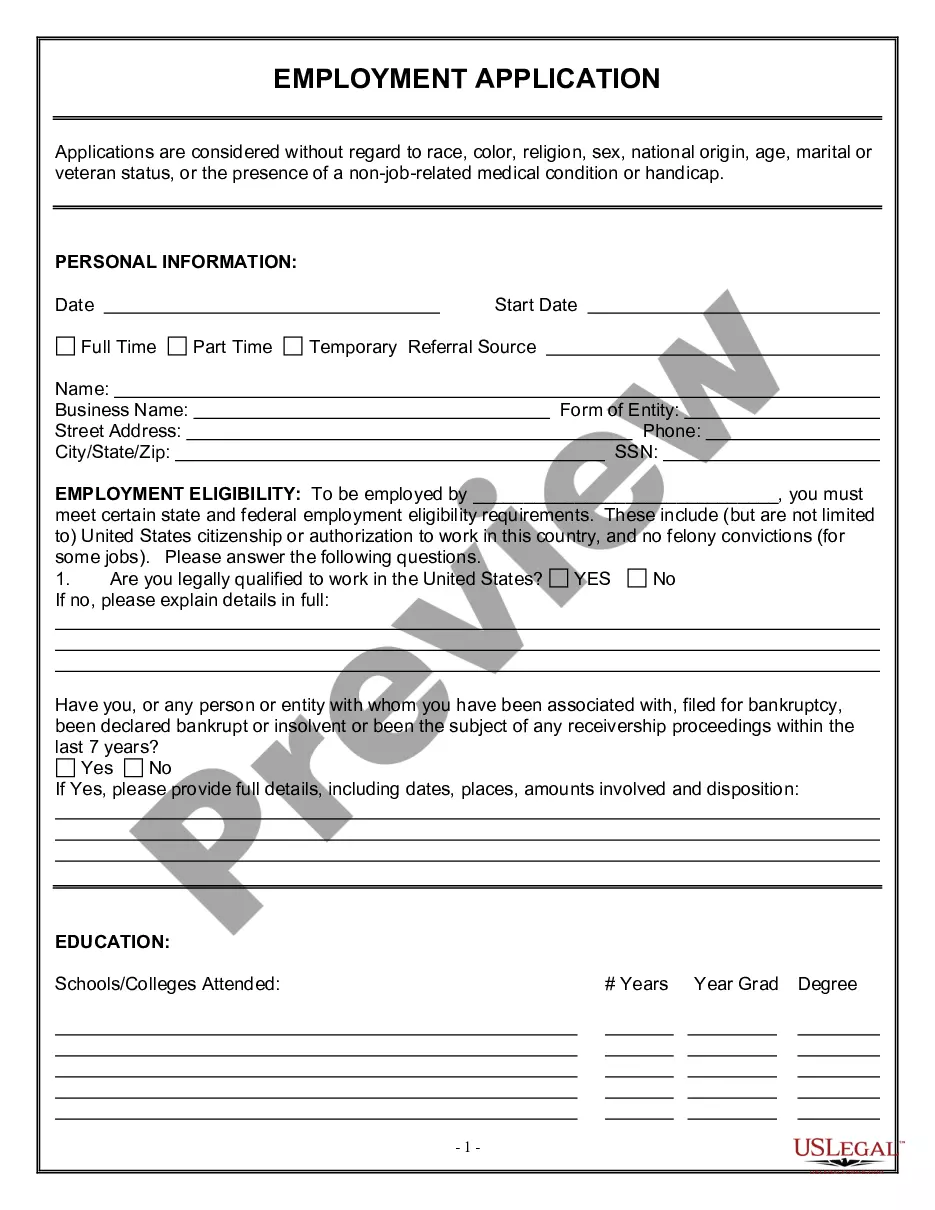

The Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property is a legal document that outlines the terms and conditions involved in the transfer of a sole proprietorship business, along with any real estate property associated with it. This agreement serves as a binding contract between the seller and the buyer, ensuring a smooth and lawful transfer of ownership. Within Idaho, there are several types of agreements for sale of business by sole proprietorship, including purchase of real property. These may include: 1. Asset Purchase Agreement: This type of agreement focuses on the transfer of the business assets from the seller (sole proprietor) to the buyer, while also addressing the purchase of any real property involved in the transaction. 2. Stock Purchase Agreement: If the sole proprietorship is structured as a corporation, this type of agreement is utilized for the transfer of stock shares from the seller to the buyer, leading to the transfer of control and ownership of the sole proprietorship and any related real property. 3. Business Purchase Agreement: This agreement outlines the sale of the entire sole proprietorship business to a buyer, along with any associated real property. It covers various aspects such as inventory, equipment, customer lists, contracts, intellectual property, and goodwill. Key elements commonly found in an Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property include: 1. Parties involved: The agreement clearly identifies the seller, purchaser, and any other relevant parties involved, including their legal names and addresses. 2. Description of business: A detailed description of the sole proprietorship business being sold, including its name, structure, and any essential assets. 3. Real property details: If there is any real estate property included in the sale, the agreement describes the property's legal description, address, and any relevant terms such as lease arrangements or mortgage details. 4. Purchase price and payment terms: This section outlines the purchase price for the business and any real property, including the agreed-upon payment terms, such as down payment, financing arrangements, or installments. 5. Representations and warranties: Both parties make certain declarations about the accuracy of information, assets, and liabilities related to the business and real property, ensuring transparency and honesty in the transaction. 6. Conditions and contingencies: Any specific conditions, contingencies, or prerequisites that need to be met before the sale is finalized are stated in this section. This may include obtaining necessary licenses or permits, approval from lenders, or inspections. 7. Closing procedures: The process for closing the sale, transferring ownership, and handling any necessary legal documentation or records is outlined in this section. 8. Confidentiality and non-compete provisions: To protect confidential information and the goodwill of the business, the agreement may include provisions that restrict the seller from operating a similar business or sharing proprietary knowledge within a specified time and geographic range. It is crucial to consult with a legal professional or attorney experienced in Idaho business law when drafting or entering into an Agreement for Sale of Business by Sole Proprietorship, ensuring all legal requirements and considerations specific to the state are met.

Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property

Description

How to fill out Idaho Agreement For Sale Of Business By Sole Proprietorship Including Purchase Of Real Property?

Have you been in the place that you require documents for either business or individual purposes virtually every day? There are a lot of lawful document layouts accessible on the Internet, but locating kinds you can trust isn`t easy. US Legal Forms provides 1000s of develop layouts, much like the Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property, that are published in order to meet federal and state demands.

Should you be already informed about US Legal Forms web site and get an account, basically log in. After that, it is possible to down load the Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property web template.

Should you not have an bank account and wish to start using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for that right town/region.

- Take advantage of the Preview switch to check the shape.

- See the explanation to actually have chosen the right develop.

- If the develop isn`t what you`re looking for, take advantage of the Research area to get the develop that meets your needs and demands.

- Whenever you find the right develop, click on Purchase now.

- Select the costs program you desire, submit the specified info to create your money, and pay money for an order making use of your PayPal or charge card.

- Choose a hassle-free file formatting and down load your version.

Discover every one of the document layouts you possess purchased in the My Forms food selection. You can aquire a additional version of Idaho Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property whenever, if necessary. Just click on the necessary develop to down load or print the document web template.

Use US Legal Forms, probably the most comprehensive collection of lawful forms, to save lots of time and steer clear of mistakes. The support provides expertly manufactured lawful document layouts which you can use for a range of purposes. Generate an account on US Legal Forms and begin making your way of life a little easier.