Idaho Sample Letter for Closing of Estate - Request to Execute

Description

How to fill out Sample Letter For Closing Of Estate - Request To Execute?

Are you inside a placement where you need papers for possibly company or person uses almost every time? There are tons of legal record themes available on the Internet, but getting kinds you can rely on isn`t effortless. US Legal Forms delivers a huge number of kind themes, such as the Idaho Sample Letter for Closing of Estate - Request to Execute, which can be created to satisfy federal and state needs.

When you are presently acquainted with US Legal Forms site and also have a free account, basically log in. After that, you can acquire the Idaho Sample Letter for Closing of Estate - Request to Execute design.

If you do not provide an profile and wish to start using US Legal Forms, follow these steps:

- Discover the kind you require and make sure it is for your right town/state.

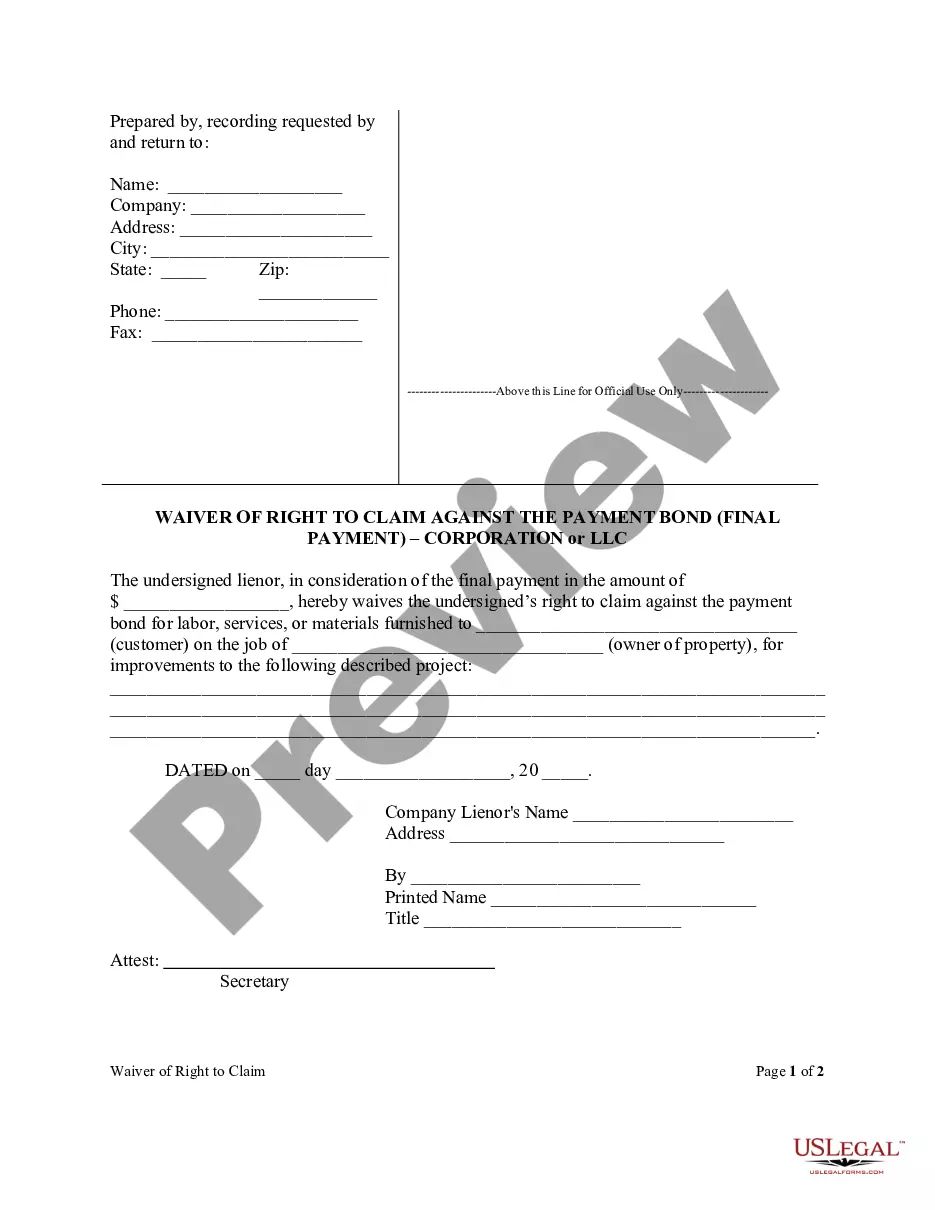

- Use the Review option to analyze the shape.

- Read the outline to ensure that you have chosen the correct kind.

- In the event the kind isn`t what you are looking for, make use of the Search area to obtain the kind that suits you and needs.

- Once you find the right kind, click on Acquire now.

- Choose the prices strategy you desire, fill in the necessary info to produce your bank account, and purchase the order making use of your PayPal or charge card.

- Select a handy data file formatting and acquire your copy.

Get all of the record themes you may have purchased in the My Forms menus. You can obtain a extra copy of Idaho Sample Letter for Closing of Estate - Request to Execute at any time, if possible. Just go through the necessary kind to acquire or produce the record design.

Use US Legal Forms, probably the most extensive selection of legal types, to save time and stay away from errors. The support delivers skillfully manufactured legal record themes which you can use for a selection of uses. Produce a free account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

Creditors have a certain time frame, typically four months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.

Through an ancillary probate, the original or main probate will be started where the person who died resided when they were alive. This state has the authority to control that particular probate.

If you factor in all fees, the cost of a probate attorney and any Executor fees, a basic, simple probate could average somewhere between around $2,000 - $3,000. Of course this range could drastically change depending on how complicated the estate is and other factors we've mentioned.

The Deadlines for a Regular Probate ing to Idaho's applicable statutes, (I.C. § 15-3-108) a regular probate must be completed within 3 years of a person's death.

Ing to Idaho Code § 15-3-1201 et seq., after a family member or loved one passes away, an individual can use a small estate affidavit that specifically identifies them as the recipient of personal property owned by the decedent. The small estate affidavit has to have some specific language in it.

Once all the assets have been distributed, the Personal Representative files the Informal Verification Statement of the Personal Representative with the Court formally closing probate.