Idaho Employee Payroll Record

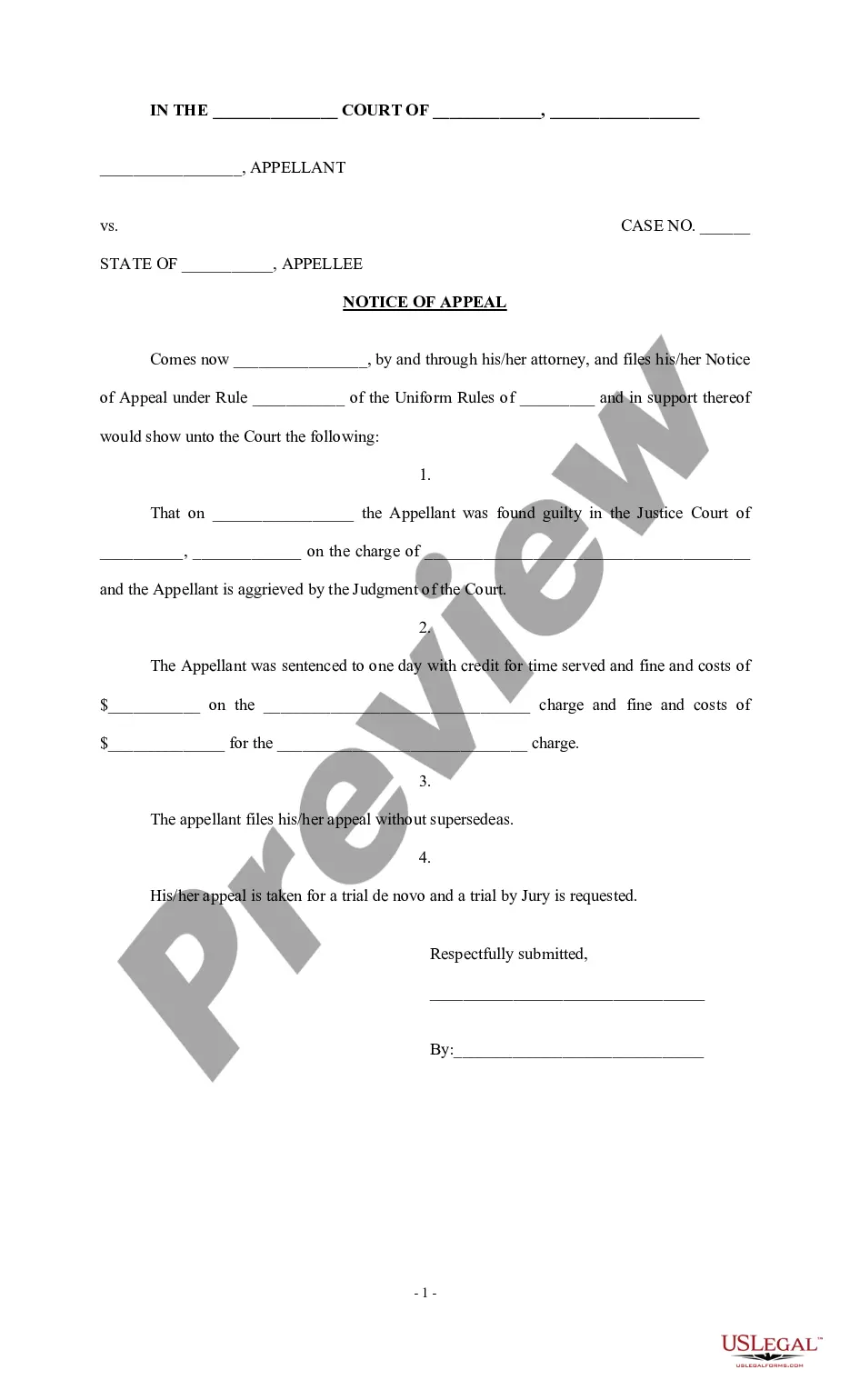

Description

How to fill out Employee Payroll Record?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Idaho Employee Payroll Record in moments.

If you have an existing subscription, Log In and download the Idaho Employee Payroll Record from your US Legal Forms collection. The Download button will be available on each form you view. You will have access to all previously downloaded forms in the My documents section of your account.

Then, process the payment. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Idaho Employee Payroll Record. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, just navigate to the My documents section and click on the form you need.

- Firstly, ensure you have chosen the correct form for your state/region.

- Click the Review button to examine the form's details.

- Read the form description to confirm you’ve selected the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select your preferred payment plan and provide your information to create an account.

Form popularity

FAQ

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

Step-by-Step Instructions to Running Payroll in IdahoStep 1: Set up your business as an employer.Step 2: Register your business in Idaho.Step 3: Set up your payroll.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.Step 6: Calculate payroll and pay employees.More items...?

Claim allowances for you or your spouse.If you're married, claim your allowances on the W-4 for the highest-paying job for the most accurate withholding. If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances.

Register online at the State Tax Commission's Idaho Business Registration (IBR) portal to receive both Withholding and UI account numbers within 5 days of completing the application.Find an existing Withholding Account Number: on Form 967, Annual Withholding Form (for M/Q/Y filers) by calling the State Tax Commission.

You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. (For example you're a college student and your parents claim you). This ensures the maximum amount of taxes are withheld from each paycheck. You'll most likely get a refund back at tax time.

You can make payments:In person at our Boise office or at our other offices. (We recommend you don't leave cash in a drop box.)Online by credit/debit card or e-check. The credit cards we accept are: American Express, Discover, MasterCard, and Visa.

As an employer, you're responsible for paying SUI (remember, if you pay your state SUI in full and on time, you get a 90% tax credit on FUTA). Idaho's SUI rates range from 0.24% to 5.4%. The taxable wage base in 2022 is $46,500 for each employee. New employers pay 0.97% for at least the first six quarters.

Before opening a business in Idaho, the owner should register the business with the Idaho Secretary of State. For more information, please call (208) 334-2301 or visit their website at . If the business will have employees, the business must have a Federal Employer Identification Number (EIN).

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.