Idaho Guaranty without Pledged Collateral

Description

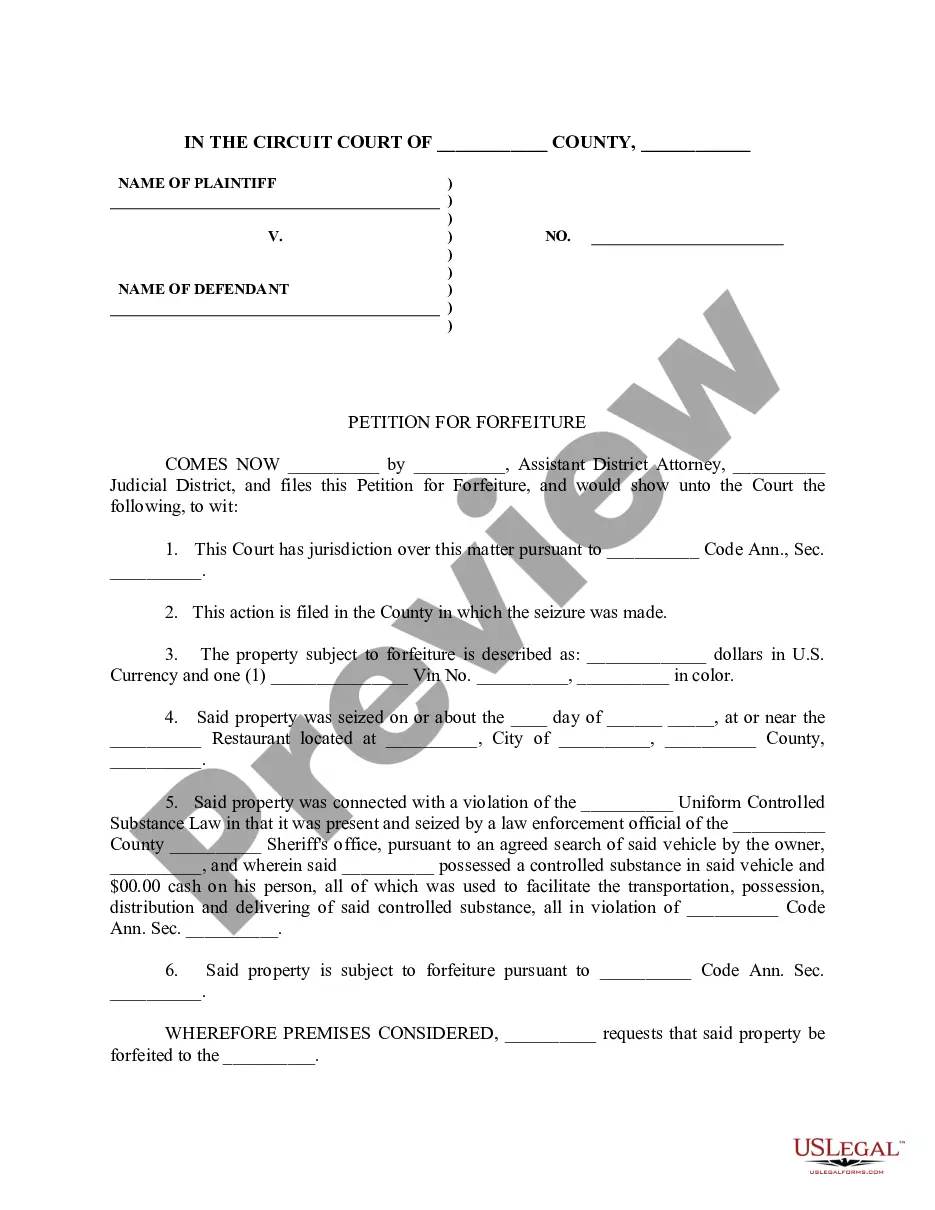

How to fill out Guaranty Without Pledged Collateral?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a wide range of legal document templates that you can download or create.

By utilizing the site, you can discover thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Idaho Guaranty without Pledged Collateral in mere moments.

Check the form description to ensure that you have chosen the correct form.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you have a membership, Log In and download the Idaho Guaranty without Pledged Collateral from the US Legal Forms library.

- The Download option will appear on every form you view.

- You have access to all previously saved forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have selected the right form for your city/county.

- Click the Preview option to review the form's content.

Form popularity

FAQ

If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages and car loans are two types of collateralized loans. Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan.

More Definitions of Collateral Requirement Collateral Requirement means with respect to Loans an amount equal to 102% of the then current Market Value of Loaned Securities which are the subject of Loans as of the close of trading on the preceding Business Day.

Nonrecourse carve-out guarantees, also known as bad boy or springing recourse guarantees, are designed to require the guarantor to repay the loan (or portions thereof) if the borrower commits any of the specified bad acts, or where the borrower takes steps to prevent the lender from enforcing on its collateral, such

A phrase meaning that one party has no legal claim against another party. It is often used in two contexts: 1. In litigation, someone without recourse against another party cannot sue that party, or at least cannot obtain adequate relief even if a lawsuit moves forward.

Referred to colloquially as Bad Boy Carve-outs, a list of actions or guarantees that may result in the borrower or guarantor taking on partial or full recourse liability for the loan.

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

Pledged-Asset Mortgage Homebuyers can sometimes pledge assets, such as securities, to lending institutions to reduce or eliminate the necessary down payment. With a traditional mortgage, the house itself is the collateral for the loan.

Leasehold mortgage loan documents may include an unqualified or conditional recourse carve-out for failure to pay ground rent when it comes due and/or for modifications of the underlying ground lease without the lender's consent.

Collateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default.

Carve-Out Guarantees In Commercial Mortgages A carve-out guarantee, also referred to as a carve-out guaranty, gives a commercial lender the authority go after a borrower's personal assets if the lender forecloses on the property.