Idaho Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

Are you presently in a situation in which you require documents for both business or individual uses nearly every day time? There are a variety of legitimate papers themes accessible on the Internet, but finding versions you can rely on isn`t easy. US Legal Forms provides a large number of develop themes, much like the Idaho Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership, that happen to be created to satisfy state and federal requirements.

If you are presently knowledgeable about US Legal Forms internet site and also have your account, simply log in. After that, you can obtain the Idaho Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership web template.

Unless you come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for that right area/area.

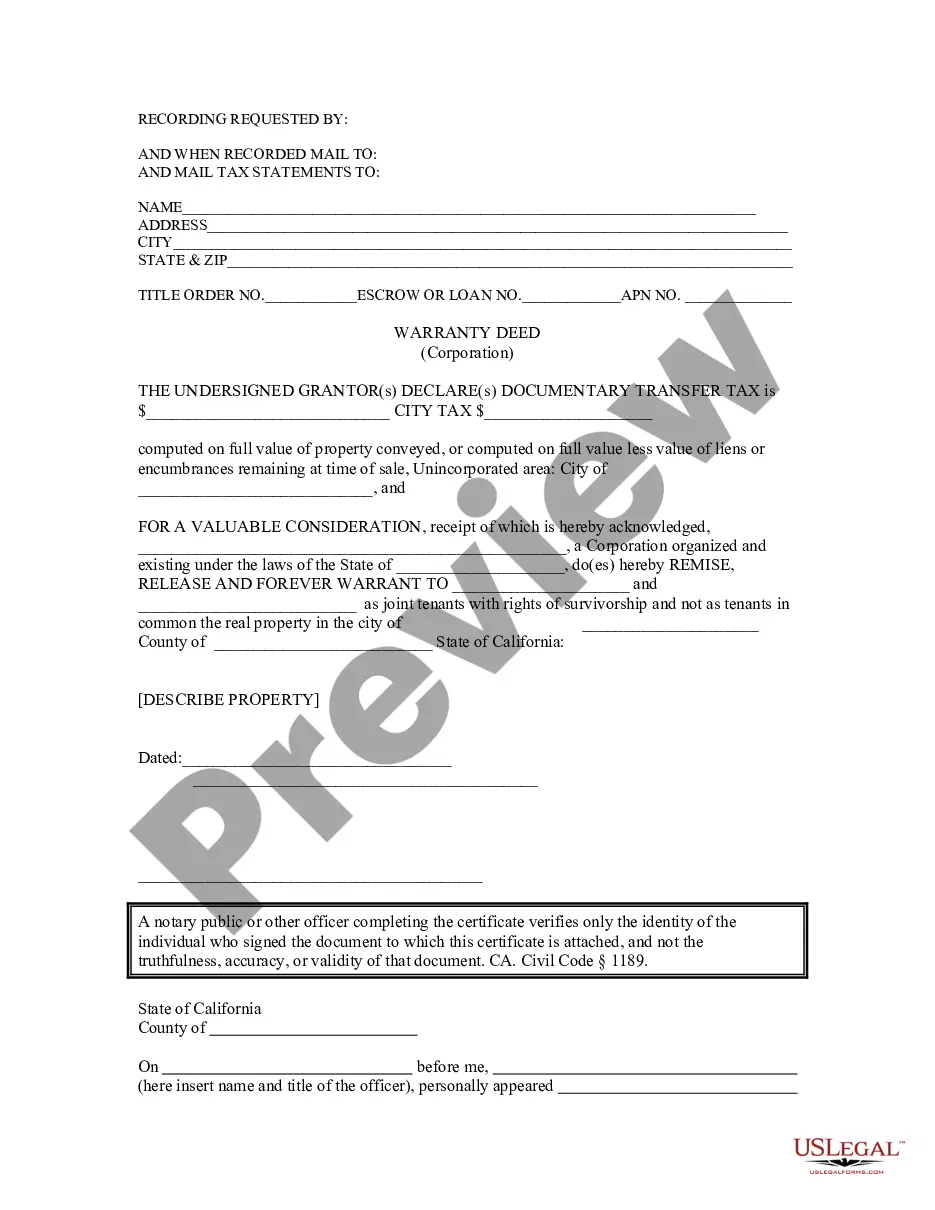

- Take advantage of the Review switch to review the form.

- Browse the explanation to ensure that you have chosen the proper develop.

- When the develop isn`t what you`re seeking, utilize the Lookup field to obtain the develop that fits your needs and requirements.

- Once you discover the right develop, click on Buy now.

- Opt for the rates prepare you want, complete the specified details to make your account, and buy the transaction using your PayPal or bank card.

- Pick a hassle-free document file format and obtain your copy.

Find all of the papers themes you have purchased in the My Forms food list. You can aquire a more copy of Idaho Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership at any time, if necessary. Just go through the required develop to obtain or print out the papers web template.

Use US Legal Forms, probably the most extensive selection of legitimate varieties, in order to save time as well as prevent faults. The services provides professionally created legitimate papers themes that you can use for an array of uses. Produce your account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.

A buyout agreement can stand on its own or can be several provisions in your written partnership agreement that control the following business decisions: whether a departing partner must be bought out. what price will be paid for the departing partner's interest in the partnership.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

The parents may have a revocable living trust serve as general partner. A revocable living trust holds title to assets of the trust maker. It is frequently used to avoid probate and to provide for the trust maker in the event of incapacitation. The trust maker is usually the trustee of the trust.

Can You Inherit A Partnership Interest? The partner can acquire his interest from his existing partner, for example. Gift or inheritance may be used to acquire a partnership interest. In addition, a partnership could get a special interest in property and cash from a partner.

An experienced property manager, a corporation, or a successful real estate development company would serve as the general partner.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Generally speaking, any person can be a partner in a partnership. A partnership is formed simply when two or more persons decide to get together and agree to do business together for profit.

One benefit of a buy-sell agreement is that it outlines terms to ensure the former spouse is compensated. The agreement avoids the risk of having to manage the business alongside a co-owner's ex-spouse or lose control of the company altogether. Tensions are often high in a divorce.