Idaho Authority of Partnership to Open Deposit Account and to Procure Loans

Category:

State:

Multi-State

Control #:

US-11005

Format:

Word;

Rich Text

Instant download

Description

The partnership is authorized to establish a deposit and checking account. If any other persons become interested in the business as co-partners or relations with the bank are altered in any way, or if the business shall become incorporated, the partners agree to notify the bank.

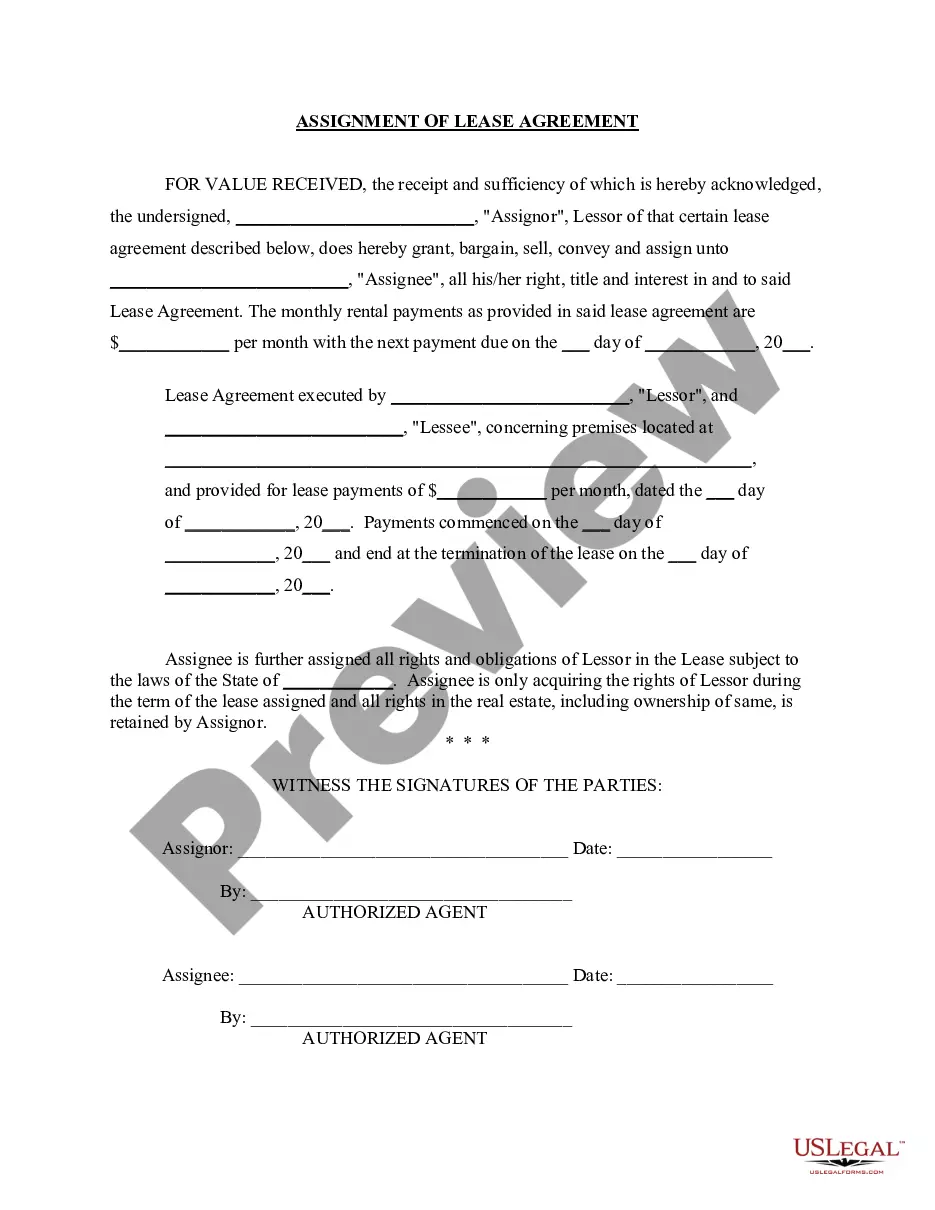

Free preview

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

You might spend numerous hours online looking for the legal document template that fulfills the federal and state criteria you require.

US Legal Forms offers a plethora of legal documents that can be reviewed by experts.

You can easily obtain or print the Idaho Authority of Partnership to Open Deposit Account and to Secure Loans from the service.

If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Idaho Authority of Partnership to Open Deposit Account and to Secure Loans.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your area/city of choice.

- Read the document description to ensure you have chosen the appropriate form.