Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

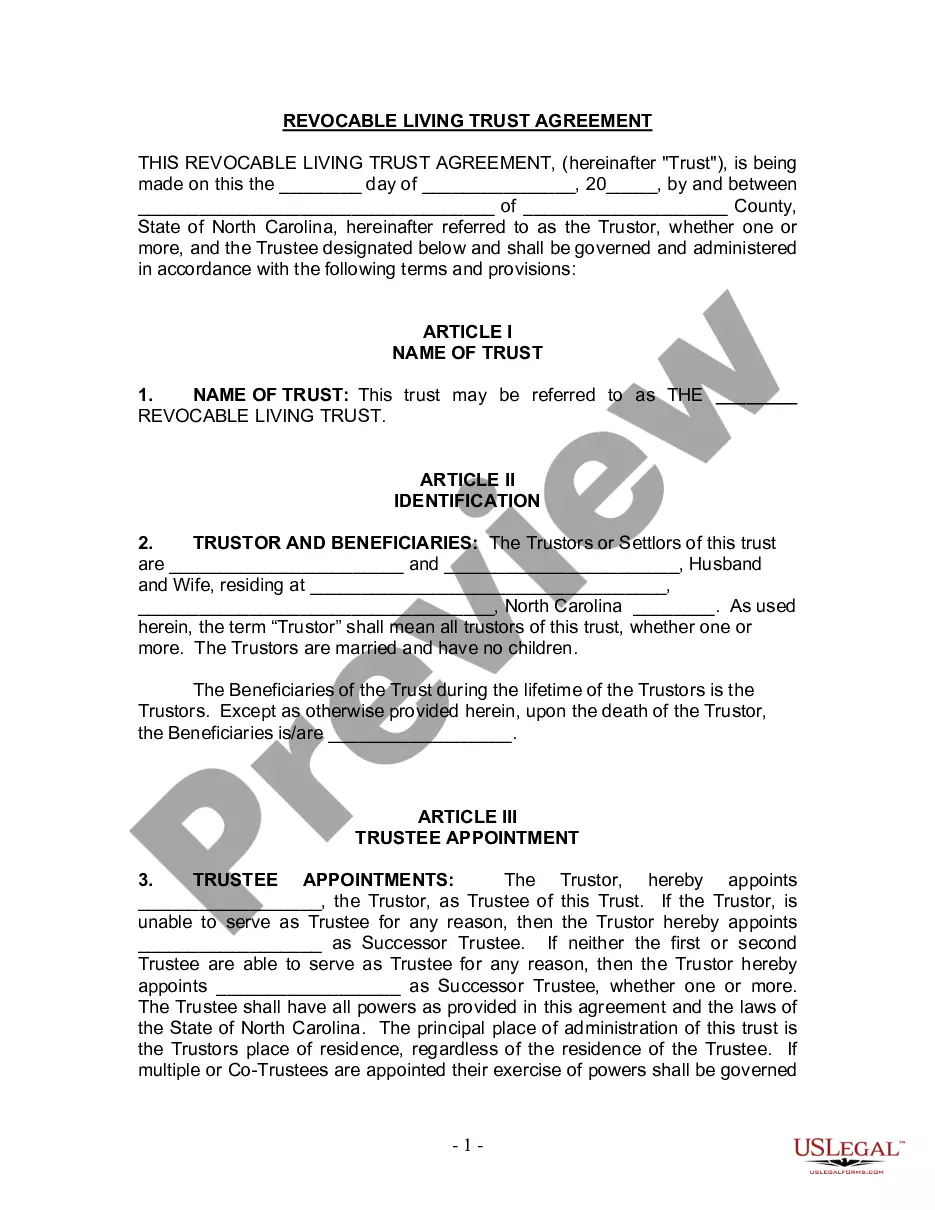

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you presently in the situation that you need documents for either organization or individual functions just about every day time? There are a variety of legal document templates available online, but getting ones you can depend on isn`t straightforward. US Legal Forms gives 1000s of develop templates, such as the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which can be written to fulfill federal and state needs.

If you are already knowledgeable about US Legal Forms web site and get a free account, merely log in. After that, you may down load the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse template.

Should you not provide an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is to the right city/county.

- Make use of the Preview key to review the shape.

- See the description to actually have chosen the right develop.

- When the develop isn`t what you`re searching for, take advantage of the Research discipline to get the develop that meets your needs and needs.

- Whenever you get the right develop, click Get now.

- Opt for the prices plan you want, fill in the necessary information to create your money, and purchase an order utilizing your PayPal or bank card.

- Decide on a handy data file formatting and down load your duplicate.

Locate all the document templates you possess bought in the My Forms menu. You can aquire a more duplicate of Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse any time, if necessary. Just select the required develop to down load or printing the document template.

Use US Legal Forms, the most considerable variety of legal kinds, to conserve some time and avoid faults. The service gives appropriately made legal document templates that you can use for a range of functions. Produce a free account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

TESTAMENTARY TRUST These trusts can have many names including: Bypass Trust, Family Trust, Children's Trust, Residuary Trust or QTIP (Second Marriage Trust). Testamentary Trusts are typically created to provide support for surviving spouses, children or family groups.

A SLAT is an irrevocable trust used to transfer money and property out of the trustmaker spouse's estate into a trust for the other spouse's benefit. Using a SLAT, the trustmaker spouse can take advantage of their lifetime gift and estate tax exclusion amounts by making sizable, permanent gifts to the SLAT.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.