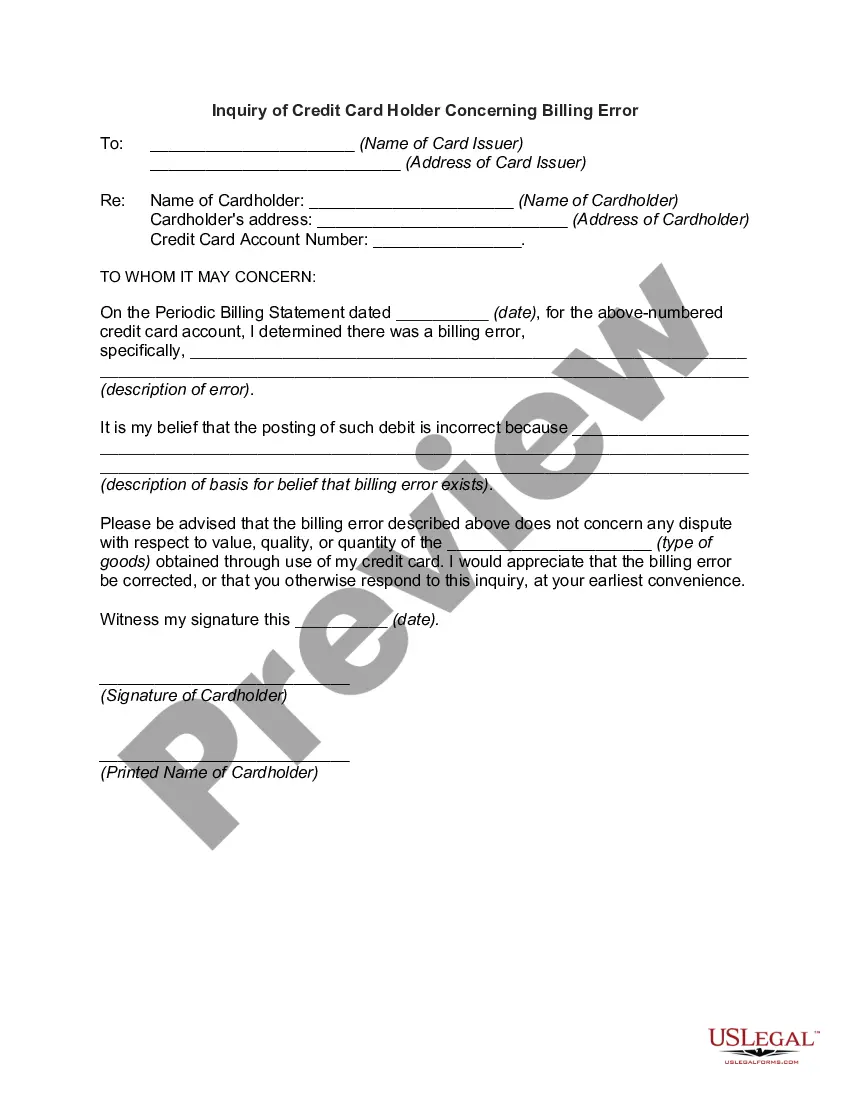

Idaho Inquiry of Credit Cardholder Concerning Billing Error is a formal process that allows credit cardholders in Idaho to address any billing discrepancies or errors on their credit card statements. It provides a way for cardholders to request an investigation into the disputed charges and to seek resolution with the credit card issuer. The Idaho Inquiry of Credit Cardholder Concerning Billing Error is governed by regulations outlined in the Fair Credit Billing Act (CBA) and the Truth in Lending Act (TILL). These federal laws protect consumers' rights when it comes to billing errors on credit card statements. Types of Idaho Inquiry of Credit Cardholder Concerning Billing Error: 1. Unauthorized Charges: If a credit cardholder identifies charges on their statement that they did not authorize or make, they can file an Idaho Inquiry to dispute those charges. This includes charges resulting from stolen or lost cards, fraudulent use, or identity theft. 2. Incorrect Amounts: Credit cardholders can file an Idaho Inquiry if they believe they have been incorrectly charged for a purchase, or if the amount on the statement differs from what was initially agreed upon during the transaction. This could include errors such as duplicate charges, overcharges, or inaccurate exchange rates. 3. Billing Disputes: If there is a dispute between the credit cardholder and the merchant regarding the quality or delivery of goods or services, the cardholder can file an Idaho Inquiry to address the dispute. This could include scenarios where the product received was damaged, not as described, or when the service was not provided as expected. 4. Calculation Errors: Credit cardholders can file an Idaho Inquiry if they identify errors in the calculation of interest charges, finance charges, late fees, or any other fees associated with their credit card account. This ensures that cardholders are not being overcharged due to mistakes made by the credit card issuer. When filing an Idaho Inquiry, cardholders are required to submit a written notification to their credit card issuer within a specified time frame (usually within 60 days) from the date of the disputed billing statement. The notification should include details of the error, the amount in question, and any supporting documentation, such as receipts or correspondence with the merchant. Upon receiving the Idaho Inquiry, the credit card issuer is obligated to acknowledge the dispute within a certain period (typically within 30 days) and initiate an investigation. During the investigation process, the credit card issuer may temporarily remove the disputed amount from the cardholder's account, ensuring it does not accrue interest charges or affect the cardholder's credit score. Once the investigation is complete, the credit card issuer is required to inform the cardholder of the outcome. If the billing error is confirmed, the credit card issuer must promptly correct the statement, refund any disputed amount, and adjust any related finance charges or fees. It is important for Idaho credit cardholders to be aware of their rights and responsibilities when it comes to billing errors. By filing an Idaho Inquiry, cardholders can protect themselves from unauthorized charges, incorrect amounts, billing disputes, and calculation errors, ensuring fair and accurate billing practices.

Idaho Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Idaho Inquiry Of Credit Cardholder Concerning Billing Error?

Are you presently in a place in which you need to have papers for possibly company or individual uses nearly every day time? There are a variety of authorized file web templates available on the Internet, but locating ones you can trust isn`t effortless. US Legal Forms delivers a huge number of type web templates, much like the Idaho Inquiry of Credit Cardholder Concerning Billing Error, which can be published to satisfy federal and state demands.

Should you be already acquainted with US Legal Forms web site and have a free account, simply log in. After that, you may acquire the Idaho Inquiry of Credit Cardholder Concerning Billing Error design.

Should you not come with an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for that appropriate area/county.

- Use the Review key to examine the shape.

- Read the description to ensure that you have selected the proper type.

- In case the type isn`t what you are trying to find, utilize the Lookup field to discover the type that suits you and demands.

- If you obtain the appropriate type, click Acquire now.

- Choose the pricing plan you desire, fill in the necessary details to produce your money, and purchase the order using your PayPal or bank card.

- Decide on a handy data file structure and acquire your duplicate.

Discover each of the file web templates you might have purchased in the My Forms food list. You can obtain a additional duplicate of Idaho Inquiry of Credit Cardholder Concerning Billing Error anytime, if necessary. Just click the essential type to acquire or printing the file design.

Use US Legal Forms, one of the most comprehensive variety of authorized forms, in order to save some time and prevent blunders. The assistance delivers expertly created authorized file web templates that you can use for a variety of uses. Generate a free account on US Legal Forms and start generating your daily life a little easier.