The Idaho Irrevocable Funded Life Insurance Trust (IIT) with Beneficiaries Having Crummy Right of Withdrawal, along with a First to Die Policy and Survivorship Rider, is a sophisticated estate planning tool that offers several advantages for individuals seeking to protect their assets, optimize their estate, and provide financial security for their loved ones. This trust structure, when properly implemented, provides for the efficient transfer of wealth while minimizing estate taxes and ensuring that beneficiaries receive their intended financial benefits. The Idaho IIT allows individuals to establish a trust in which they can transfer ownership of a life insurance policy. By doing so, the policy's death benefit is excluded from the insured's estate, helping to reduce the potential estate tax burden. The irrevocable nature of this trust means that once the assets are transferred, the insured no longer has control or access to them. As a result, they are effectively removed from the taxable estate. Key to the Idaho IIT is the Crummy Right of Withdrawal. This provision allows the trust beneficiaries to have the option to withdraw a limited amount of money from the trust each year, typically within a specific time frame. This withdrawal right serves to make the contributions to the trust considered as gifts for tax purposes, qualifying for the annual gift tax exclusion. By utilizing this strategy, the insured can make contributions to the trust without incurring gift tax liabilities while funding the life insurance policy. The First to Die Policy with Survivorship Rider is an additional feature of the Idaho IIT. This policy ensures that the death benefit is paid upon the passing of the first insured individual in a married couple. This helps to provide immediate liquidity to the surviving spouse, facilitating the payment of estate settlement costs, debts, and potential estate taxes. While the structure described above represents the general concept of the Idaho IIT with Beneficiaries Having Crummy Right of Withdrawal and a First to Die Policy with Survivorship Rider, it's important to note that there can be variations based on individual circumstances and estate planning goals. Some variations include: 1. Irrevocable Life Insurance Trust (IIT) with Crummy Powers and a Survivorship Policy: This variant excludes the First to Die Policy and focuses solely on the Crummy withdrawal rights. The IIT acts as the owner and beneficiary of the survivorship policy, leading to effective estate tax reduction. 2. Generation-Skipping IIT with Crummy Powers and Survivorship Policy: This type of IIT aims to transfer wealth to grandchildren or subsequent generations, skipping the potential estate tax implications for the children. By utilizing the Crummy withdrawal powers and a survivorship policy, assets pass directly to future generations with minimized tax liabilities. In conclusion, the Idaho Irrevocable Funded Life Insurance Trust with Beneficiaries Having Crummy Right of Withdrawal, coupled with a First to Die Policy and Survivorship Rider, offers individuals an efficient and tax-advantaged estate planning solution. By leveraging these strategies, individuals can protect their assets, reduce potential estate taxes, and ensure the financial security of their loved ones in a carefully structured manner.

Idaho Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

How to fill out Idaho Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

US Legal Forms - one of the greatest libraries of authorized forms in the United States - delivers an array of authorized document layouts you may down load or print. Making use of the web site, you may get a huge number of forms for enterprise and personal functions, categorized by classes, claims, or key phrases.You can find the most recent types of forms like the Idaho Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider within minutes.

If you already possess a subscription, log in and down load Idaho Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider in the US Legal Forms local library. The Download option will appear on every form you see. You have access to all formerly acquired forms from the My Forms tab of the bank account.

In order to use US Legal Forms the first time, allow me to share straightforward recommendations to get you started off:

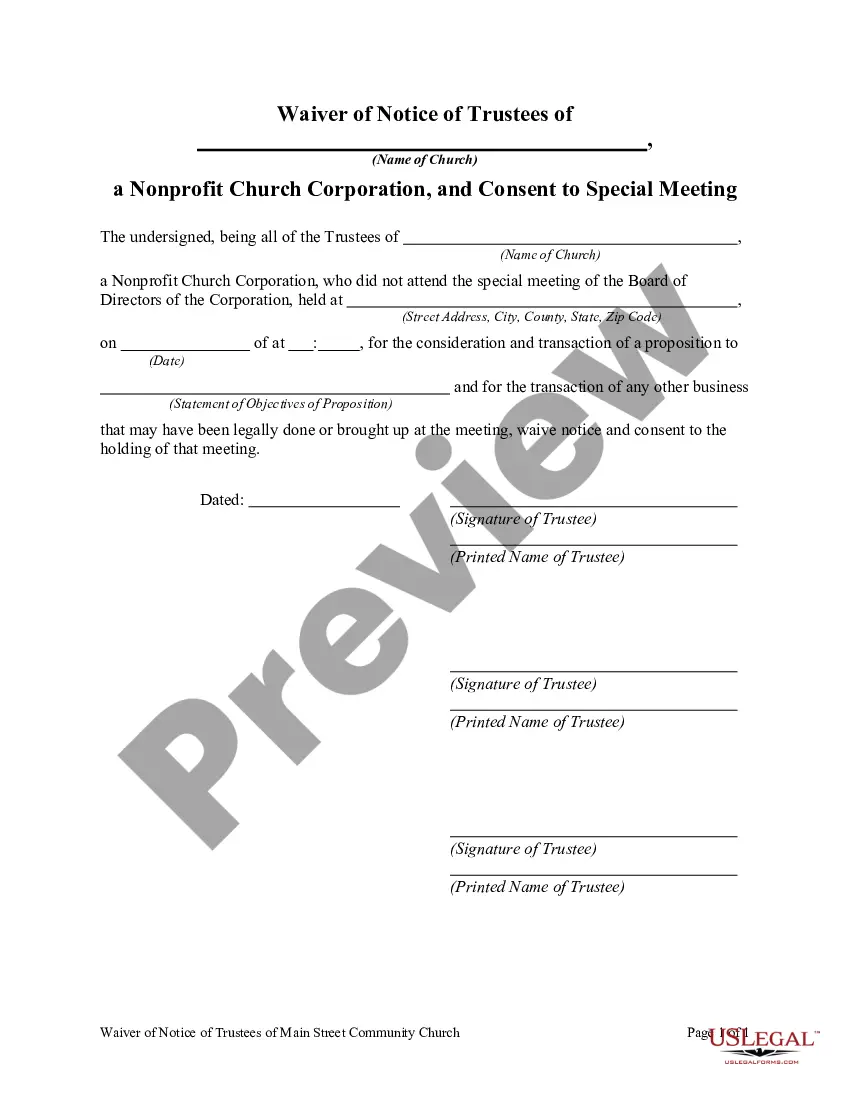

- Ensure you have picked the proper form to your area/region. Click the Review option to examine the form`s information. See the form explanation to actually have selected the proper form.

- When the form doesn`t fit your demands, use the Search discipline on top of the display to discover the one that does.

- In case you are pleased with the form, confirm your option by visiting the Get now option. Then, choose the prices plan you want and give your credentials to register for the bank account.

- Process the purchase. Make use of charge card or PayPal bank account to finish the purchase.

- Find the format and down load the form on your device.

- Make modifications. Fill out, revise and print and indication the acquired Idaho Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider.

Each and every web template you put into your bank account lacks an expiration particular date which is yours eternally. So, if you want to down load or print yet another copy, just go to the My Forms segment and click in the form you require.

Obtain access to the Idaho Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider with US Legal Forms, probably the most extensive local library of authorized document layouts. Use a huge number of professional and condition-specific layouts that meet up with your company or personal needs and demands.

Form popularity

FAQ

The buildup of cash value within a policy owned by the trustee of an ILIT is wholly free from income tax. Even more important, the life insurance proceeds ultimately received by the trustee of the ILIT are not subject to the federal income tax.

A Crummey trust is a specific type of trust that can be used to transfer assets to minor children and other people as a strategy to avoid gift taxes. If you need hands-on guidance, a financial advisor can help you create an estate plan for your family's needs and goals.

Crummey Trusts and Crummey Powers Since the beneficiaries do not have to pay any income taxes when they receive the proceeds of the life insurance policy, the Crummey trust allows the transfer of considerable wealth tax-free.

A Right of Withdrawal Trust, a.k.a. a Crummey Trust is an irrevocable trust used by parents, grandparents, etc., to make gifts to a trust for their children and grandchildren, taking advantage of their annual gift tax exclusion.

Crummey powers give the beneficiary a limited time (often 30, 45 or 60 days) to withdraw contributions to a trust at will, converting the future interest gift to a present interest gift. This withdrawal right is generally limited to an amount equal to the current annual gift tax exclusion.

Putting the life insurance policy in the trust can remove it from the grantor's personal assets. As an irrevocable trust, once the life insurance is owned by the trust, you can't take it back.

Types of Irrevocable TrustsIrrevocable life insurance trust.Grantor-retained annuity trust (GRAT), spousal lifetime access trust (SLAT), and qualified personal residence trust (QPRT) (all types of lifetime gifting trusts)Charitable remainder trust and charitable lead trust (both forms of charitable trusts)

A Right of Withdrawal Trust, a.k.a. a Crummey Trust is an irrevocable trust used by parents, grandparents, etc., to make gifts to a trust for their children and grandchildren, taking advantage of their annual gift tax exclusion.

Even an irrevocable trust can be revoked with a court order. A court may execute an order that permits the dissolution of a life insurance trust if changes in trust or tax laws or in the grantor's family situation make the life insurance trust no longer serve its original purpose.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.