Subject: Idaho Sample Letter for Estate Probate Proceedings Keywords: Idaho, estate, probate proceedings, sample letter, detailed description, estate administration, executor, beneficiaries, assets, liabilities, will, inheritance, court, legal, process, documentation, distribution, executor's duties, fiduciary responsibilities. Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with a detailed description of Idaho's sample letter for estate probate proceedings. Idaho's probate laws and procedures aim to ensure a fair and orderly distribution of an individual's assets upon their death. During this challenging time, it is crucial to adhere to the prescribed legal practices and fulfill all obligations set forth by the court. In the state of Idaho, the estate probate proceedings commence upon the death of an individual who leaves behind assets and property. The executor, nominated in the decedent's will or appointed by the court, plays a significant role in overseeing the estate administration process. The primary objective of probate is to protect the rights of beneficiaries and fulfill the decedent's intentions as stated in their will. Different types of letters may be required in the course of Idaho's estate probate proceedings, each serving a specific purpose. While the specific contents of the letters may vary depending on the case's unique circumstances, they generally cover essential aspects of the probate process such as: 1. Notice of Death: The initial step is to inform all interested parties and potential beneficiaries of the death, providing them with basic details and necessary contact information. This letter ensures transparency and keeps all relevant parties informed. 2. Inventory of Assets and Liabilities: The executor must compile a comprehensive list of the deceased individual's assets, including real estate, financial accounts, personal property, and any outstanding liabilities. A letter detailing this inventory is submitted to the court, ensuring transparency in the determination of the estate's overall value. 3. Notice to Creditors: A letter notifying the decedent's creditors of their passing is crucial to initiate the claims process. Creditors are given a specified period to submit their claims against the estate for settlement, providing transparency and preventing any unnecessary disputes. 4. Distribution Plan: The executor shall prepare a detailed letter outlining the proposed distribution plan once all debts, expenses, and taxes have been settled. Beneficiaries will be informed of their entitlements and the estimated timeline for the distribution of assets and inheritance. Throughout the entire estate probate process, the executor must fulfill their fiduciary responsibilities diligently. They are legally bound to act in the best interests of the estate, beneficiaries, and creditors. It is essential to note that these sample letters serve as guides and should be tailored to specific estate circumstances. Consulting an attorney who specializes in probate law in Idaho is highly recommended ensuring all required documentation, deadlines, and legal obligations are met. We understand that estate probate proceedings can be complex and emotionally challenging. At [Legal Firm/Executor's Office Name], we are committed to providing the necessary support, guidance, and expertise to navigate through this process seamlessly. Our team is well-versed in Idaho's laws and can assist you in efficient estate administration while ensuring compliance with the court's requirements. Please feel free to reach out to us at [Contact Information] if you have any questions, require further assistance, or wish to schedule a consultation. We are here to help you during this intricate period. Sincerely, [Your Name] [Your Title/Organization]

Idaho Sample Letter for Estate Probate Proceedings

Description

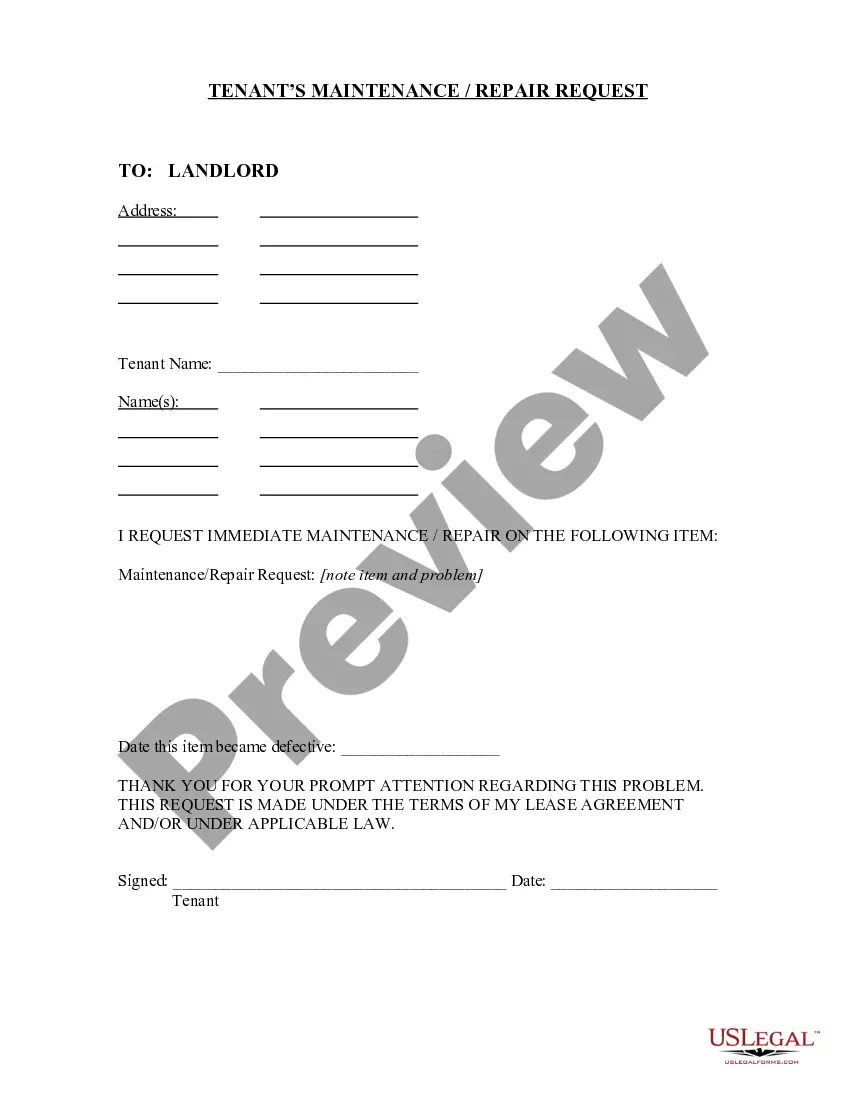

How to fill out Idaho Sample Letter For Estate Probate Proceedings?

US Legal Forms - one of many greatest libraries of authorized forms in America - provides a variety of authorized papers web templates it is possible to download or print. Using the site, you can find thousands of forms for enterprise and individual purposes, sorted by groups, says, or keywords and phrases.You can get the newest variations of forms just like the Idaho Sample Letter for Estate Probate Proceedings in seconds.

If you already possess a registration, log in and download Idaho Sample Letter for Estate Probate Proceedings in the US Legal Forms library. The Down load switch will appear on every develop you look at. You have access to all in the past saved forms inside the My Forms tab of the account.

If you would like use US Legal Forms initially, allow me to share basic recommendations to help you get started out:

- Make sure you have picked out the best develop for your personal town/county. Go through the Review switch to check the form`s articles. Read the develop outline to actually have chosen the right develop.

- In the event the develop doesn`t match your demands, utilize the Look for field at the top of the screen to discover the one who does.

- In case you are happy with the form, validate your choice by visiting the Acquire now switch. Then, pick the prices prepare you favor and give your references to sign up for the account.

- Approach the financial transaction. Make use of your credit card or PayPal account to perform the financial transaction.

- Find the structure and download the form on your device.

- Make alterations. Load, edit and print and sign the saved Idaho Sample Letter for Estate Probate Proceedings.

Every design you added to your money lacks an expiration date which is the one you have for a long time. So, if you would like download or print another version, just proceed to the My Forms area and then click on the develop you require.

Obtain access to the Idaho Sample Letter for Estate Probate Proceedings with US Legal Forms, by far the most considerable library of authorized papers web templates. Use thousands of expert and express-certain web templates that satisfy your business or individual requirements and demands.

Form popularity

FAQ

(d) Informal probate of a will that has been previously probated elsewhere may be granted at any time upon written application by any interested person, together with deposit of an authenticated copy of the will and of the statement probating it from the office or court where it was first probated. Section 15-3-303 ? Idaho State Legislature idaho.gov ? title15 ? sect15-3-303 idaho.gov ? title15 ? sect15-3-303

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.

Typically, there are seven steps in Idaho's informal probate process: Initiate the Probate Proceeding. ... Acceptance of the Application and Issuance of Letters. ... Notice to Heirs and Devisees. ... Notice to Creditors. ... Inventory of Estate. ... Distribution of Estate assets. The Seven Steps in Idaho's Informal Probate Process shaila buckley law ? full-blog ? the-se... shaila buckley law ? full-blog ? the-se...

The first method is by an affidavit. This is only for certain small estates and does not involve the court. The other three are court proceedings. The first is called Informal Probate, the second is Formal Probate and the third is Summary Administration of Estate where Surviving Spouse is Sole Beneficiary.

I.C. § 15-3-1205. Letters Testamentary: The instrument by which a probate court approves the appointment of an executor under a will and authorizes the executor to administer the estate. clerk of the district court manual - Idaho Supreme Court idaho.gov ? links ? 7.0 Estate Proceedings.pdf idaho.gov ? links ? 7.0 Estate Proceedings.pdf

This is a court process that transfers property after payment to any creditors. If the decedent (1) had no will; (2) had a will; (3) owned property with a net value of more than $100,000; or (4) owned real property, then Informal Probate may be the appropriate method to handle the estate.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.