Idaho Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Debt Settlement Offer In Response To Creditor's Proposal?

Choosing the best legal document design can be quite a have a problem. Needless to say, there are a lot of layouts accessible on the Internet, but how do you get the legal form you want? Use the US Legal Forms internet site. The services delivers 1000s of layouts, including the Idaho Debt Settlement Offer in Response to Creditor's Proposal, that you can use for organization and personal needs. All of the types are examined by specialists and fulfill federal and state needs.

Should you be previously listed, log in to the account and click the Obtain button to get the Idaho Debt Settlement Offer in Response to Creditor's Proposal. Utilize your account to look throughout the legal types you have ordered previously. Check out the My Forms tab of your respective account and get one more version of the document you want.

Should you be a fresh consumer of US Legal Forms, allow me to share simple guidelines that you should stick to:

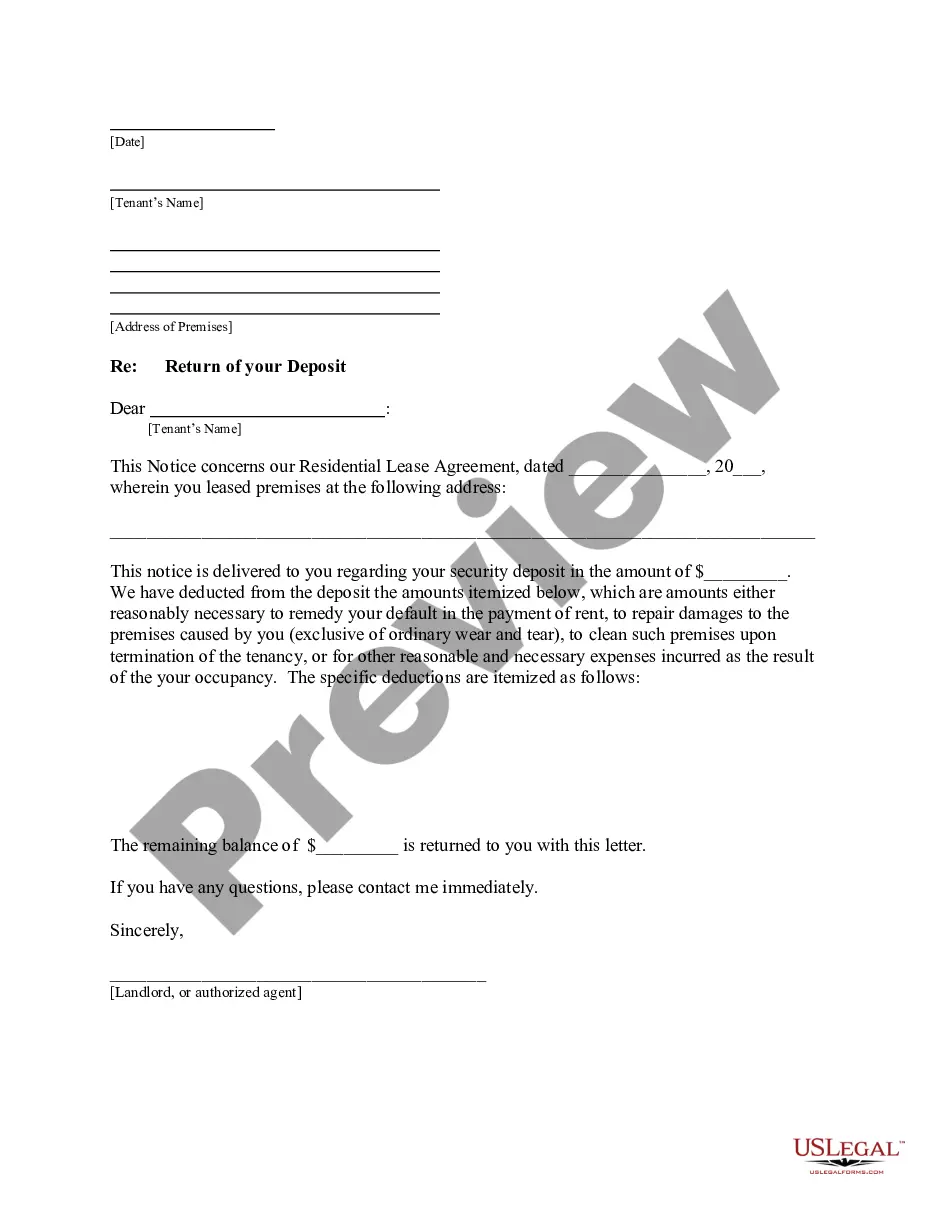

- Initial, ensure you have chosen the proper form for the area/county. You are able to check out the form making use of the Preview button and look at the form explanation to make sure this is basically the right one for you.

- When the form does not fulfill your preferences, take advantage of the Seach industry to obtain the appropriate form.

- When you are certain the form is proper, select the Purchase now button to get the form.

- Pick the pricing prepare you would like and type in the needed information and facts. Build your account and purchase the transaction making use of your PayPal account or credit card.

- Choose the data file formatting and download the legal document design to the product.

- Total, edit and produce and signal the acquired Idaho Debt Settlement Offer in Response to Creditor's Proposal.

US Legal Forms is definitely the biggest local library of legal types for which you can see various document layouts. Use the company to download skillfully-manufactured paperwork that stick to condition needs.

Form popularity

FAQ

What is full and final settlement? full and final settlement is a letter written to request payment of final salary. One may require this letter when he/she is resigning from his/her job in order to get the remaining salary.

You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports. For payment, you may be able to settle your debts for 40% to 50% of what you originally owed, Bovee says.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Debt settlement is an offer you make to your creditors to have your debt considered paid in full for payment of less than you owe. Your creditors agree to settle for pennies on the dollar because otherwise, they may see nothing or far less than that.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

Two Options for Taking the Settlement OfferRead the settlement offer carefully or have an attorney review the offer to be sure it's legally binding that the creditor or collector can't come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.