Idaho Sample Letter for Notification to Creditor to Probate and Register Claim

Description

How to fill out Sample Letter For Notification To Creditor To Probate And Register Claim?

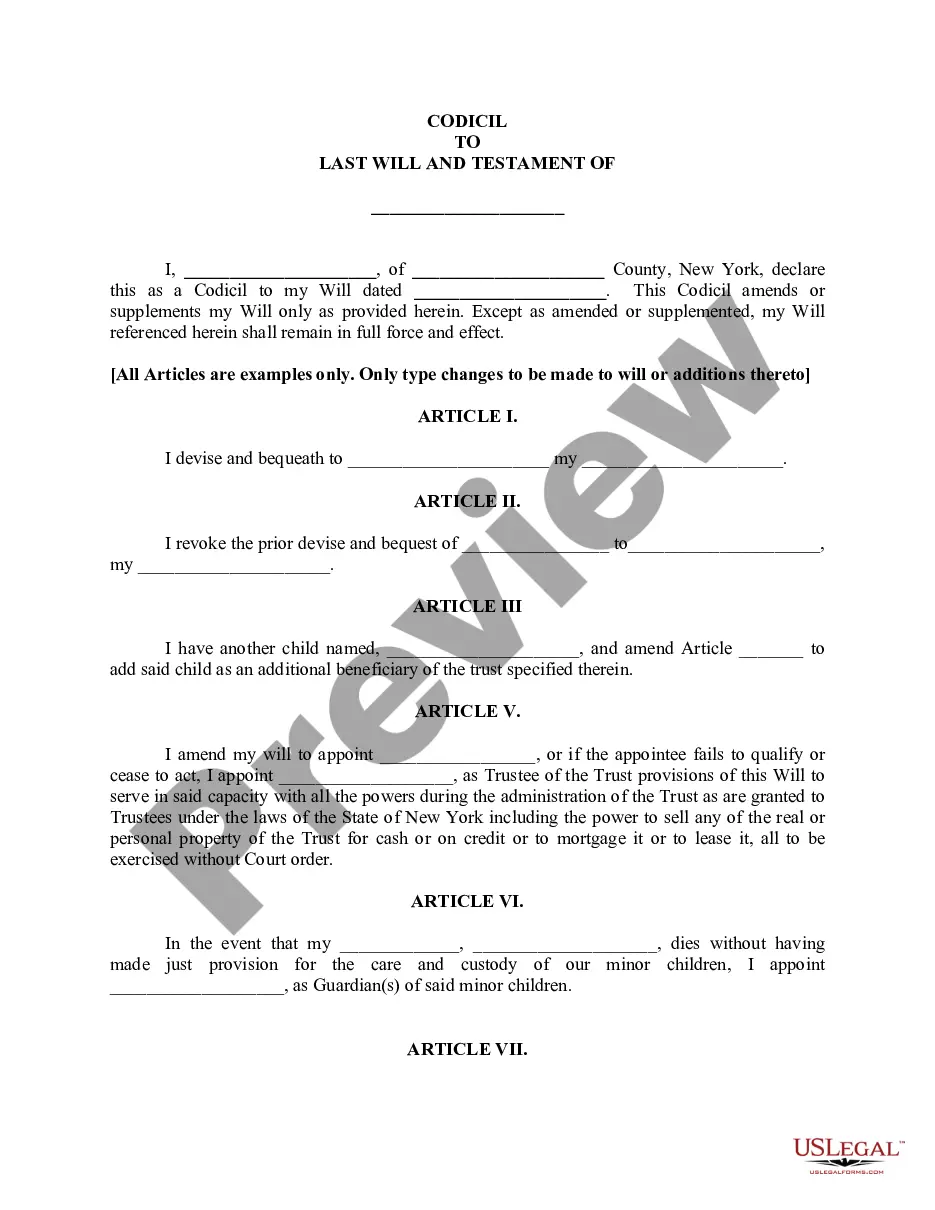

You may commit hrs online trying to find the legal papers format that fits the state and federal requirements you will need. US Legal Forms gives thousands of legal varieties which are reviewed by experts. It is possible to download or print out the Idaho Sample Letter for Notification to Creditor to Probate and Register Claim from our assistance.

If you already have a US Legal Forms bank account, you can log in and click the Download option. Afterward, you can comprehensive, edit, print out, or indicator the Idaho Sample Letter for Notification to Creditor to Probate and Register Claim. Each legal papers format you get is your own for a long time. To acquire another duplicate of the obtained develop, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, keep to the simple recommendations below:

- First, make sure that you have chosen the best papers format to the county/metropolis of your choice. Read the develop information to make sure you have chosen the proper develop. If accessible, utilize the Review option to search with the papers format as well.

- In order to discover another variation of the develop, utilize the Look for area to get the format that fits your needs and requirements.

- When you have found the format you desire, simply click Get now to move forward.

- Pick the pricing strategy you desire, type your references, and register for your account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal bank account to fund the legal develop.

- Pick the structure of the papers and download it for your device.

- Make modifications for your papers if needed. You may comprehensive, edit and indicator and print out Idaho Sample Letter for Notification to Creditor to Probate and Register Claim.

Download and print out thousands of papers templates making use of the US Legal Forms site, which provides the greatest assortment of legal varieties. Use professional and status-certain templates to take on your business or individual needs.

Form popularity

FAQ

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

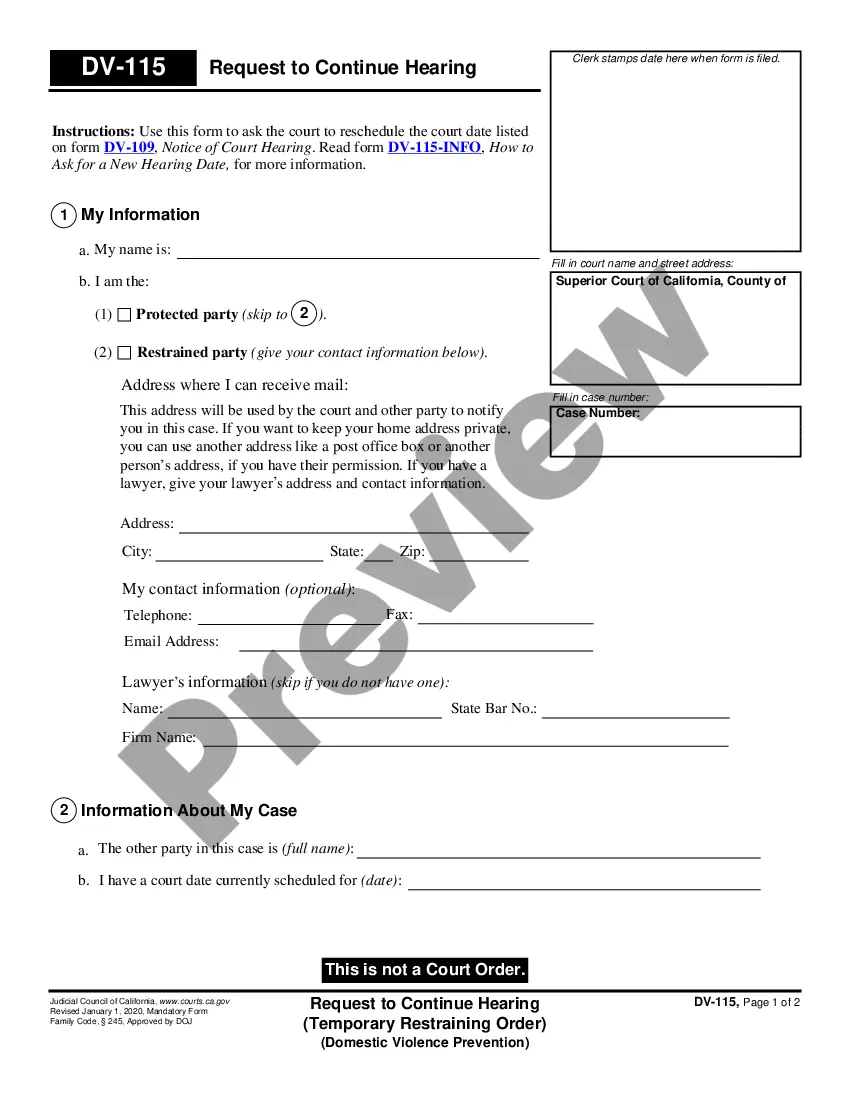

Letters testamentary are documents that a probate court delivers to the executor of the deceased's estate to enforce the terms of the deceased person's will. A court can issue letters testamentary only to persons who are chosen as an executor in a will.

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.

The Seven Steps in Idaho's Informal Probate Process Initiate the Probate Proceeding. ... Acceptance of the Application and Issuance of Letters. ... Notice to Heirs and Devisees. ... Notice to Creditors. ... Inventory of Estate. ... Distribution of Estate assets. ... Informal Verification Statement of Personal Representative Closing Estate.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.

I.C. § 15-3-1205. Letters Testamentary: The instrument by which a probate court approves the appointment of an executor under a will and authorizes the executor to administer the estate.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.