Idaho Exemption Statement

Description

How to fill out Exemption Statement?

Are you in a place in which you will need documents for both company or specific functions almost every working day? There are plenty of authorized document templates available online, but getting kinds you can depend on isn`t easy. US Legal Forms gives a large number of develop templates, such as the Idaho Exemption Statement - Texas, that are published to meet federal and state demands.

Should you be already knowledgeable about US Legal Forms site and have a merchant account, basically log in. After that, it is possible to down load the Idaho Exemption Statement - Texas template.

If you do not provide an account and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is to the correct metropolis/state.

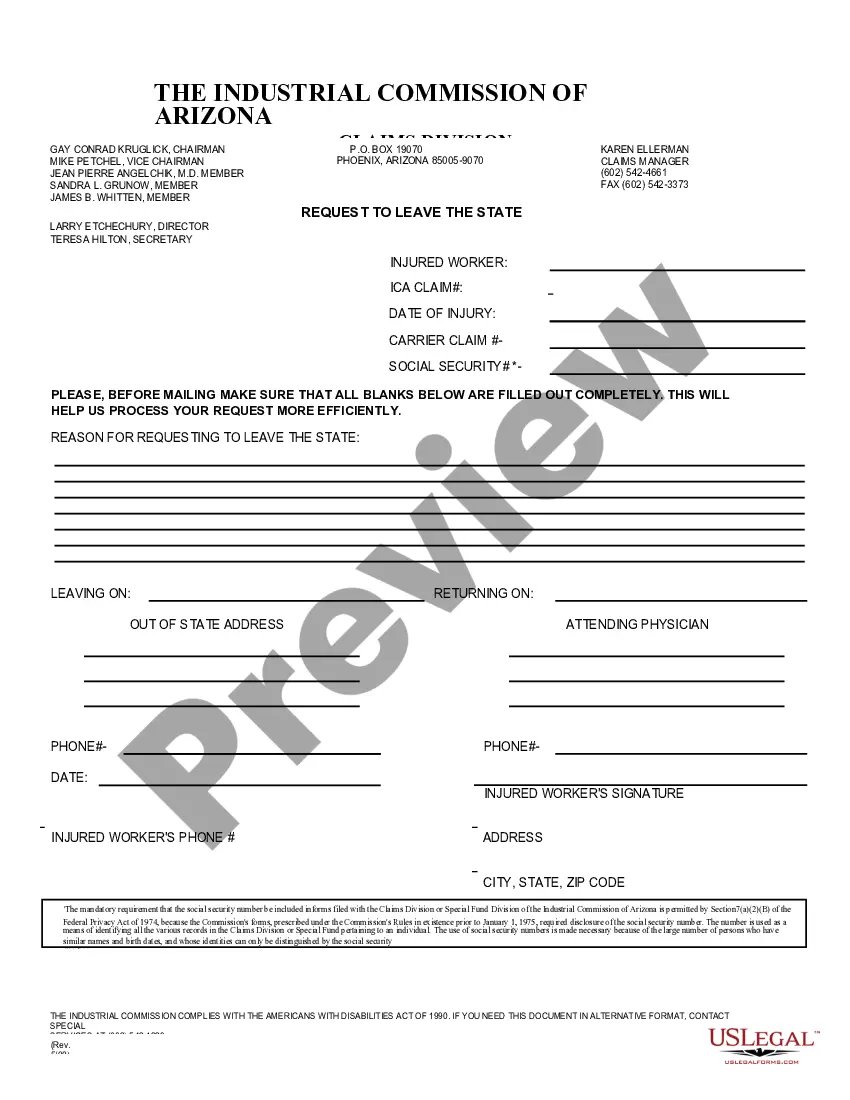

- Use the Preview option to review the form.

- Browse the description to ensure that you have chosen the correct develop.

- When the develop isn`t what you are looking for, take advantage of the Research discipline to get the develop that fits your needs and demands.

- If you obtain the correct develop, just click Get now.

- Pick the costs prepare you want, fill in the specified info to generate your bank account, and buy the order with your PayPal or credit card.

- Decide on a practical document format and down load your duplicate.

Find each of the document templates you may have purchased in the My Forms food list. You can obtain a more duplicate of Idaho Exemption Statement - Texas whenever, if necessary. Just go through the essential develop to down load or print the document template.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to save time and stay away from mistakes. The service gives professionally made authorized document templates that you can use for an array of functions. Make a merchant account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Most employees are subject to withholding tax. Your employer is the one responsible for sending it to the IRS. In order to be exempt from tax withholding, you must have owed no federal income tax in the prior tax year and you must not expect to owe any federal income tax this tax year.

Hear this out loud PauseAll nonprofits in Idaho must register with the Idaho Secretary of State. Contact the Internal Revenue Service (IRS) to request approval for an income tax exemption. Read more on the IRS Applying for Tax Exempt Status page.

The income tax withholding formula for the State of Idaho has changed as follows: The annual amount, per exemption allowance, has changed from $3,154 to $3,417.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Hear this out loud PauseYou apply for this exemption with your county assessor's office, and it determines if you qualify. Once approved, your exemption lasts until the home's ownership changes or you no longer use the home as your primary residence.

Hear this out loud PauseAs an Idaho employer, you're always required to have a withholding account and report payroll. You don't have to withhold Idaho income tax in any of the following situations: The employee isn't a resident of Idaho and earns less than $1,000 in Idaho in a calendar year.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.