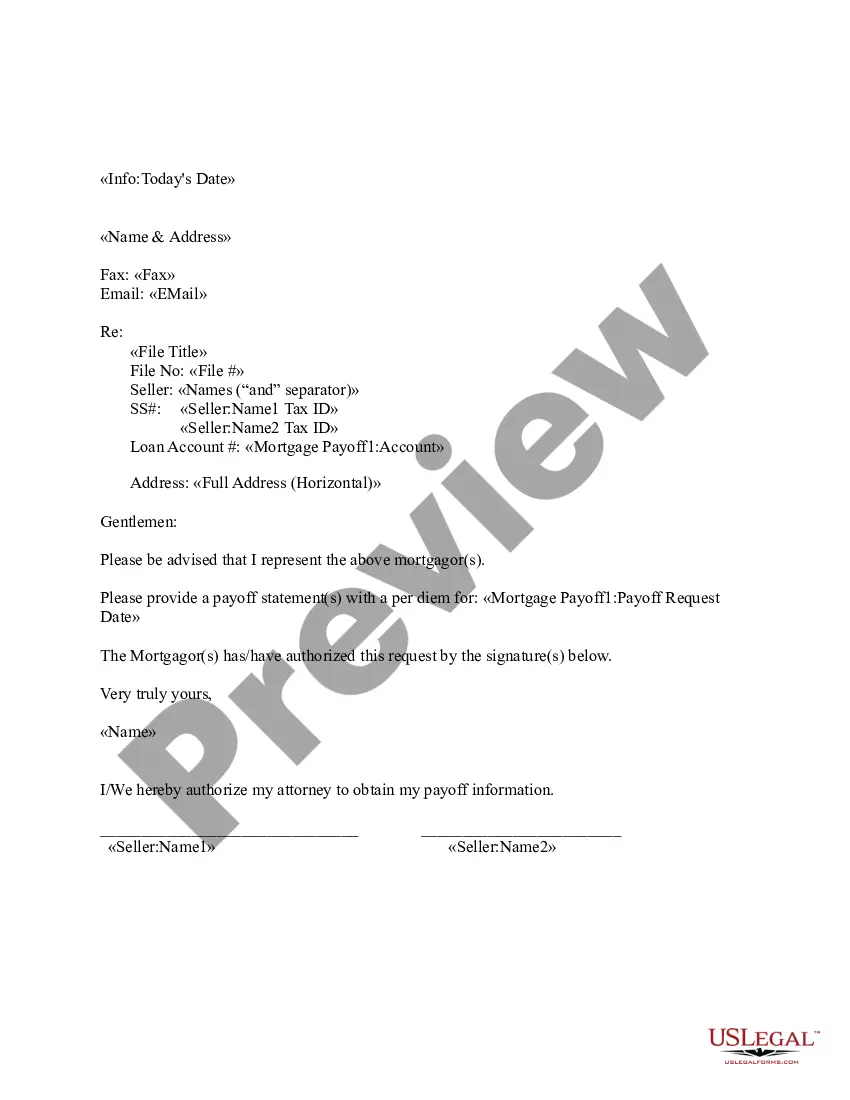

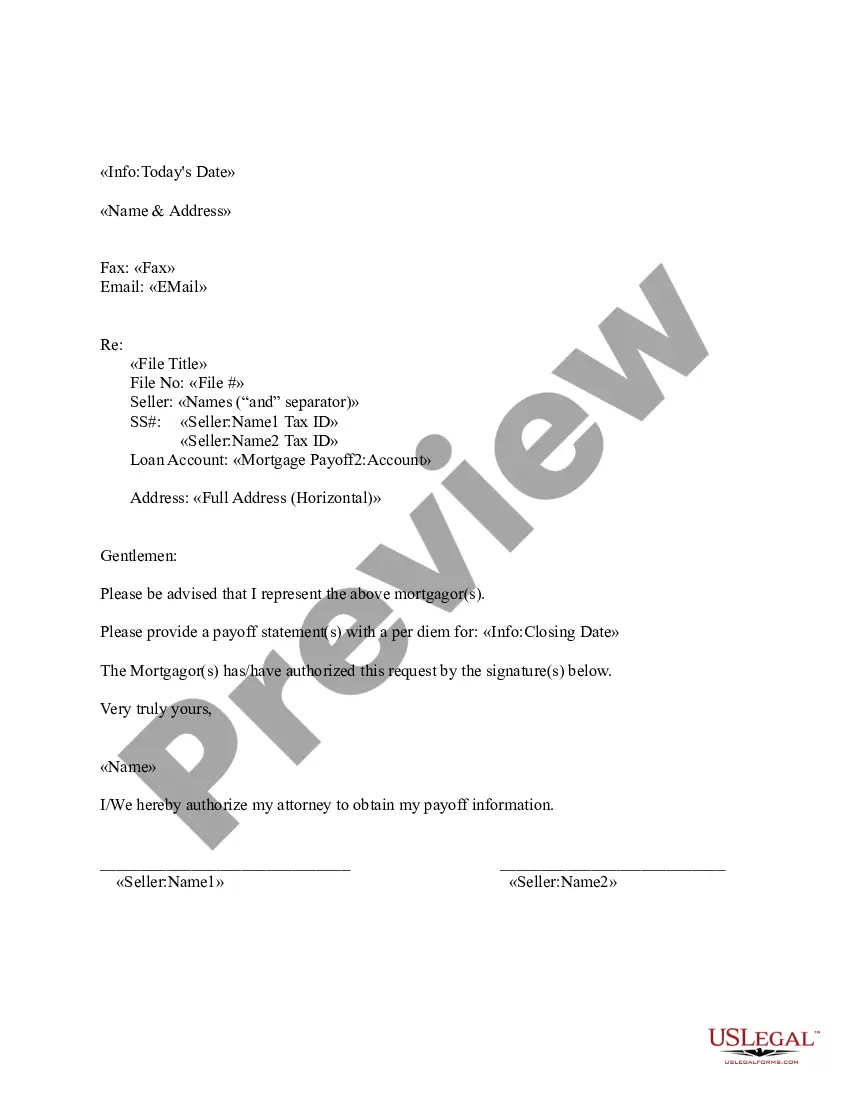

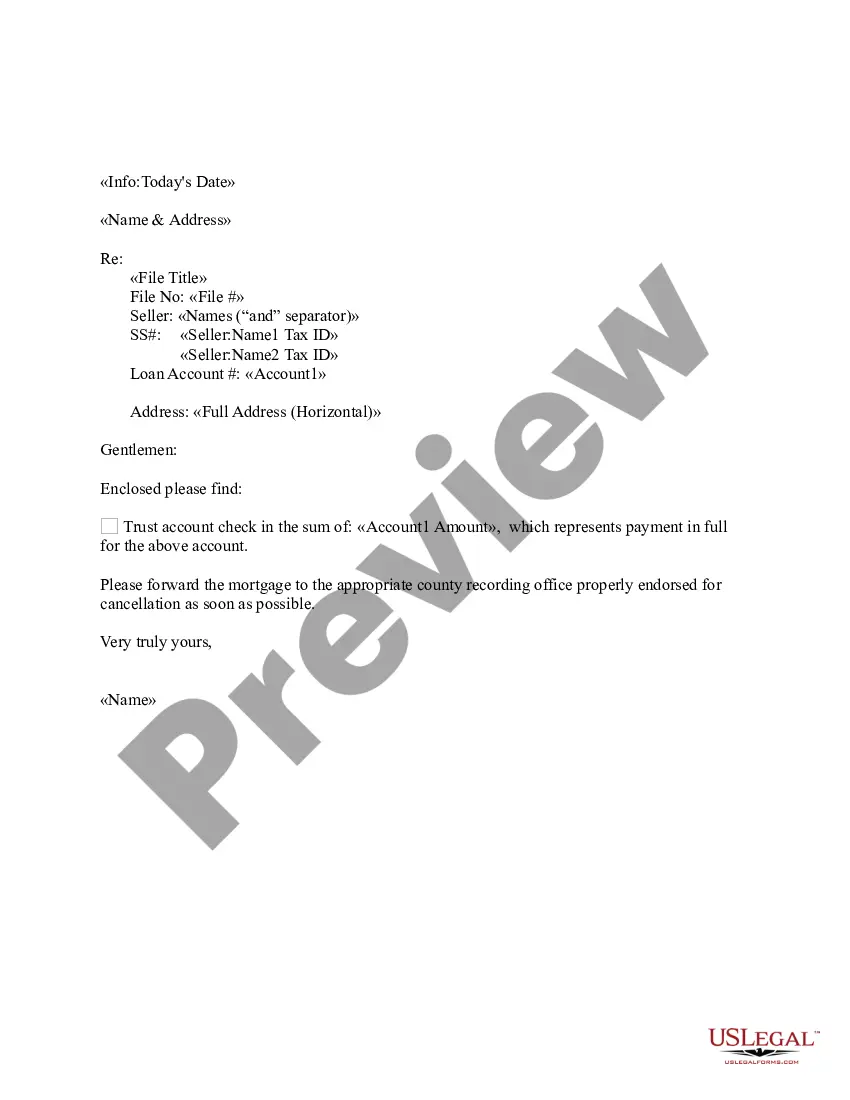

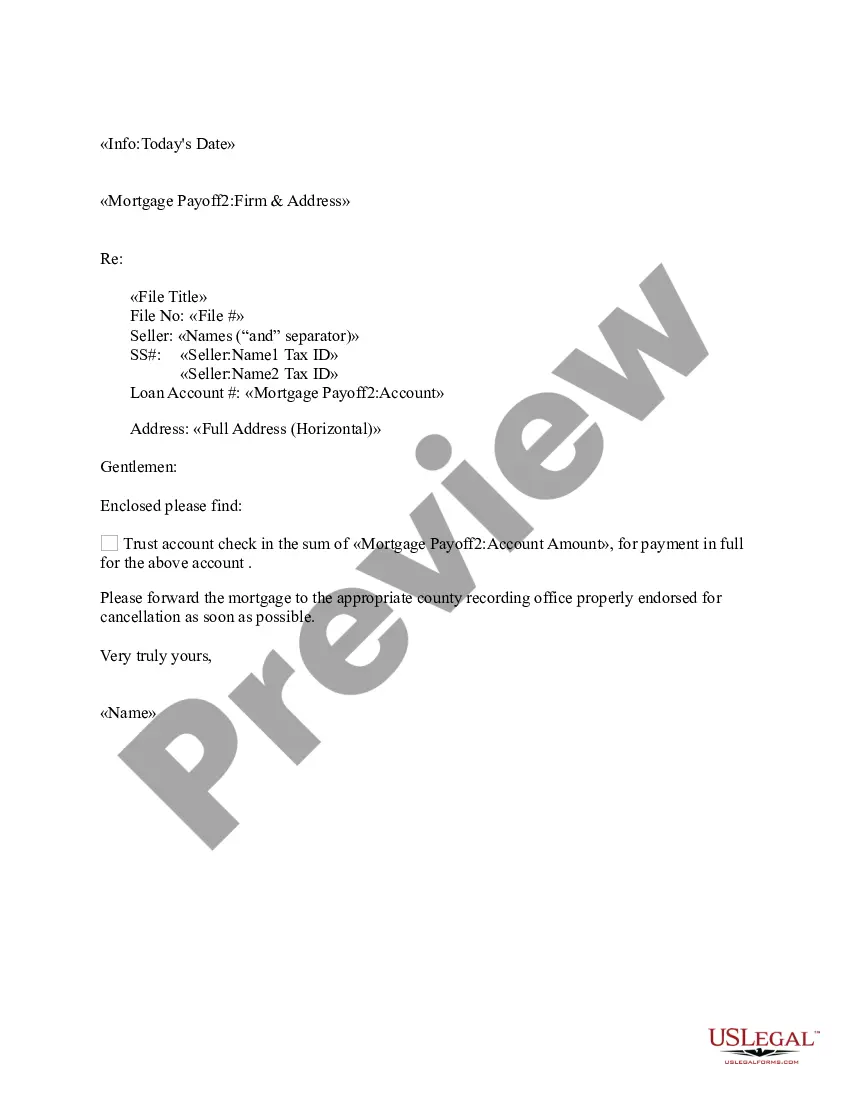

Idaho Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

You can commit time on-line searching for the lawful record template which fits the state and federal requirements you need. US Legal Forms provides a huge number of lawful forms which can be analyzed by pros. You can actually download or print out the Idaho Sample Letter Requesting Payoff Balance of Mortgage from the assistance.

If you already possess a US Legal Forms account, you are able to log in and click on the Obtain key. Following that, you are able to complete, revise, print out, or indicator the Idaho Sample Letter Requesting Payoff Balance of Mortgage. Every lawful record template you buy is your own for a long time. To acquire yet another duplicate for any bought develop, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site the very first time, follow the basic directions below:

- First, ensure that you have chosen the right record template for the county/town of your choice. See the develop outline to make sure you have picked out the correct develop. If offered, take advantage of the Preview key to appear through the record template too.

- In order to get yet another edition in the develop, take advantage of the Lookup area to get the template that fits your needs and requirements.

- Upon having identified the template you desire, simply click Buy now to proceed.

- Pick the pricing prepare you desire, key in your credentials, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal account to cover the lawful develop.

- Pick the format in the record and download it to your gadget.

- Make modifications to your record if necessary. You can complete, revise and indicator and print out Idaho Sample Letter Requesting Payoff Balance of Mortgage.

Obtain and print out a huge number of record layouts making use of the US Legal Forms Internet site, that provides the largest variety of lawful forms. Use skilled and condition-specific layouts to handle your business or individual requires.

Form popularity

FAQ

Lenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

Your principal balance is not the payoff amount because the interest on your loan is calculated in arrears. For example, when you paid your August payment you actually paid interest for July and principal for August.

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

A payoff statement is a statement prepared by a lender providing a payoff amount for prepayment on a mortgage or other loan. A payoff statement or a mortgage payoff letter will typically show the balance you must pay in order to close your loan.

How do I figure out my loan payoff amount? you can just call your bank and ask them to share the payoff amount with you. you can go to your online banking and look for the link to your payoff amount and print out a PDF file. you can dial a 1-800 number and use the IVR to get to the payoff amount.

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.