Idaho Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years allow individuals to leave a charitable gift using a trust arrangement in their last will and testament. This type of provision provides a reliable stream of income for beneficiaries while supporting a favored charitable organization. In Idaho, there are two main types of Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years: 1. Charitable Remainder Annuity Trust (CAT) for Term of Years: This type of trust guarantees a fixed annual payment to the beneficiaries for a specified term of years. The term can be defined by the individual creating the trust, usually ranging from 5 to 20 years. At the end of the term, the remaining trust assets are distributed to the named charitable organization(s). 2. Net Income with Make-Up Charitable Remainder Annuity Trust (NI MCU CAT) for Term of Years: Similar to the CAT, this trust structure also provides fixed annual payments for a predetermined term. However, it allows for the possibility of lower income or insufficient trust earnings in any given year. If the trust's net income falls below the required payment in a particular year, the shortfall can be made up in future years when the trust's income exceeds the annual payment. These testamentary provisions are designed to maximize both the financial benefits for beneficiaries and the charitable legacy of the individual creating the trust. By utilizing these arrangements, donors can pass on assets while ensuring a steady income source for their loved ones. It is important to consult with an experienced estate planning attorney to draft these provisions correctly and ensure they align with one's specific goals and intentions. Additionally, individuals should research and select reputable charitable organizations to include as beneficiaries in their trust, ensuring their philanthropic goals are met effectively.

Idaho Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Idaho Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Are you currently within a placement where you need papers for possibly business or person reasons nearly every day? There are a lot of authorized papers web templates available on the Internet, but locating versions you can rely isn`t straightforward. US Legal Forms delivers thousands of type web templates, much like the Idaho Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, that happen to be composed to satisfy state and federal specifications.

If you are currently knowledgeable about US Legal Forms website and also have a merchant account, basically log in. Next, you can download the Idaho Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years web template.

Should you not provide an bank account and want to begin to use US Legal Forms, adopt these measures:

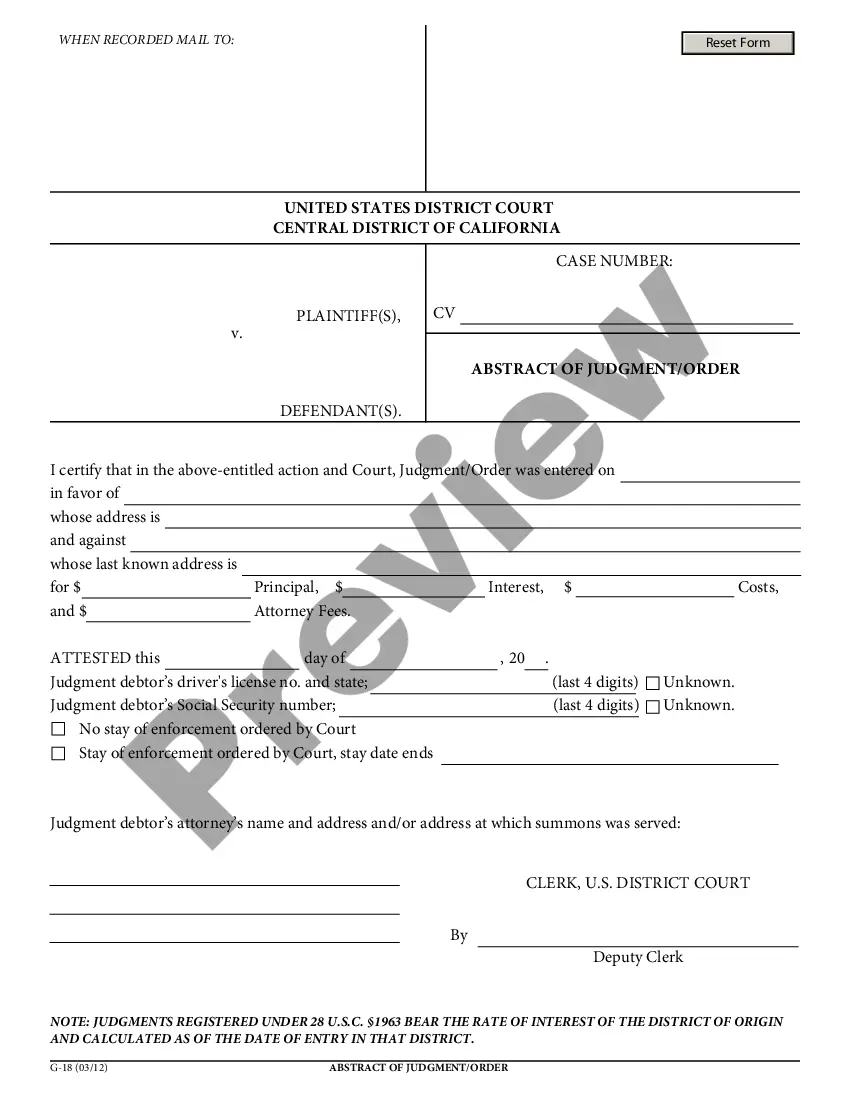

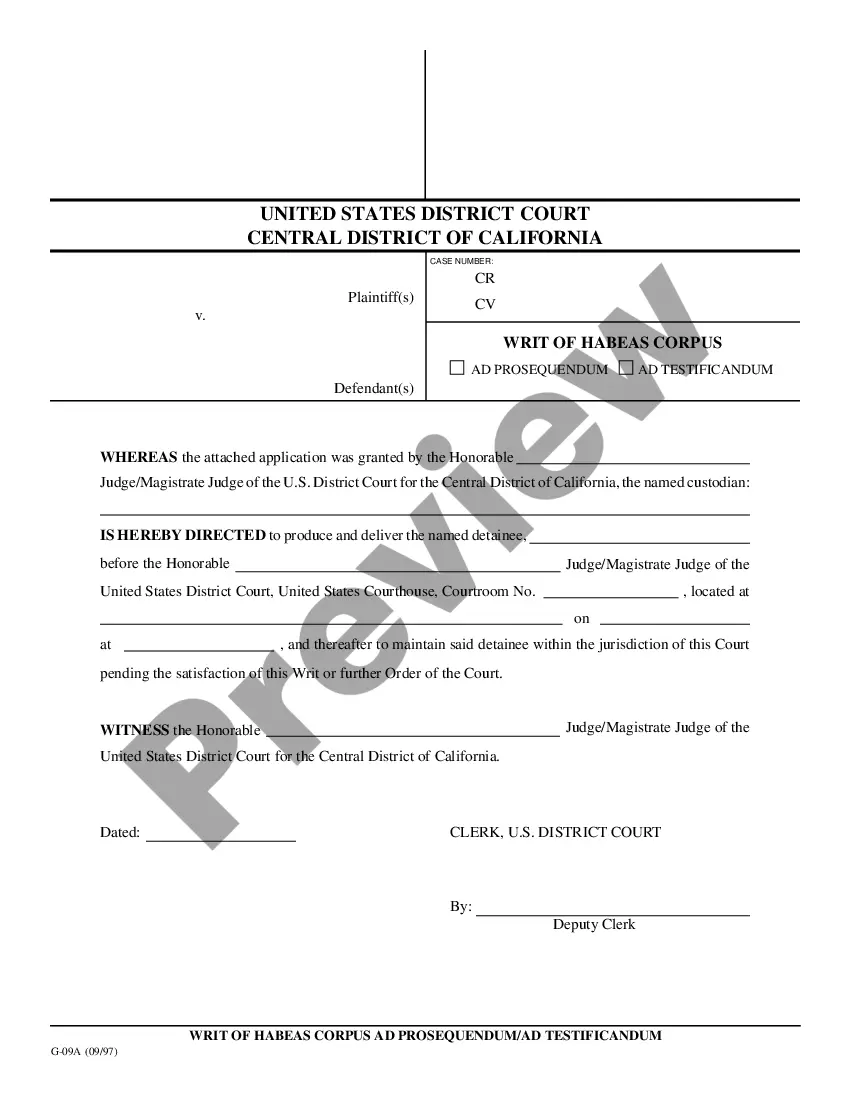

- Get the type you will need and make sure it is for the correct city/area.

- Use the Review key to check the form.

- Browse the explanation to ensure that you have selected the proper type.

- If the type isn`t what you are searching for, utilize the Look for industry to obtain the type that fits your needs and specifications.

- When you get the correct type, click on Get now.

- Choose the prices program you need, fill in the specified information to produce your account, and purchase the transaction with your PayPal or bank card.

- Pick a convenient file file format and download your backup.

Get every one of the papers web templates you may have bought in the My Forms menu. You may get a further backup of Idaho Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years any time, if necessary. Just go through the essential type to download or print the papers web template.

Use US Legal Forms, probably the most substantial selection of authorized varieties, to save efforts and avoid mistakes. The support delivers expertly created authorized papers web templates which can be used for a range of reasons. Generate a merchant account on US Legal Forms and commence creating your lifestyle easier.