Description: The Idaho Independent Contractor Agreement for Accountant and Bookkeeper is a legally binding contract that establishes the terms and conditions between an independent contractor and a client seeking accounting and bookkeeping services in the state of Idaho. This agreement ensures that both parties understand their rights and responsibilities, and helps to prevent any future disagreements or misunderstandings. Keywords: — Idaho: This refers to the geographical location and legal jurisdiction where the independent contractor agreement is applicable. — Independent Contractor: Describes the individual or entity providing accounting and bookkeeping services to the client. — Agreement: Refers to the legally binding contract that outlines the terms and conditions agreed upon by both parties. — Accountant: Indicates the specific role of the independent contractor as a professional who specializes in financial record-keeping, analysis, and reporting. — Bookkeeper: Highlights another role performed by the independent contractor, focusing on recording, organizing, and maintaining financial transactions and records. — Contract: Implies a formal agreement between the parties involved. — Terms and Conditions: Represents the terms, rules, and obligations that both parties must adhere to during the duration of the agreement. — Rights and Responsibilities: Encompasses the entitlements and duties of each party, ensuring clarity on their respective roles and obligations. — Disagreements: Refers to potential conflicts or disputes that may arise between the independent contractor and the client. — Misunderstandings: Implies a lack of clarity or misinterpretation of terms and conditions within the agreement. Different Types of Idaho Independent Contractor Agreements for Accountant and Bookkeeper: 1. General Idaho Independent Contractor Agreement for Accountant and Bookkeeper: This agreement covers standard terms and conditions applicable to most accounting and bookkeeping services provided by the independent contractor in Idaho. 2. Project-Specific Independent Contractor Agreement for Accountant and Bookkeeper: This type of agreement is tailored to a specific accounting or bookkeeping project, outlining the scope of work, deadlines, and payment terms. 3. Part-Time or Temporary Idaho Independent Contractor Agreement for Accountant and Bookkeeper: This agreement is designed for short-term or part-time accounting or bookkeeping services, addressing the duration of the engagement and related terms. 4. Commission-Based Independent Contractor Agreement for Accountant and Bookkeeper in Idaho: This contract outlines the commission structure or performance-based compensation agreed upon between the independent contractor and the client, with specific provisions related to calculations and payments. 5. Confidentiality and Non-Disclosure Agreement for Idaho Independent Contractor Accountant and Bookkeeper: This type of agreement focuses on the protection of sensitive financial information and trade secrets, preventing the independent contractor from disclosing privileged client information without consent. It's important to note that these are general terms, and the actual names and types of Idaho Independent Contractor Agreements for Accountant and Bookkeeper may vary based on the specific circumstances and requirements of each engagement.

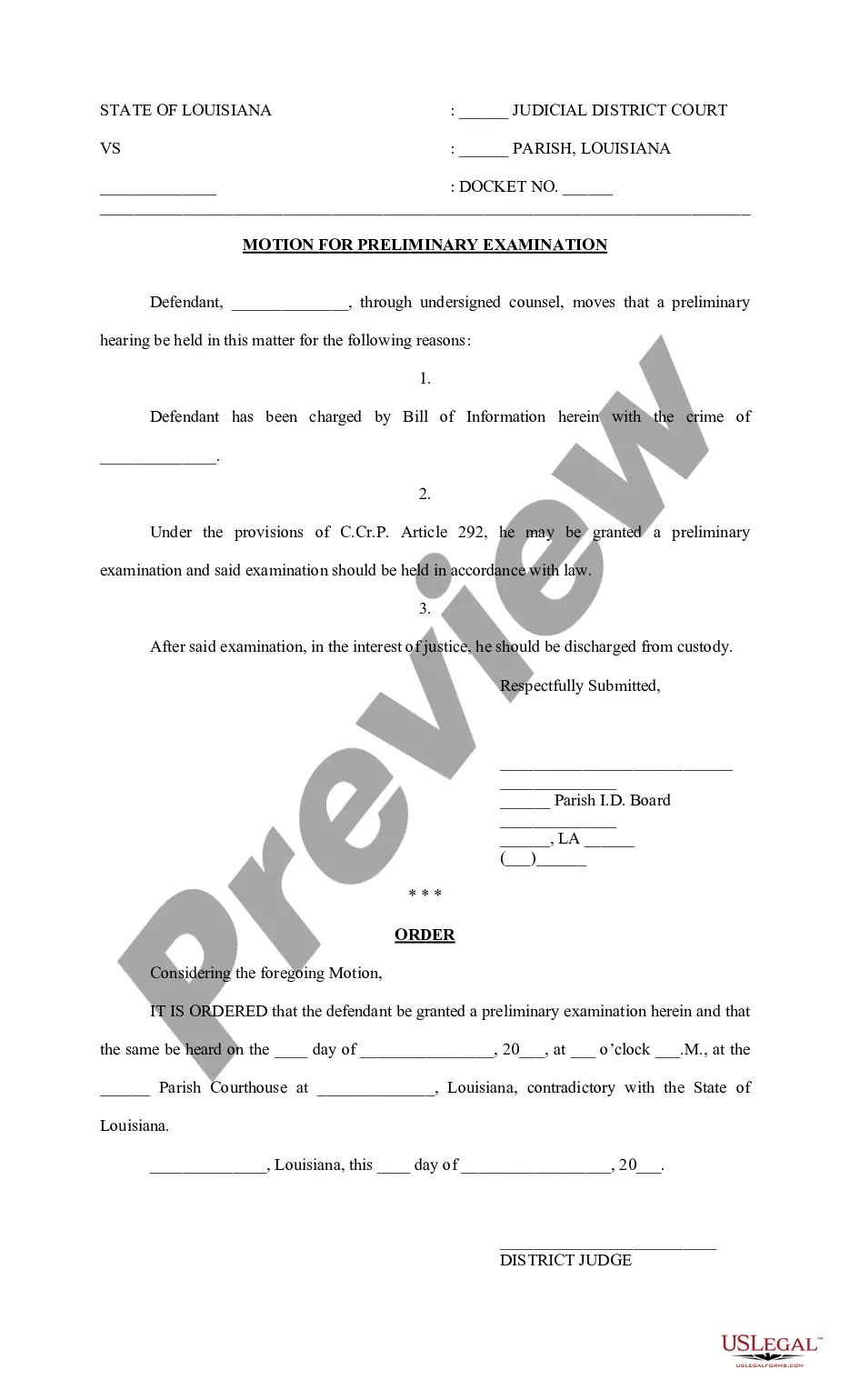

Idaho Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Independent Contractor Agreement For Accountant And Bookkeeper?

US Legal Forms - one of the greatest libraries of legal forms in America - delivers a variety of legal document themes it is possible to down load or print out. Using the website, you can find thousands of forms for enterprise and person purposes, categorized by groups, claims, or key phrases.You can find the most up-to-date versions of forms such as the Idaho Independent Contractor Agreement for Accountant and Bookkeeper within minutes.

If you already have a registration, log in and down load Idaho Independent Contractor Agreement for Accountant and Bookkeeper through the US Legal Forms collection. The Acquire key will show up on each kind you perspective. You have access to all earlier downloaded forms in the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, listed here are straightforward guidelines to help you get started out:

- Ensure you have picked the proper kind for your city/region. Go through the Preview key to review the form`s content material. Look at the kind explanation to actually have selected the proper kind.

- If the kind doesn`t satisfy your needs, use the Lookup field near the top of the display screen to find the one which does.

- If you are satisfied with the shape, affirm your decision by simply clicking the Buy now key. Then, opt for the costs plan you favor and provide your references to register for an profile.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal profile to complete the purchase.

- Choose the file format and down load the shape on your own device.

- Make modifications. Fill out, modify and print out and sign the downloaded Idaho Independent Contractor Agreement for Accountant and Bookkeeper.

Every web template you put into your account lacks an expiration day and is your own permanently. So, if you wish to down load or print out yet another backup, just go to the My Forms area and click around the kind you want.

Obtain access to the Idaho Independent Contractor Agreement for Accountant and Bookkeeper with US Legal Forms, by far the most substantial collection of legal document themes. Use thousands of expert and status-specific themes that meet up with your organization or person needs and needs.

Form popularity

FAQ

In Australia, you don't technically have to be certified in any way to work as a bookkeeper. That's the reason why small business owners can do their own books and BAS. Administrators with experience in bookkeeping can offer their services without having to get a qualification to formalise their experience.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

There are no legal requirements for a self-employed bookkeeper to have any formal qualifications. However, if you are planning to start a bookkeeping business, it is essential you have bookkeeping experience.

Do you need a license to be a bookkeeper in the UK? To be a bookkeeper you need to have a money laundering license, also known as AML - Anti Money Laundering. If you don't have this you would be breaking the law if you start a bookkeeping business from home.

A bookkeeping business plan is necessary for your career as a self-employed bookkeeper. You must structure your journey so you don't get stuck in the middle. You must know which industry to work in, services to offer, tools to use, and important precautions to take.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.