Idaho Call of Special Stockholders' Meeting By Board of Directors of Corporation

Description

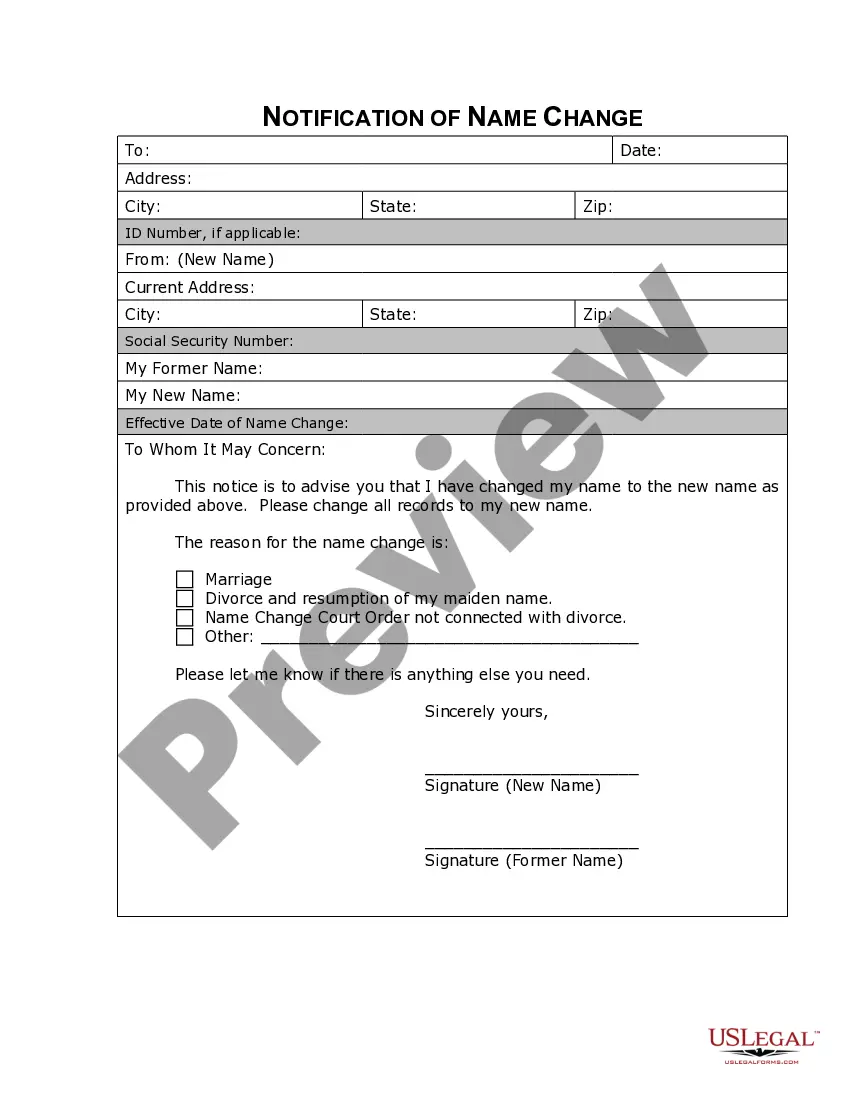

How to fill out Call Of Special Stockholders' Meeting By Board Of Directors Of Corporation?

Are you within a place where you require documents for sometimes company or specific reasons nearly every time? There are tons of legal file layouts accessible on the Internet, but getting kinds you can trust isn`t simple. US Legal Forms gives 1000s of develop layouts, just like the Idaho Call of Special Stockholders' Meeting By Board of Directors of Corporation, which are created to meet state and federal requirements.

When you are currently acquainted with US Legal Forms website and get your account, just log in. Next, you may acquire the Idaho Call of Special Stockholders' Meeting By Board of Directors of Corporation design.

Should you not come with an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is for that correct city/state.

- Make use of the Review key to review the shape.

- Browse the explanation to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you`re trying to find, utilize the Lookup field to discover the develop that suits you and requirements.

- When you obtain the correct develop, just click Buy now.

- Opt for the prices strategy you need, submit the required information to generate your money, and pay money for your order with your PayPal or credit card.

- Select a hassle-free document formatting and acquire your duplicate.

Locate all the file layouts you may have bought in the My Forms food selection. You may get a additional duplicate of Idaho Call of Special Stockholders' Meeting By Board of Directors of Corporation whenever, if necessary. Just go through the necessary develop to acquire or print out the file design.

Use US Legal Forms, probably the most extensive variety of legal types, to save time as well as steer clear of mistakes. The services gives skillfully created legal file layouts which can be used for a selection of reasons. Create your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

Who can attend Shareholders' Meetings? Each holder of one or more shares may attend Shareholders' Meetings, either in person or by written proxy, speak and vote according to the Articles of Association.

The term shareholders refers to the people directly involved in the corporation who are participating in the company's gains or losses. The special meeting aims to enable the shareholders to know the company's affairs and vote on the management's recommendations in the proposed resolution.

Typically either the president or a majority vote of the board (or both) can call a special meeting. You need to give proper notice to members and, of course, you need a quorum to do business. The procedure should be spelled out in your bylaws.

Who can call the meeting? An AGM can be called by two or more members who own at least 10% of the company's share capital.

Annual general meetings (AGMs) are important for the transparency they provide, the ability to include shareholders, as well as bringing management to accountability.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda. Meetings are generally administrative sessions that follow a specific format set forth well in advance.

Under section 61 of the Companies Act 71 of 2008 (Companies Act), only the board of a company, or any other person specified in the company's Memorandum of Incorporation (MOI) or rules, has the power to call a shareholders' meeting.