Idaho Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

You can spend time online searching for the legal document format that suits the state and federal requirements you need.

US Legal Forms offers a vast array of legal templates that are reviewed by experts.

It is easy to download or print the Idaho Pay in Lieu of Notice Guidelines from their service.

If available, utilize the Preview option to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Idaho Pay in Lieu of Notice Guidelines.

- Every legal document format you obtain is yours forever.

- To retrieve another copy of any downloaded form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions provided below.

- First, ensure that you have chosen the correct document format for the state/town of your preference.

- Review the form description to confirm you have selected the right one.

Form popularity

FAQ

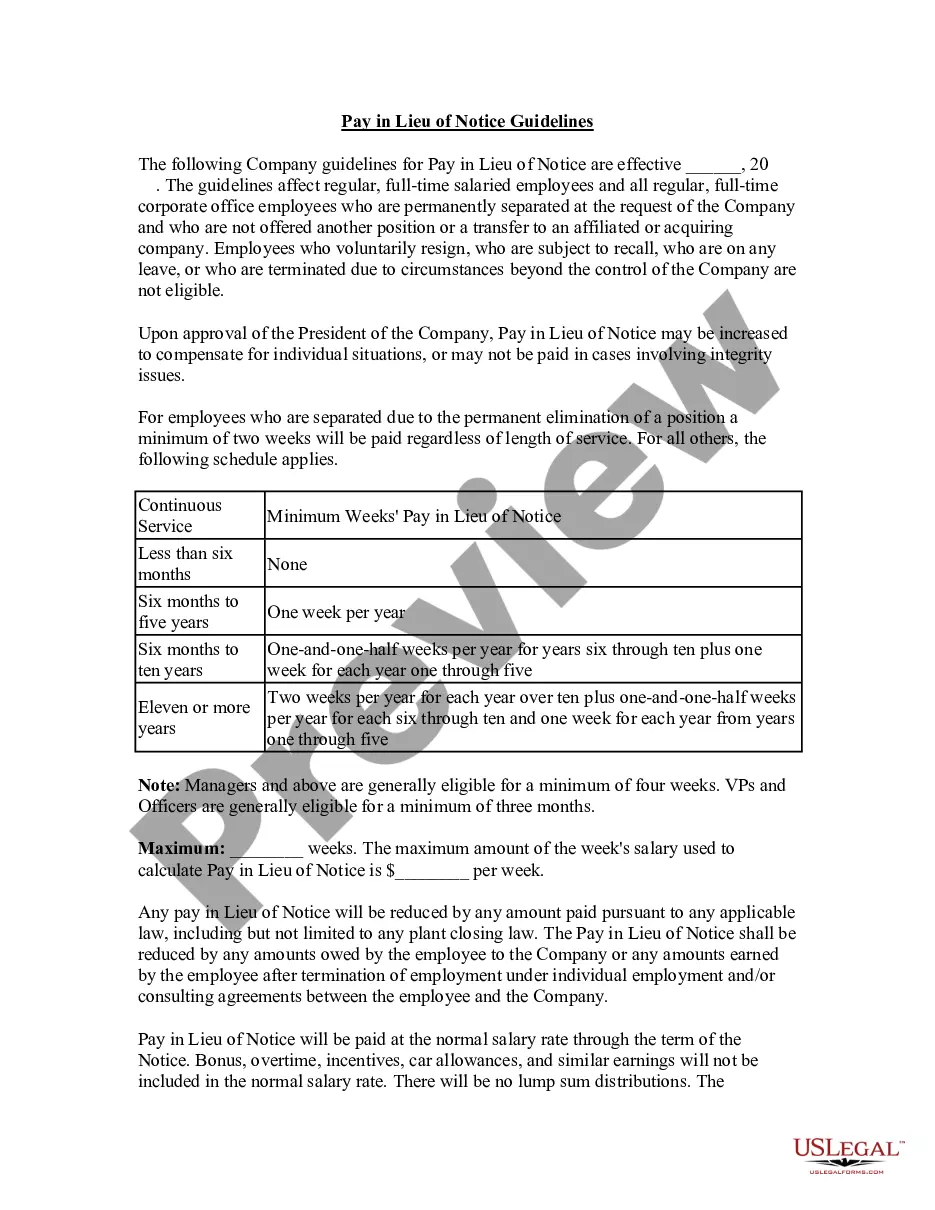

Payment in lieu of leave refers to a monetary compensation offered to employees for any unused leave entitlements when their employment ends. This payment is an important aspect of the Idaho Pay in Lieu of Notice Guidelines, as it ensures employees are compensated fairly for their accrued leave. Understanding these guidelines can help both employers and employees navigate leave entitlements effectively.

Yes, payments made in lieu of notice do attract superannuation contributions. Under the Idaho Pay in Lieu of Notice Guidelines, employers are required to include these payments in their calculations for superannuation. This ensures that employees receive the benefits they deserve, even when an employment contract ends abruptly.

A letter payment in lieu of notice from an employer is a document that confirms the payment made to an employee instead of providing the required notice period before termination. This payment allows the employer to end the employment relationship immediately, while still compensating the employee for the notice period they would have worked. The Idaho Pay in Lieu of Notice Guidelines help clarify the legal requirements and obligations regarding this payment, ensuring both parties understand their rights.

To process payment in lieu of notice, employers usually calculate the amount based on the employee’s current salary for the notice period. After determining the total, the employer should issue the payment promptly to avoid potential legal issues. Following the Idaho Pay in Lieu of Notice Guidelines is essential during this process to ensure transparency and fairness. For assistance in paperwork and compliance, you can visit UsLegalForms to access essential legal forms and templates.

Payment in lieu of leave means that an employee receives financial compensation for unused leave rather than taking time off. This type of compensation is usually offered when the employee cannot utilize their accrued leave balance due to various circumstances. Under the Idaho Pay in Lieu of Notice Guidelines, understanding this concept helps you manage your benefits and rights effectively. Check out UsLegalForms for more information on employee rights regarding leave.

Payment in lieu of notice refers to the compensation provided to an employee when their employer terminates their employment without the required notice period. Instead of working through the notice, you receive a payment that corresponds to what you would have earned during that time. This practice aligns with Idaho Pay in Lieu of Notice Guidelines and helps ensure that you are fairly compensated. For clear documentation and guidance, UsLegalForms offers templates and resources.

The statute 45 606 in Idaho outlines the guidelines for payment in lieu of notice for employees. This law allows employers to compensate employees financially instead of providing the standard notice period before termination. Understanding these guidelines is crucial for both employees and employers to ensure compliance with Idaho Pay in Lieu of Notice Guidelines. If you need further assistance, consider visiting UsLegalForms for detailed resources.

Idaho law does not require employers to pay out unused vacation time upon termination. However, it's important to note that your employer's policies may dictate a different approach in line with the Idaho Pay in Lieu of Notice Guidelines. Make sure to check your employment contract or company handbook for specific information on vacation payout. If you have questions, consider visiting USLegalForms for further insights and resources.

Yes, you can request your employee file after termination in Idaho. The Idaho Pay in Lieu of Notice Guidelines allow you to access certain documents related to your employment. To obtain your file, you typically need to submit a formal request to your employer. It’s advisable to keep a record of your request for your records.

To process a payment in lieu of notice, first, ensure you understand the specific Idaho Pay in Lieu of Notice Guidelines that apply to your situation. You should calculate the amount owed based on the employee's pay rate and the standard notice period required. Next, document the payment formally to maintain clear records. Finally, consider using reliable platforms like US Legal Forms to help you prepare the necessary documents and ensure compliance with Idaho state laws.