Idaho Assignment of Profits of Business is a legal process that allows individuals or entities to transfer their rights to receive profits from a business to another party. This transaction is commonly utilized in various business scenarios, such as partnerships, joint ventures, or contractual agreements. By assigning the profits, the assigning party relinquishes their entitlement to the business's income, directing it to the assignee instead. The Idaho Assignment of Profits of Business agreement typically involves a written contract outlining the terms and conditions of the assignment. This document specifies the identity of the parties involved, the effective date of the assignment, and the scope of the profits being transferred. It is crucial for all parties to clearly understand and agree upon the terms stated in the assignment to avoid any future disputes. In Idaho, there are different types of Assignment of Profits of Business, each catering to specific business needs and structures. Some common types include: 1. Partnership Assignment of Profits: This type of assignment is relevant when one partner transfers their share of profits to another partner within a partnership agreement. It simplifies profit-sharing arrangements and allows partners to reallocate their interests in the business. 2. Joint Venture Assignment of Profits: In a joint venture, where two or more entities collaborate for a specific project, an assignment of profits agreement can allocate the distribution of profits among the participants based on agreed-upon ratios or percentages. 3. Contractual Assignment of Profits: This type of assignment arises when a party transfers their right to receive profits from a particular business under a contractual agreement. It could involve the assignment of royalties, licensing fees, or other types of income generated from intellectual property or business operations. The Idaho Assignment of Profits of Business serves as a legally binding document that protects the rights of both the assignor and the assignee. While the assignor benefits from the flexibility to reallocate their financial interests, the assignee gains a direct claim to the profits generated by the business. It is crucial to consult with an experienced attorney or legal professional to ensure compliance with Idaho's specific laws and regulations when drafting an assignment of profits agreement.

Idaho Assignment of Profits of Business

Description

How to fill out Idaho Assignment Of Profits Of Business?

Finding the right legitimate record format might be a have difficulties. Obviously, there are plenty of web templates available on the net, but how can you get the legitimate kind you will need? Use the US Legal Forms site. The support gives a huge number of web templates, like the Idaho Assignment of Profits of Business, which you can use for organization and private requires. All of the forms are inspected by specialists and meet up with federal and state requirements.

If you are currently registered, log in for your account and click the Obtain key to get the Idaho Assignment of Profits of Business. Use your account to check through the legitimate forms you might have ordered previously. Visit the My Forms tab of the account and have an additional copy of the record you will need.

If you are a fresh customer of US Legal Forms, allow me to share basic recommendations that you can comply with:

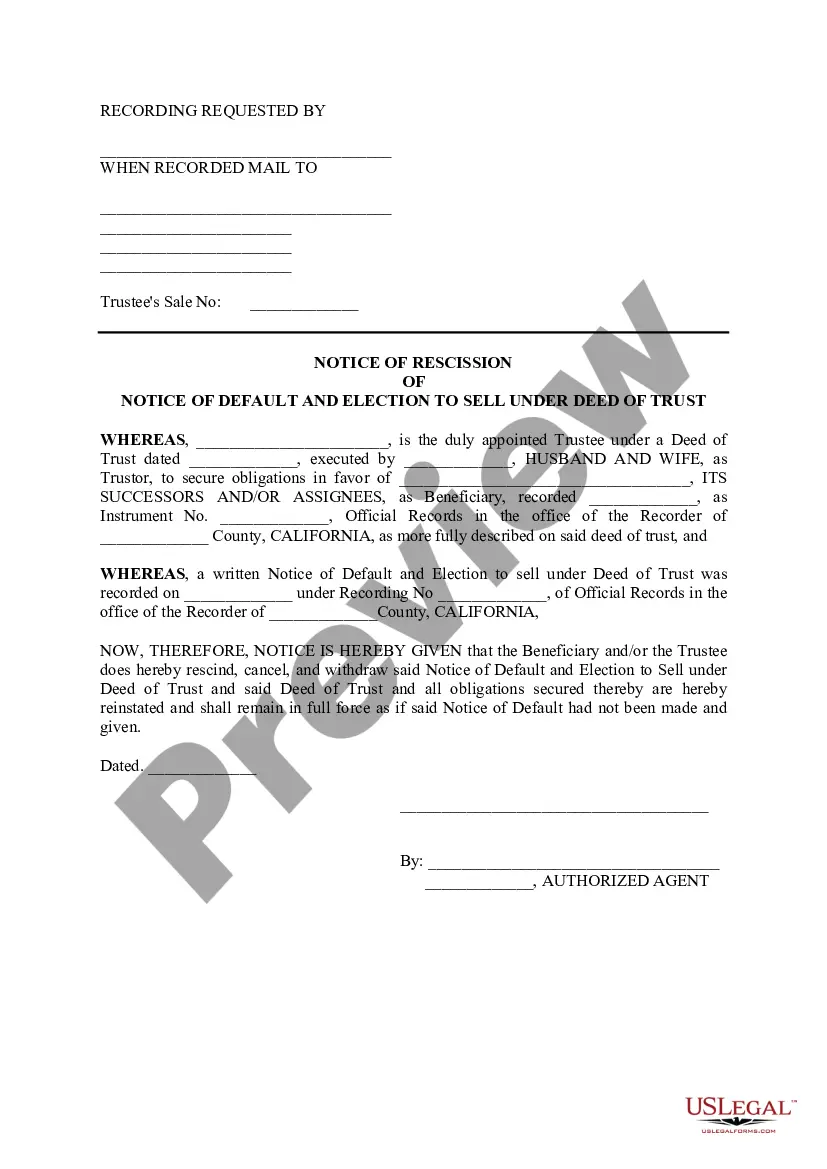

- Initially, make sure you have selected the correct kind for the area/area. You are able to check out the form making use of the Preview key and study the form information to guarantee it will be the best for you.

- If the kind fails to meet up with your preferences, utilize the Seach field to discover the right kind.

- Once you are sure that the form is acceptable, click on the Acquire now key to get the kind.

- Pick the rates program you would like and enter in the required information. Build your account and pay for the transaction utilizing your PayPal account or bank card.

- Select the file structure and obtain the legitimate record format for your gadget.

- Full, modify and print out and indicator the acquired Idaho Assignment of Profits of Business.

US Legal Forms may be the most significant collection of legitimate forms that you can find a variety of record web templates. Use the service to obtain appropriately-created documents that comply with express requirements.