Idaho Credit Approval Form is a standardized document utilized by financial institutions and lenders in the state of Idaho to assess and determine an applicant's eligibility for credit. This form plays a crucial role in the loan application process, as it assists lenders in evaluating an individual or entity's financial standing before extending credit. The Idaho Credit Approval Form is designed to gather comprehensive information about the applicant, including personal details such as name, address, contact information, and social security number. Moreover, it requires the applicant to provide employment details, including the name of the current employer, position, length of employment, and income information. In addition to personal and employment information, the Idaho Credit Approval Form delves into the applicant's financial history. It seeks details on existing debts, outstanding credit balances, payment histories, and other financial obligations. This information helps lenders assess an individual's current financial standing and evaluate their ability to repay any additional credit extended. The form also includes a section for the applicant's consent, authorizing the lender to perform a credit check and obtain credit reports from credit bureaus and other financial institutions. This allows lenders to obtain a comprehensive view of the individual's credit history to make an informed decision regarding credit approval. Different types of Idaho Credit Approval Forms may be available based on the specific financial institution or type of credit being sought. For instance, there might be separate forms for mortgage loans, automobile loans, personal loans, or business loans. These forms may include additional sections or questions tailored to gather information relevant to the specific type of credit. In conclusion, the Idaho Credit Approval Form is a vital tool utilized by lenders and financial institutions in Idaho to evaluate creditworthiness and determine whether to grant credit to applicants. By providing comprehensive personal, employment, and financial details, the form helps lenders assess an individual's ability to meet financial obligations and make informed credit decisions.

Idaho Credit Approval Form

Description

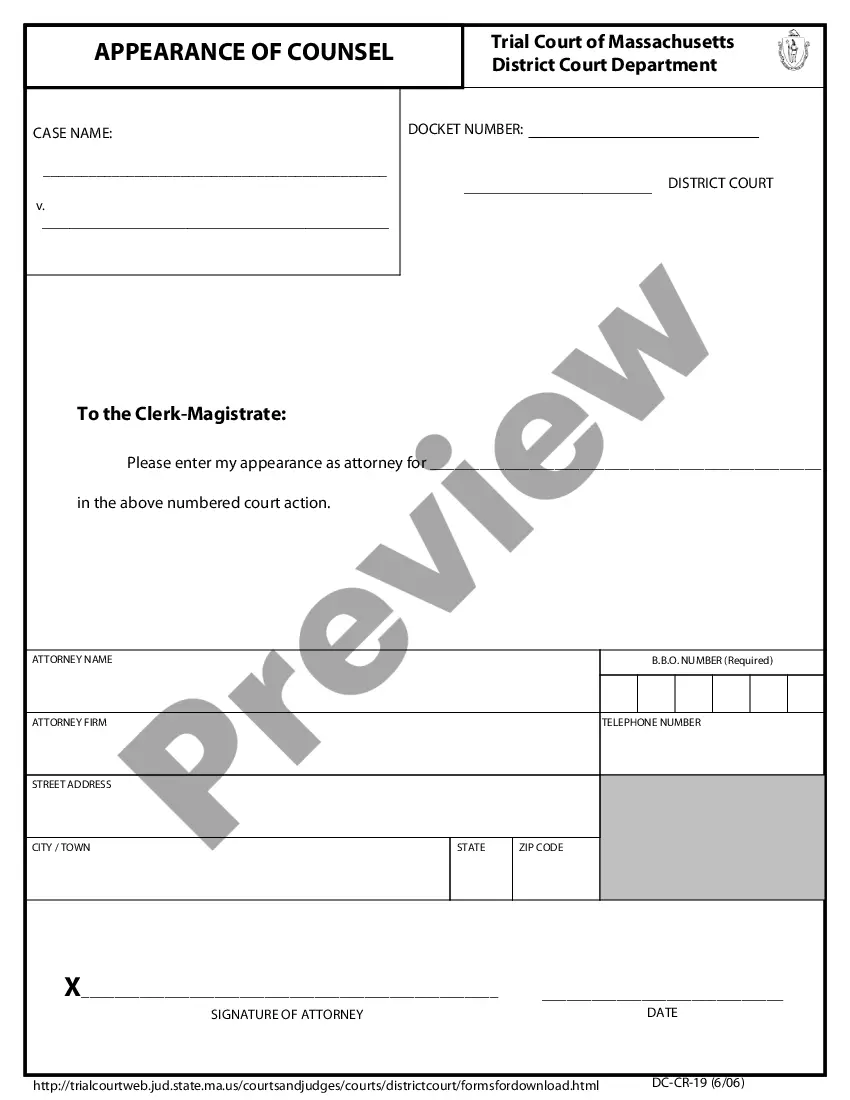

How to fill out Idaho Credit Approval Form?

Finding the right legal papers web template can be a struggle. Needless to say, there are a lot of templates available on the net, but how do you get the legal form you will need? Take advantage of the US Legal Forms site. The assistance delivers a large number of templates, including the Idaho Credit Approval Form, which can be used for enterprise and private needs. Each of the forms are examined by experts and fulfill state and federal needs.

Should you be currently listed, log in to the accounts and click on the Download option to obtain the Idaho Credit Approval Form. Use your accounts to check throughout the legal forms you have bought previously. Go to the My Forms tab of the accounts and have yet another backup of the papers you will need.

Should you be a fresh consumer of US Legal Forms, here are easy recommendations for you to comply with:

- Initially, ensure you have chosen the right form for your personal city/area. It is possible to look through the shape while using Review option and study the shape explanation to ensure this is basically the best for you.

- When the form will not fulfill your requirements, make use of the Seach discipline to get the proper form.

- When you are certain that the shape is acceptable, go through the Buy now option to obtain the form.

- Opt for the rates program you desire and type in the necessary info. Build your accounts and buy the transaction utilizing your PayPal accounts or charge card.

- Opt for the data file file format and obtain the legal papers web template to the device.

- Full, revise and print and signal the acquired Idaho Credit Approval Form.

US Legal Forms is definitely the largest collection of legal forms that you can see a variety of papers templates. Take advantage of the company to obtain skillfully-created paperwork that comply with status needs.

Form popularity

FAQ

You don't have to withhold Idaho income tax in any of the following situations: The employee isn't a resident of Idaho and earns less than $1,000 in Idaho in a calendar year. You employ an agricultural laborer who earns less than $1,000 in a calendar year.

Electronic Filing Mandate Idaho does not currently mandate electronic filing for individual returns. Individual income tax returns can be e-filed or filed by mail to the address below.

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.

You must e-file if you file 11 or more individual federal returns per calendar year, and you must have an IRS-issued EFIN in order to e-file. (An EFIN designates you as an authorized e-file provider.) To apply for an EFIN, use the IRS' e-Services - Online Tools for Tax Professionals.

Form 910. Monthly filers: You must file Form 910 monthly if you're in one of these situations: You withhold less than $25,000 a month and more than $750 a quarter. You have only one monthly pay period.

Form ID K-1 Partner's, Shareholder's, or Beneficiary's Share of Idaho Adjustments, Credits, Etc. is used to provide the partner, shareholder, or beneficiary of a pass-through entity with information required to complete the pass-through owner's Idaho income tax return.

Form 967. Send Form 967 to us once a year. On it, you report the taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid us during the same year.

As an employer, you're responsible for paying SUI (remember, if you pay your state SUI in full and on time, you get a 90% tax credit on FUTA). Idaho's SUI rates range from 0.24% to 5.4%. The taxable wage base in 2022 is $46,500 for each employee. New employers pay 0.97% for at least the first six quarters.

Residents 65 or older get $120. All full-year Idaho residents qualify for a grocery credit refund. Qualifying dependents include those born or adopted by the end of 2021, as well as resident dependents who died in 2021.