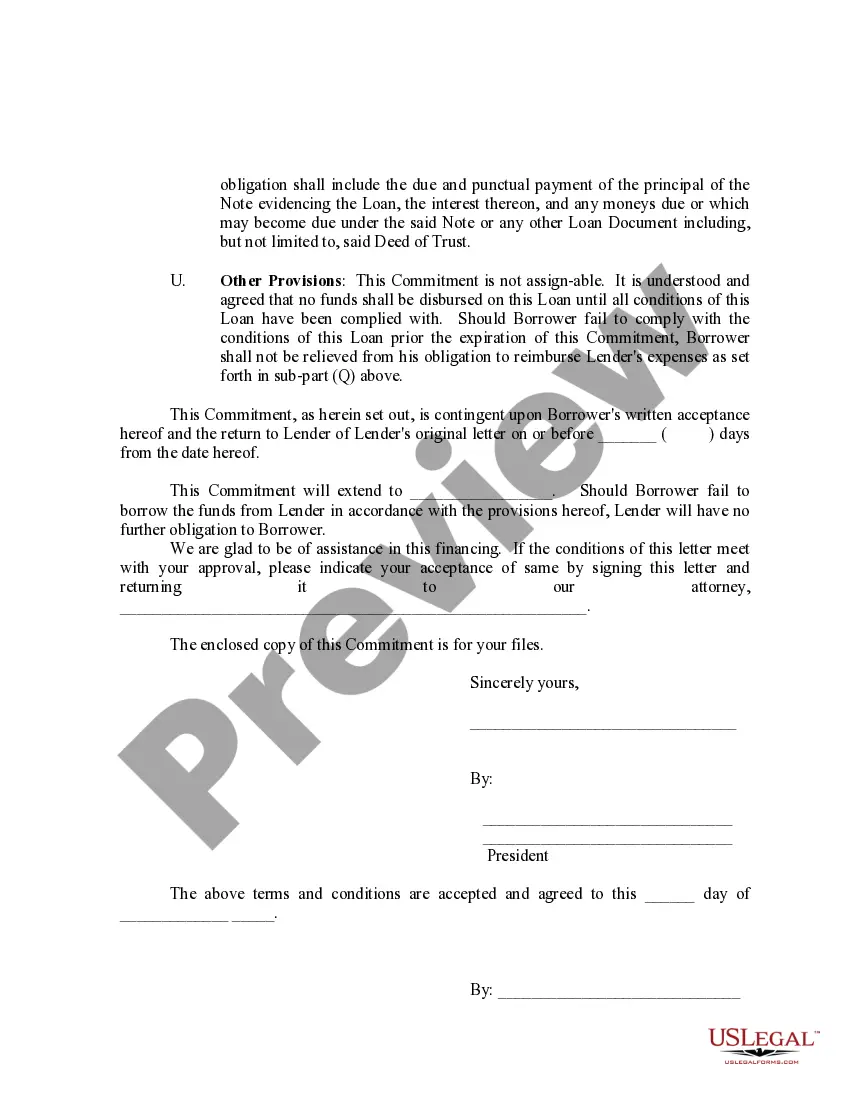

Idaho Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

You are able to invest hours on the Internet trying to find the authorized record template that suits the federal and state specifications you require. US Legal Forms offers a huge number of authorized kinds which are reviewed by experts. You can easily down load or print out the Idaho Loan Commitment Agreement Letter from the services.

If you have a US Legal Forms bank account, you can log in and click the Down load button. Next, you can complete, revise, print out, or signal the Idaho Loan Commitment Agreement Letter. Every single authorized record template you get is your own forever. To acquire another copy for any acquired kind, check out the My Forms tab and click the related button.

If you are using the US Legal Forms website initially, follow the basic directions listed below:

- Initially, ensure that you have chosen the proper record template for the area/metropolis of your liking. Look at the kind explanation to ensure you have picked out the right kind. If accessible, take advantage of the Review button to search throughout the record template as well.

- If you want to locate another variation in the kind, take advantage of the Research field to find the template that suits you and specifications.

- Upon having discovered the template you want, click on Get now to move forward.

- Find the pricing strategy you want, type in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal bank account to pay for the authorized kind.

- Find the formatting in the record and down load it to your gadget.

- Make adjustments to your record if necessary. You are able to complete, revise and signal and print out Idaho Loan Commitment Agreement Letter.

Down load and print out a huge number of record themes utilizing the US Legal Forms site, which provides the greatest variety of authorized kinds. Use professional and state-certain themes to handle your small business or person demands.

Form popularity

FAQ

The loan agreement becomes useful in case a borrower does not return the money to the lender within the stipulated time. An agreement is enforceable in the court of law when it is signed and agreed by both parties.

The letter of commitment specifies the amount of a loan that the bank is willing to offer the borrower. The amount may be below or above what the borrower requested. The loan commitment serves as a formal record of the loan processing but is not the loan contract.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved.

The Agreement shall have become binding on the Borrower and the Lender on and from the date of execution hereof. It shall be in force till all the monies due and payable to the Lender under this Agreement are fully paid.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

To avoid such uncomfortable circumstances, you need to create a legally binding promissory note or a loan agreement. Make the terms of your loan agreement clear. It is advisable to have the following details in your loan agreement: Both parties' names and addresses.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.