The Idaho Agreement for Withdrawal of Partner from Active Management, also known as the Idaho withdrawal agreement, is a legal document that governs the process of a partner withdrawing from active management in a business or partnership in the state of Idaho. This agreement outlines the rights, responsibilities, and procedures that must be followed when a partner decides to step down from their active role. Keywords: 1. Idaho Agreement for Withdrawal of Partner: This is the official name of the legal document that governs the withdrawal process of a partner in Idaho. It emphasizes the jurisdiction of Idaho laws and regulations. 2. Withdrawal of Partner: Refers to the voluntary decision of a partner to step down from their active management role within a business or partnership. 3. Active Management: Indicates the managerial responsibilities and active involvement of a partner in the day-to-day operations, decision-making, and strategic planning of a business. 4. Legal Document: Refers to a written agreement that outlines the terms, conditions, and obligations to be followed by the involved parties. 5. Rights and Responsibilities: Pertains to the privileges, entitlements, duties, and obligations that partners have during the withdrawal process, ensuring a fair and equitable arrangement for all parties involved. 6. Procedures: Specifies the step-by-step process to be followed for the withdrawal of a partner, including the necessary notifications, legal documentation, and any other required actions. 7. Business or Partnership: Refers to the entity in which the partner is involved. It can include various types of entities, such as a corporation, limited liability company (LLC), or general partnership. Types of Idaho Agreement for Withdrawal of Partner from Active Management: 1. General Partnership Withdrawal Agreement: Specifically designed for partners in a general partnership to withdraw from active management. 2. Limited Partnership Withdrawal Agreement: Tailored for partners in a limited partnership to formally withdraw from active management roles. 3. LLC Withdrawal Agreement: Pertains to partners in a limited liability company who wish to withdraw from their active management duties. 4. Corporation Withdrawal Agreement: Created for partners involved in a corporation to formalize their withdrawal from active management responsibilities. In conclusion, the Idaho Agreement for Withdrawal of Partner from Active Management is a legal document that establishes the process and guidelines for a partner to step down from their active role in a business or partnership within Idaho. It is essential to understand the specific requirements and terms applicable to different types of entities, such as general partnerships, limited partnerships, LCS, and corporations.

Idaho Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Idaho Agreement For Withdrawal Of Partner From Active Management?

Are you within a position that necessitates documentation for potentially corporate or personal motives nearly every day.

There are numerous authentic document templates accessible online, but locating ones you can rely on is not straightforward.

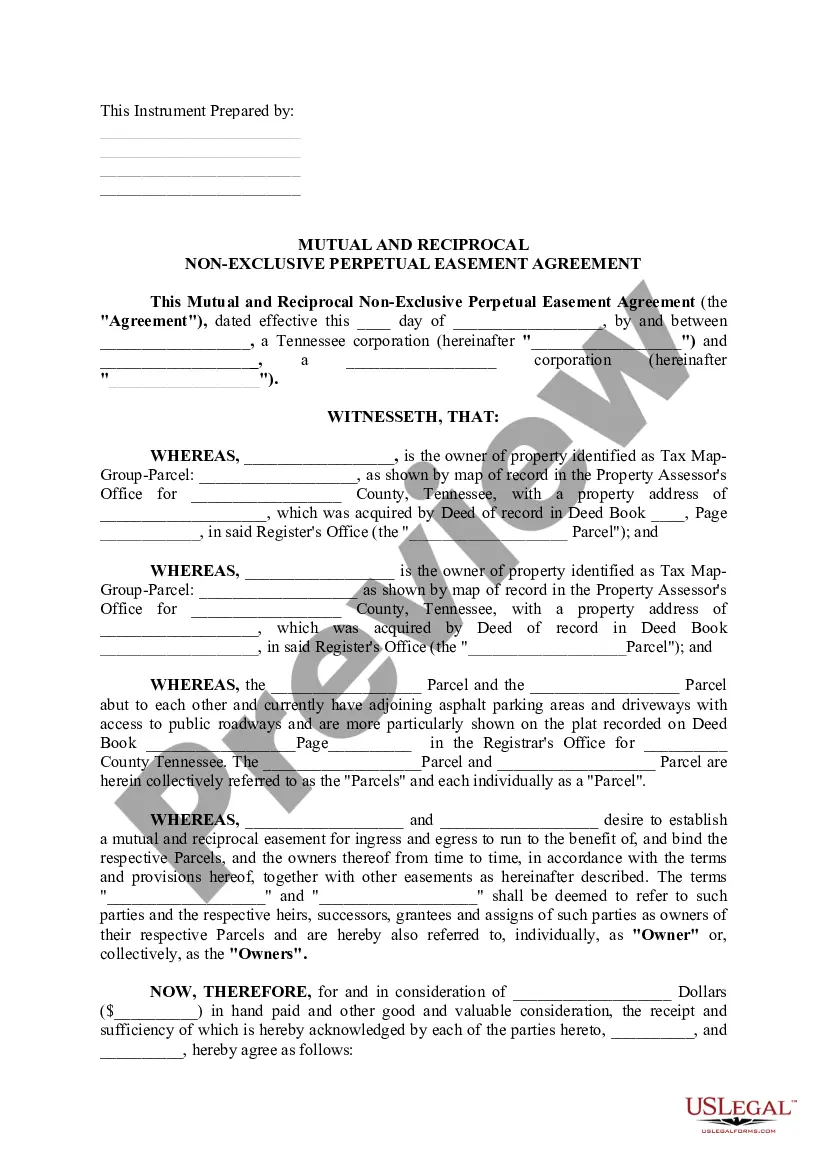

US Legal Forms offers an extensive selection of form templates, such as the Idaho Agreement for Withdrawal of Partner from Active Management, which can be drafted to satisfy local and national regulations.

Once you find the correct form, simply click Purchase now.

Select the pricing plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Idaho Agreement for Withdrawal of Partner from Active Management template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/region.

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that fits your needs and requirements.

Form popularity

FAQ

Withdrawing a partner from a partnership firm typically involves reviewing your existing partnership agreement and following its procedures. If you have an Idaho Agreement for Withdrawal of Partner from Active Management, this document will guide you through the steps necessary for a smooth withdrawal process. Consulting with legal experts can also ensure that all actions meet Idaho's legal requirements, protecting both you and the remaining partners.

Yes, a partner can be removed from a partnership, usually according to the terms outlined in the partnership agreement. The Idaho Agreement for Withdrawal of Partner from Active Management offers a structured process for such removals, ensuring compliance with legal standards and protecting the interests of remaining partners. It's essential to follow proper procedures to maintain the integrity of the partnership.

Code 32-906 pertains to the Idaho statutes regarding partnership law. It specifically outlines the regulations and agreements related to the withdrawal of a partner from active management. If you are considering using an Idaho Agreement for Withdrawal of Partner from Active Management, understanding this code can provide valuable insights into the legal framework governing partnerships in Idaho.

When a partner withdraws, the remaining partners must address several critical factors to maintain business continuity as outlined in the Idaho Agreement for Withdrawal of Partner from Active Management. The partnership can either dissolve or continue, depending on the terms of the partnership agreement. Typically, the remaining partners may adjust their ownership shares, reassess business operations, and potentially seek a new partner to fill the void left by the departing individual. This transition should be handled with careful planning to ensure stability.

The tax implications of withdrawing from a partnership can be significant and are detailed in the Idaho Agreement for Withdrawal of Partner from Active Management. Generally, partners may recognize gains or losses based on their share of assets and liabilities at the time of withdrawal. It's crucial to consult a tax professional to understand these consequences fully and to plan accordingly for your tax obligations after the withdrawal.

When one partner wishes to exit the partnership, the Idaho Agreement for Withdrawal of Partner from Active Management provides a structured approach to handle this transition. The departing partner should review the partnership agreement for specific provisions regarding withdrawal. Typically, the departure involves settling financial obligations, redistributing ownership, and possibly bringing in a new partner. Clear communication is essential to ensure a smooth process for all parties involved.

If a partner wishes to leave the partnership, the Idaho Agreement for Withdrawal of Partner from Active Management provides a clear framework for the withdrawal process. This includes the valuation of the partner's share and settling any obligations. By following the agreed-upon procedures, you can ensure a fair and efficient exit for the departing partner.

Withdrawal of a partner is not necessarily a dissolution of the partnership. The Idaho Agreement for Withdrawal of Partner from Active Management helps differentiate between withdrawal and dissolution. Depending on the terms set forth, the partnership can continue to operate even after one partner's exit.

Upon the withdrawal of a partner, the Idaho Agreement for Withdrawal of Partner from Active Management outlines the necessary steps to take. Typically, the partnership continues, but changes in profit sharing and responsibilities may occur. It is essential for the remaining partners to communicate and implement the agreement to ensure a smooth transition.

When a partner withdraws from a partnership, the Idaho Agreement for Withdrawal of Partner from Active Management comes into effect. This agreement dictates the procedures for managing the withdrawal, including distribution of assets and obligations. The remaining partners may need to adjust their roles and responsibilities to maintain operational effectiveness.

Interesting Questions

More info

Living Trust Estate Vault Notice Withdrawal from Partnership Template Back to Top.