Idaho Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

US Legal Forms - one of the most prominent collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you will access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You will find the latest editions of forms such as the Idaho Irrevocable Trust, which qualifies as a Subchapter-S Trust, in just minutes.

Examine the form details to confirm you have chosen the right form.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already possess a membership, Log In to download the Idaho Irrevocable Trust, qualifying as a Subchapter-S Trust, from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

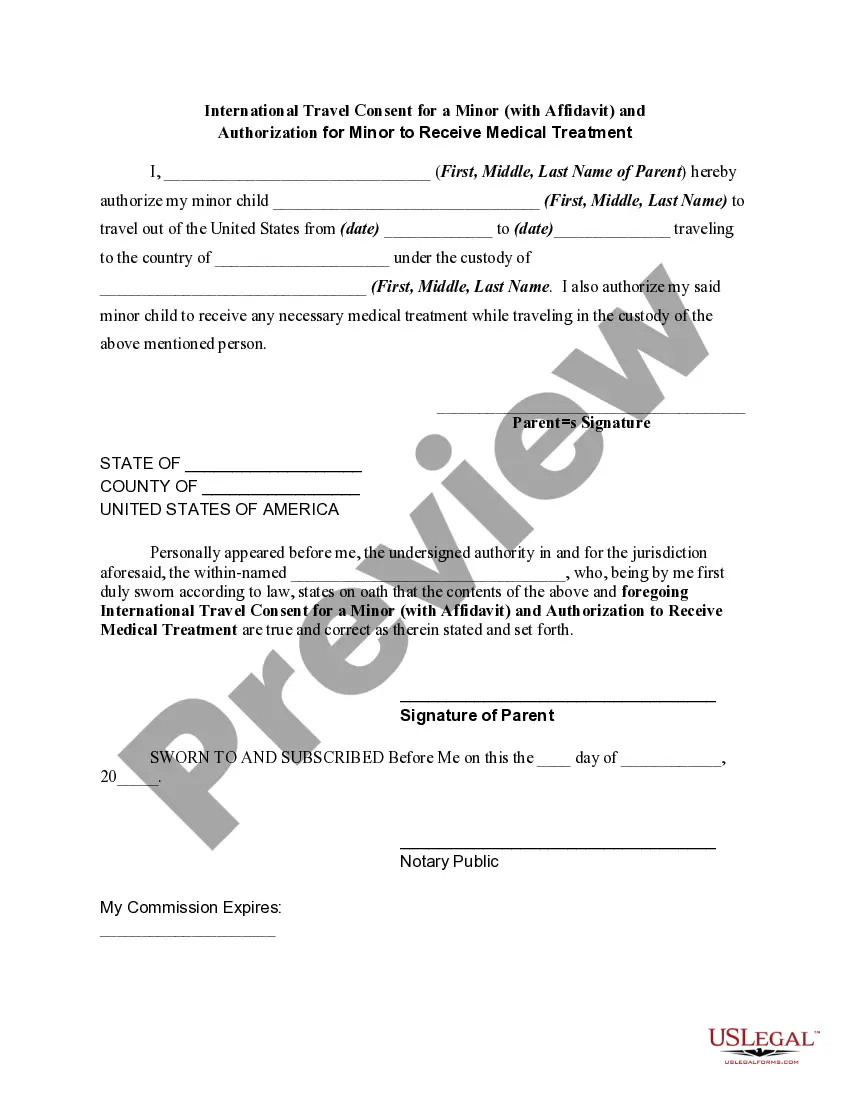

- Choose the Preview option to review the contents of the form.

Form popularity

FAQ

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

An irrevocable trust is simply a kind of trust that cannot be changed or canceled after the document has been signed. This sets it apart from a revocable trust, which can be altered or terminated and only becomes irrevocable when the trust maker, or grantor, dies.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Irrevocable trusts are often set up as grantor trusts, which simply means that they are not recognized for income tax purposes (all of the income tax attributes of the trust, such as income, loss, gains, etc. is passed on to the grantor of the trust).

An irrevocable trust cannot be changed or modified without the beneficiary's permission. Essentially, an irrevocable trust removes certain assets from a grantor's taxable estate, and these incidents of ownership are transferred to a trust.

For example, if a trust is a grantor trust to one individual, it is eligible as an S corporation shareholder, even though it is irrevocable (rather than revocable).

Irrevocable trust distributions can vary from being completely tax free to being taxable at the highest marginal tax rates, and in some cases, can be even higher.

A trust can hold stock in an S corp only if it (1) is treated as owned by its grantor for income tax purposes under us grantor trust rules, (2) was a grantor trust immediately before its grantor's death (the trust can be a shareholder only for two years from that date), (3) received stock from the will of a decedent (

The two-year limitation for S corporations to have as a shareholder either a testamentary trust or living trust that becomes irrevocable can be avoided by electing to convert the trust to a Qualified Subchapter S Trust, commonly referred to as a QSST.

A simple trust must distribute all its income currently. Generally, it cannot accumulate income, distribute out of corpus, or pay money for charitable purposes. If a trust distributes corpus during a year, as in the year it terminates, the trust becomes a complex trust for that year.