Idaho Sample Letter regarding Chapter 13 Plan

Description

How to fill out Sample Letter Regarding Chapter 13 Plan?

US Legal Forms - among the greatest libraries of legal kinds in the United States - provides a wide range of legal papers themes you can down load or print out. While using internet site, you will get a large number of kinds for company and individual reasons, categorized by types, says, or key phrases.You will discover the newest types of kinds like the Idaho Sample Letter regarding Chapter 13 Plan within minutes.

If you currently have a registration, log in and down load Idaho Sample Letter regarding Chapter 13 Plan in the US Legal Forms collection. The Down load option will show up on every develop you perspective. You have access to all formerly acquired kinds within the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, listed here are simple instructions to help you started out:

- Make sure you have picked out the correct develop to your town/state. Select the Preview option to examine the form`s information. Read the develop description to actually have selected the right develop.

- In the event the develop does not suit your requirements, use the Search area on top of the screen to find the one which does.

- Should you be happy with the shape, verify your decision by clicking the Get now option. Then, opt for the costs strategy you want and offer your references to sign up on an account.

- Method the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Choose the format and down load the shape on your gadget.

- Make modifications. Fill out, edit and print out and signal the acquired Idaho Sample Letter regarding Chapter 13 Plan.

Each design you included in your money lacks an expiry date which is your own for a long time. So, in order to down load or print out one more backup, just go to the My Forms area and click on on the develop you will need.

Gain access to the Idaho Sample Letter regarding Chapter 13 Plan with US Legal Forms, one of the most extensive collection of legal papers themes. Use a large number of expert and status-distinct themes that meet up with your small business or individual needs and requirements.

Form popularity

FAQ

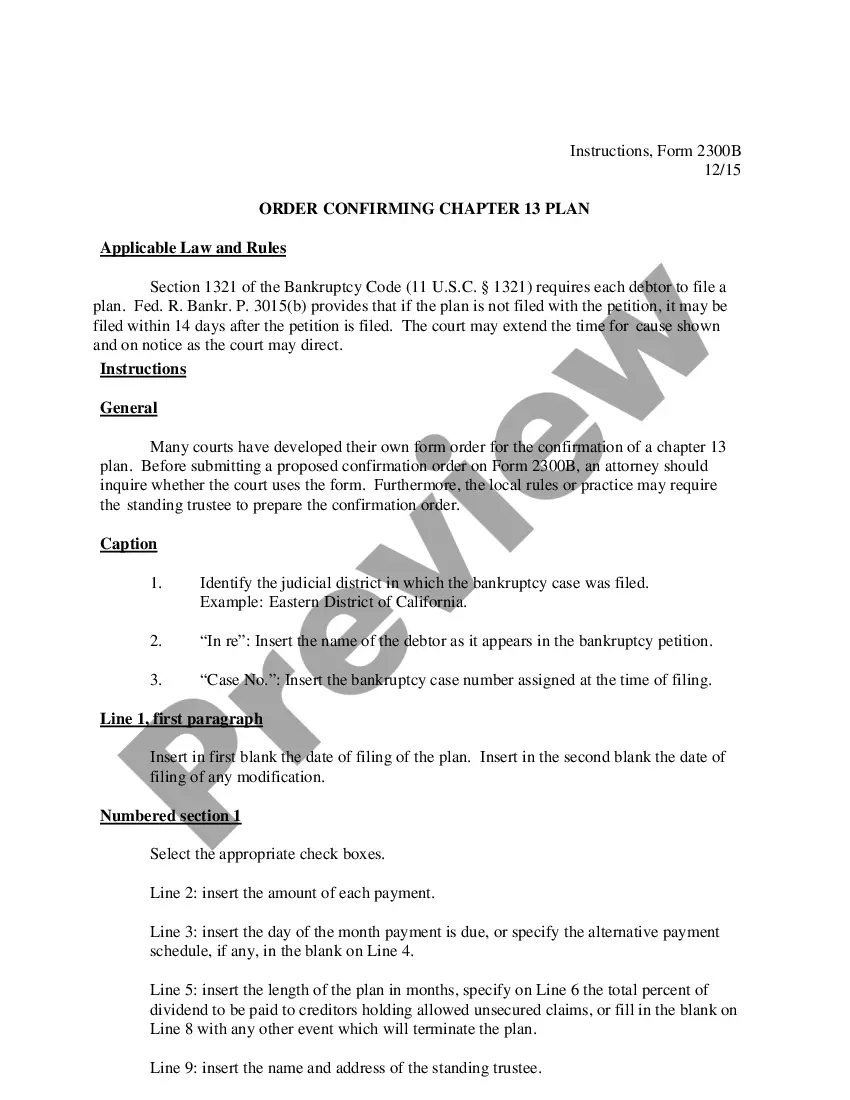

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

Once your repayment plan gets confirmed, you must continue to make timely payments to the bankruptcy trustee each month for the duration of your plan. You must also continue to make payments on debts, such as your mortgage or car payment, which you proposed to pay outside of bankruptcy.

In bankruptcy law, a hearing generally occurs related to either Chapter 13 or Chapter 11 federal bankruptcy. Here, a confirmation hearing is a court proceeding wherein a judge either approves or rejects a proposed debtor repayment plan, based on its feasibility and other legal requirements.

An order confirming the chapter 13 plan is a Bankruptcy judge's approval of the Debtor's proposed chapter 13 repayment plan. For more information, see 11 U.S.C. §1325 .

Some common reasons creditors object to Chapter 13 plan confirmation include: Disagreement about the outstanding balance on the debt. Disagreement about the past-due amount. Objection to a ?cramdown? of an automobile loan.

The Trustee may file other notices that a case is not feasible. If you are close to making the final payments on your plan and the case is still not feasible, the Trustee will file a motion asking to dismiss the case because it will not pay creditors in the manner required by the plan.

An objection to the confirmation of a chapter 13 plan shall be made by motion setting forth the facts and legal arguments that give rise to the objection in sufficient detail to allow the debtor to file a reply or an amended plan that addresses the objection.

After Plan Completion: After all payments have been completed, the Chapter 13 Trustee will file a Motion to Return any Excess Funds to Debtor and to Terminate any Payroll Deduction by Employer. If the Motion is granted, the Court will enter an order granting the motion and issue two notices.