Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process involving the dissolution and closure of a partnership in the state of Idaho. This happens when the partners collectively decide or when it becomes necessary to terminate the partnership and distribute its assets among the partners. The liquidation process allows for the orderly winding down of business affairs, settling of obligations, and dividing the remaining assets in accordance with the partnership agreement or state laws. Idaho's law recognizes several types of liquidation of partnership with sale and proportional distribution of assets: 1. Voluntary Liquidation: In this scenario, partners mutually agree to dissolve the partnership and sell off its assets. This can happen due to various reasons such as retirement, disagreement among partners, or achieving the goals set forth in the partnership agreement. The partners work together to sell the assets, settle outstanding debts or liabilities, and distribute the remaining proceeds proportionally based on their ownership interests. 2. Dissolution by Court Order: In some cases, a partnership may be dissolved by a court order. This can occur if one partner seeks to dissolve the partnership due to a breach of the partnership agreement, misconduct, fraud, or any other valid legal reason. In such cases, the court may order a liquidation of partnership assets and a proportional distribution among the partners after settling any outstanding obligations. 3. Insolvent Liquidation: If the partnership becomes insolvent, meaning its liabilities surpass its assets, and it is unable to pay off debts, an insolvent liquidation might occur. In this situation, an appointed trustee takes over the liquidation process to ensure proper handling of the assets and equitable distribution among creditors, partners, and other stakeholders based on priority according to Idaho law. During the liquidation process, the partnership's assets, including real estate, equipment, inventory, contracts, and intellectual property, are appraised and sold to generate funds. These proceeds are then used to settle any outstanding debts, taxes, and other obligations owed by the partnership. Remaining funds are distributed to the partners, in proportion to their ownership interests, after deducting liquidation expenses. It is crucial to follow Idaho partnership laws and regulations during the liquidation process, ensuring that the necessary filings, notifications, and approvals are completed to comply with legal requirements. Experienced legal professionals and accountants can provide guidance and assistance throughout the liquidation process, facilitating a smooth dissolution and equitable distribution of assets. In summary, Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets is the process of terminating a partnership and distributing its assets among the partners. Whether voluntary or court-ordered, this process allows for the orderly winding down of business affairs, settling of debts, and equitable distribution of remaining assets among the partners.

Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

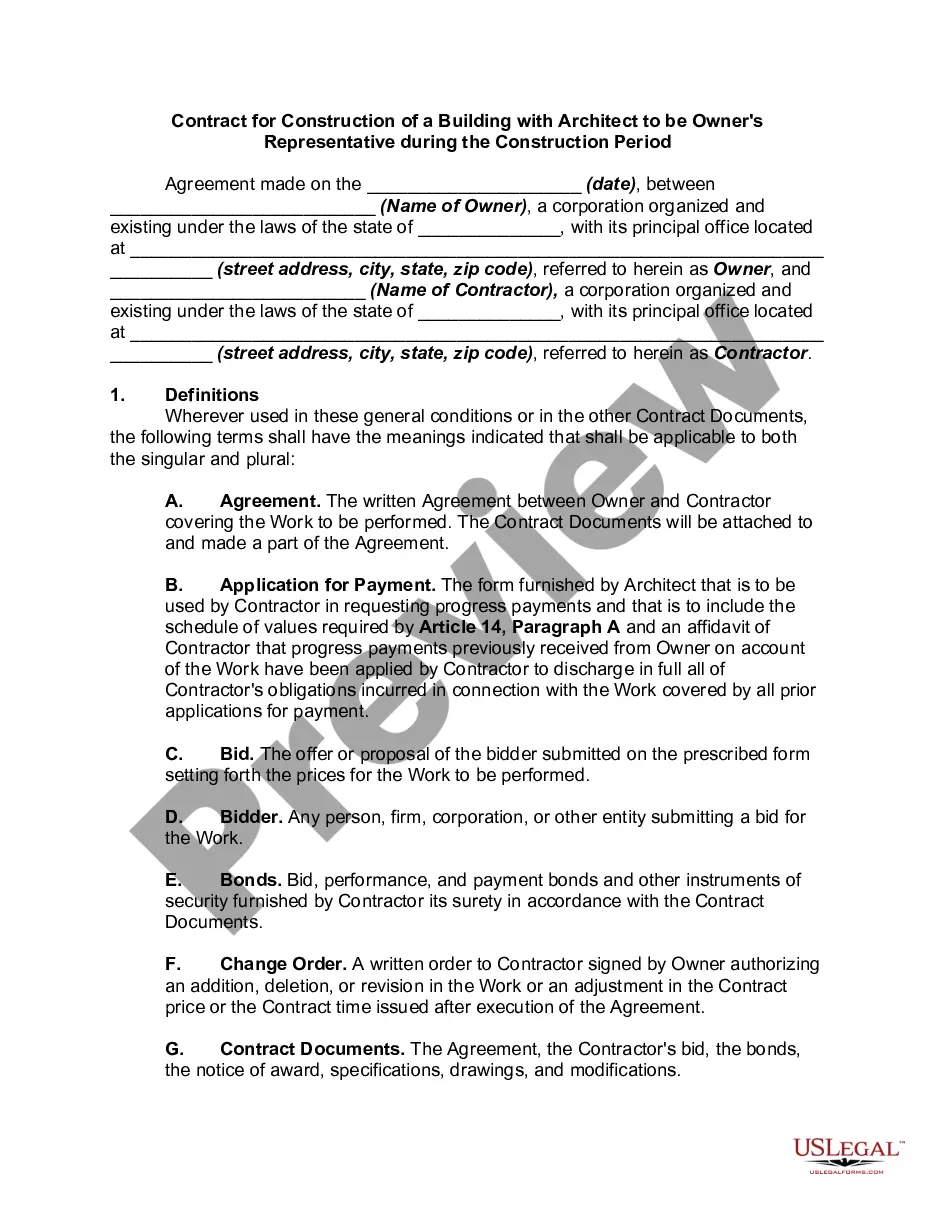

How to fill out Idaho Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

You can invest time on the Internet looking for the lawful document template that suits the state and federal specifications you want. US Legal Forms supplies thousands of lawful varieties which can be analyzed by pros. You can actually down load or produce the Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets from our assistance.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Download switch. Afterward, it is possible to full, modify, produce, or indication the Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets. Every lawful document template you buy is your own for a long time. To have another duplicate of any acquired develop, visit the My Forms tab and click on the related switch.

Should you use the US Legal Forms web site the first time, stick to the straightforward recommendations under:

- Very first, be sure that you have selected the right document template to the area/area of your choosing. Look at the develop description to make sure you have chosen the appropriate develop. If readily available, make use of the Preview switch to look with the document template as well.

- If you wish to get another version of your develop, make use of the Research area to find the template that suits you and specifications.

- Once you have identified the template you need, just click Buy now to proceed.

- Find the rates strategy you need, type in your references, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal profile to purchase the lawful develop.

- Find the format of your document and down load it in your gadget.

- Make changes in your document if possible. You can full, modify and indication and produce Idaho Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Download and produce thousands of document web templates utilizing the US Legal Forms Internet site, which provides the most important variety of lawful varieties. Use professional and condition-distinct web templates to deal with your company or person requirements.